News Releases

Stay in the know

CALGARY, AB, Jan. 11, 2024 /CNW/ - SECURE Energy Services Inc. ("SECURE", the "Corporation") (TSX: SES) announced today that, in connection with its previously announced normal course issuer bid ("NCIB") to purchase for cancellation up to 23,196,967 common shares of the Corporation ("common shares"), the Corporation has entered into an automatic share purchase plan ("ASPP") with a designated broker. The ASPP has been pre-cleared by the Toronto Stock Exchange (the "TSX") and is expected to be implemented on January 15, 2024.

The ASPP is intended to facilitate repurchases of common shares at times under the NCIB when the Corporation would ordinarily not be permitted to make purchases due to regulatory restriction or customary self-imposed blackout periods. Before the commencement of any particular trading black-out period, SECURE may, but is not required to, instruct its designated broker to make purchases of common shares under the NCIB during the ensuing black-out period in accordance with the terms of the ASPP. Such purchases will be determined by the designated broker at its sole discretion based on purchasing parameters set by SECURE in accordance with the rules of the TSX, applicable securities laws and the terms of the ASPP.

The ASPP will terminate on the earliest of the date on which: (a) the maximum annual purchase limit under the NCIB has been reached; (b) the NCIB expires; or (c) SECURE terminates the ASPP in accordance with its terms. The ASPP constitutes an "automatic securities purchase plan" under applicable Canadian securities law.

Outside of pre-determined blackout periods, common shares may be purchased under the NCIB based on management's discretion, in compliance with TSX rules and applicable securities laws. The Corporation's NCIB commenced on December 14, 2023, and will remain active until December 13, 2024, or such earlier date as the NCIB is completed or is terminated at the Corporation's election. All purchases of common shares made under the ASPP will be included in determining the number of common shares purchased under the NCIB.

Since the beginning of the NCIB, the Corporation has purchased 3,441,700 common shares at a weighted average price per share of $9.41 for a total of $32 million. All common shares purchased under the NCIB have been cancelled.

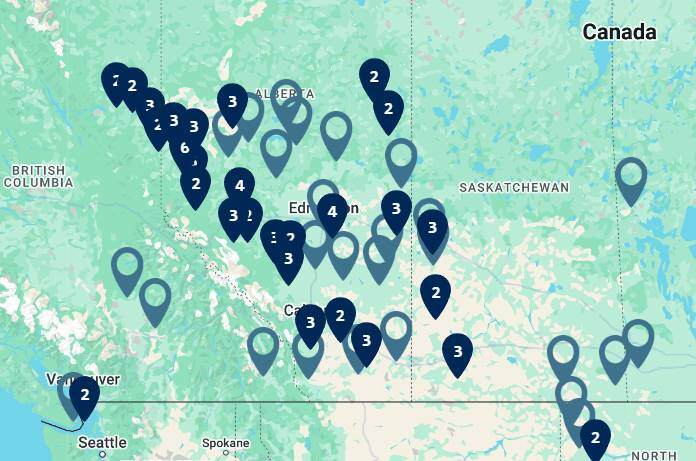

SECURE is a leading waste management and energy infrastructure business headquartered in Calgary, Alberta. The Corporation's extensive infrastructure network located throughout western Canada and North Dakota includes waste processing and transfer facilities, industrial landfills, metal recycling facilities, crude oil and water gathering pipelines, crude oil terminals and storage facilities. Through this infrastructure network, the Corporation carries out its principal business operations, including the processing, recovery, recycling and disposal of waste streams generated by our energy and industrial customers and gathering, optimization, terminalling and storage of crude oil and natural gas liquids. The solutions the Corporation provides are designed not only to help reduce costs, but also lower emissions, increase safety, manage water, recycle by-products and protect the environment.

SECURE's shares trade under the symbol SES and are listed on the Toronto Stock Exchange. For more information, visit www.SECURE-energy.com.

Certain statements contained in this news release constitute forward-looking information and statements (collectively, "forward-looking statements") including, but not limited to, statements concerning the NCIB and ASPP (including the number and timing of common shares which may be purchased thereunder) and other statements that are not historical facts. The use of any of the words ''anticipate'', ''plan'', ''contemplate'', ''continue'', ''estimate'', ''expect'', ''intend'', ''propose'', ''might'', ''may'', ''will'', ''shall'', ''project'', ''should'', ''could'', ''would'', ''believe'', ''predict'', ''forecast'', ''pursue'', ''potential'' and ''capable'' and similar expressions are intended to identify forward looking statements. These statements involve known and unknown risks, uncertainties and other factors that may cause actual results or events to differ materially from those anticipated in such forward-looking statements. No assurance can be given that these expectations will prove to be correct and such forward-looking statements included in this news release should not be unduly relied upon. These statements speak only as of the date of this news release. The Corporation does not undertake any obligations to publicly update or revise any forward-looking statements except as required by securities law. Actual results could differ materially from those anticipated in these forward-looking statements as a result of numerous risks and uncertainties including, but not limited to, the risks and uncertainties described in "Forward-Looking Statements" and "Risk Factors" included in the Company's Annual Information Form dated March 1, 2023, as filed on SEDAR and available on the SECURE website at www.secure-energy.com.

Website: www.secure-energy.com

TSX Symbol: SES

SOURCE SECURE Energy Services Inc.