News Releases

Stay in the know

Transaction Highlights

- Sale of the facilities identified in the Competition Tribunal's March 3, 2023, divestiture order resulting from SECURE's acquisition of Tervita Corporation

- Target closing in the first quarter of 2024, subject to regulatory approvals

CALGARY, AB, Dec. 11, 2023 /CNW/ - SECURE ENERGY Services Inc. ("SECURE" or the "Corporation"), a leading waste management and energy infrastructure company, announced today it has entered into a definitive agreement (the "Agreement") with Waste Connections Inc. ("Waste Connections") to sell the facilities formerly owned by Tervita Corporation that were ordered to be divested by the Competition Tribunal ("the Facilities") for $1.075 billion in cash plus approximately $75 million for certain adjustments as provided in the Agreement for total estimated cash proceeds of $1.150 billion (the "Transaction").

"Despite the challenging circumstances leading to and associated with completing this sales process, we believe the Transaction, including the counterparty, are beginning to highlight the underlying value of SECURE's businesses and represent another meaningful step forward in pursuit of our strategy as one of Canada's sector leading waste management and energy infrastructure organizations," said Rene Amirault, Chief Executive Officer of SECURE. "Following closing, the Transaction is expected to materially improve our financial position and capital allocation flexibility, marking a pivotal moment for our company to concentrate our resources, accelerate innovation, and redeploy capital in areas of growth for SECURE. The proactive decision to proceed with the divestitures underscores our resilience and adaptability as we continue to prioritize maximizing value for our shareholders, customers, and employees."

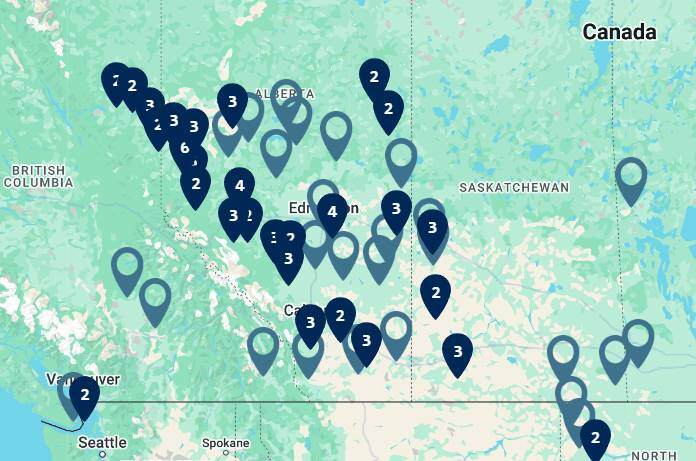

The strategic impact of this Transaction solidifies SECURE's position in the waste management sector. Following the close of the Transaction, the Corporation remains the market share leader of industrial and energy waste infrastructure in western Canada and North Dakota. SECURE's business is expected to continue to deliver robust margins, and a stable cash flow profile underpinned by recurring volumes driven by industrial waste, metals, and energy markets. The Corporation's 2024 Adjusted EBITDA is expected to range from $440 - $465 million, subject to timing of the Transaction close.

The Transaction has been carefully considered by SECURE's management and Board of Directors, and the Corporation continues to believe there are strong grounds for appeal of the Competition Tribunal's decision. However, the Corporation decided that it is in the best interest of stakeholders to take control of the process and move forward with a sale that generates significant cash proceeds and provides clear resolution of the competition matter. As a result, the Corporation expects to alleviate any uncertainty or overhang on the stock that may have been caused by the Competition Tribunal's order, while concurrently providing certainty to our employees and customers.

The Agreement outlines the sale of the Facilities to Waste Connections for proceeds of $1.075 billion plus approximately $75 million in certain adjustments as provided in the Agreement. The Corporation anticipates the Transaction to close in the first quarter of 2024 ("Closing"), subject to regulatory approval by the Competition Bureau, and the satisfaction of customary closing conditions.

Over 250 SECURE operational and support staff are expected to join the Waste Connections team upon closing the Transaction.

Waste Connections (TSX/NYSE: WCN) (www.wasteconnections.com) is an integrated solid waste services company that provides non-hazardous waste collection, transfer and disposal services, including by rail, along with resource recovery primarily through recycling and renewable fuels generation. Waste Connections serves approximately nine million residential, commercial and industrial customers in mostly exclusive and secondary markets across 44 states in the U.S. and six provinces in Canada. Waste Connections also provides non-hazardous oilfield waste treatment, recovery and disposal services in several basins across the U.S., as well as intermodal services for the movement of cargo and solid waste containers in the Pacific Northwest. The Transaction provides Waste Connections with a growth platform in the Canadian market, leveraging its expertise in waste handling, recovery and disposal, and complementing its existing U.S. based, non-hazardous oilfield waste operations.

SECURE remains dedicated to working closely with applicable regulatory authorities and Waste Connections to ensure a successful closing and a smooth transition.

Goldman Sachs & Co. LLC is acting as exclusive financial advisor to SECURE and Bennett Jones LLP is acting as legal counsel to SECURE with respect to the Transaction.

At Closing, the Transaction will enhance SECURE's financial flexibility by providing immediate liquidity for debt repayment, while maintaining significant leverage capacity and a surplus of cash available for, among other things, shareholder returns and funding of growth initiatives. The Corporation intends to continue paying its quarterly dividend of $0.10 per share, or $0.40 per share on an annualized basis, offering an attractive yield of approximately 5% based on its current share price.

The Board of Directors and management believe there is a substantive disparity between SECURE's current share price and the fundamental value of its business. The Transaction proceeds represent an accretive multiple in the face of an ordered sale, which, in the Corporation's view, underscores this disconnect, and supports a value above this benchmark. As such, the Corporation intends to move forward with a normal course issuer bid to repurchase shares, and will evaluate other methods that may be available to reduce this valuation gap and return capital to shareholders following Closing, which may include consideration of the merits of a substantial issuer bid, based on, among other things, market conditions, the discretion of the Board of Directors, compliance with debt covenants and financial performance at the applicable time. Finally, SECURE plans to execute on growth opportunities following Closing both organically, and through acquisitions that align with the Corporation's investment criteria and complement its core environmental waste management and energy infrastructure business operations.

As a result of the Transaction, the Corporation is providing updated guidance with respect to the 2024 capital program. The Corporation expects to spend approximately $60 million on sustaining capital, including landfills expansions, and approximately $15 million on settling SECURE's abandonment retirement obligations, down from guidance previously provided of $85 million and $20 million, respectively, after adjusting for the impacts of the Transaction.

At this time, SECURE continues to have $50 million allocated for growth opportunities in 2024 that leverage existing infrastructure through long-term contracts. The Corporation intends to update its growth plans and provide further details following the entering of agreements with its customers.

Following the merger with Tervita Corporation in July 2021, the Corporation conducted a thorough review of its businesses, intending to capitalize on its core competencies and strategic advantages, ultimately aiming to enhance value for shareholders. In connection with this review, business units that did not fit into the Corporation's core waste management and energy infrastructure strategy were identified for divestment.

SECURE is pleased to announce that it has successfully executed on this strategic initiative with various non-core divestitures completed over the last two years. Since the beginning of 2022, the Corporation has successfully sold three non-core oilfield services focused business units and various redundant or unused assets for aggregate gross proceeds of approximately $73 million. These sales were completed through multiple transactions and included the following businesses and assets:

- Project management services focused on mobile yellow iron used for demolition and remediation;

- Oilfield water management and water pumping services, focused on oil and gas completion activity;

- Consulting services related to oilfield environmental and regulatory matters;

- Redundant heavy-duty equipment; and

- Various real estate assets not required for ongoing core business operations.

With the final disposition expected to close on December 15, 2023, the Corporation's portfolio rationalization under this initiative will be complete.

Allen Gransch, President of SECURE, remarked "These divestitures were a key part of our strategic review and market repositioning as a leading waste management and energy infrastructure company. I'd like to thank the 400 employees associated with these business units for their contributions to SECURE and wish them and their new organizations all the best. The decision to divest these assets aligns with our commitment to optimize our portfolio and allocate resources to infrastructure-based businesses that provide stable recurring revenue while generating significant free cash flow."

Approximately 70% of the Corporation's expected Adjusted EBITDA in 2024 is anticipated to correspond to the Corporation's Environmental Waste Management Infrastructure segment which aligns with the corporate strategy as SECURE continues to grow our waste management business while divesting non-core oilfield services business lines as noted above.

SECURE will host a conference call Monday, December 11, 2023, at 1:00 p.m. MST to discuss the Transaction. To participate in the conference call, dial 416-764-8650 or toll free 1-888-664-6383. To access the simultaneous webcast, please visit www.SECURE-energy.com. For those unable to listen to the live call, a taped broadcast will be available at www.SECURE-energy.com and, until midnight MST on Monday, December 18, 2023, by dialing 1-888-390-0541 and using the pass code 037452.

The Corporation uses accounting principles that are generally accepted in Canada (the issuer's "GAAP"), which includes International Financial Reporting Standards ("IFRS"). This press release contains a supplementary non-GAAP financial measure, being Adjusted EBITDA (in respect of the Facilities and the enterprise), which does not have a standardized meaning as prescribed by IFRS.

Adjusted EBITDA is calculated as net income, adjusted for income tax, depreciation, depletion and amortization, interest, accretion and finance costs, share-based compensation, and other items the Corporation considers appropriate to adjust given the irregular nature and relevance to comparable operations.

This measure is intended as a complement to results provided in accordance with IFRS. The Corporation believes this measure provides additional useful information to analysts, shareholders, and other users to understand the Corporation's and the Facilities financial results, profitability, cost management, liquidity and ability to generate funds to finance its operations.

However, this measure should not be used as an alternative to IFRS measures because it is not a standardized financial measure under IFRS and therefore might not be comparable to similar financial measures disclosed by other companies. For further details on the Corporation's use of non-GAAP financial measures (including relevant reconciliations and explanations of their respective use and composition), see the "Non-GAAP and other specified financial measures" section of the Corporation's MD&A for the three and nine months ended September 30, 2023 and 2022 for further details on the Corporation's use of non-GAAP financial measures, which is incorporated by reference herein and available on SECURE's profile at www.sedarplus.ca and on the Corporation's website at www.SECURE-energy.com.

Certain statements contained or incorporated by reference in this press release constitute "forward-looking statements and/or "forward-looking information" within the meaning of applicable securities laws (collectively referred to as "forward-looking statements"). When used in this press release, the words "achieve", "anticipate", "believe", "capacity", "commit", "continue", "could", "deliver", "drive", "enhance", "ensure", "estimate", "execute", "expect", "focus", "forward", "future", "grow", "guidance", "intend", "may", "ongoing", "opportunity", "plan", "position", "potential", "priority", "realize", "remain", "result", "should", "strategy", "target", "will", "would" and similar expressions are intended to identify forward-looking statements. Such statements reflect the current views of SECURE and speak only as of the date of this press release.

In particular, this press release contains or implies forward-looking statements pertaining, but not limited, to: the anticipated benefits and impacts of the Transaction, including among other things the total cash consideration to be received, impact of the Transaction on SECURE's financial position, liquidity, results of operations, and capital allocation flexibility following completion of the Transaction; the satisfaction of the closing conditions to the Transaction, including obtaining applicable regulatory approvals; completion of the Transaction and the anticipated timing thereof; the potential uses of the net cash proceeds from the Transaction; SECURE's expectations in respect of its business, including deployment of capital, concentration of resources and acceleration of innovation, following completion of the Transaction; changes to SECURE's staff as a result of the Transaction; SECURE's strategy and ability to pursue potential future opportunities and the nature thereof; SECURE's strategic positioning for continued growth and success in key markets; SECURE's ability to respond to increased industry activity; long-term environmental objectives, including future ESG goals; margins; cash flow profile; SECURE's expectations and priorities for 2023, 2024 and beyond and its ability to achieve such priorities; estimates of Adjusted EBITDA for 2024 and segment contribution thereto; anticipated impact of the Transaction on the value of SECURE's business and share price; higher volumes and activity levels; economic conditions in key markets and industries; SECURE's business and demand for its products and services for the remainder of 2023 and into 2024; SECURE's infrastructure network capacity, growth, customer costs and costs to meet growing demand; SECURE's long-term contracts; guidance for SECUREs' 2024 capital program, including the amounts and purposes thereof; capital allocation priorities, including deleveraging and repayment of debt; payment of dividends and the amounts thereof; return of capital, including programs for share repurchases; capital outlook and targets; compliance with debt covenants; financial performance and results of operations; estimated sustaining capital costs, asset retirement obligation expenditures and amounts allocated for growth opportunities; future growth and acquisitions; completion of certain non-core divestitures and timing thereof; SECURE's strategic plan and the components and intentions in respect thereof.

Forward-looking statements are based on certain factors, expectations and assumptions that SECURE has made in respect thereof as at the date of this press release regarding, among other things: the satisfaction of the conditions to closing of the Transaction in a timely manner, including receipt of all necessary regulatory approvals on acceptable terms, and ability to close the Transaction and timing thereof; the ability of the Corporation to realize the anticipated benefits of the Transaction; the impacts of the Transaction on SECURE's business, including the anticipated effect on SECURE's financial position, capital allocation, resource concentration, innovation, cash flows, interest costs, sustaining capital and asset retirement obligation costs; the success of the Corporation's ongoing operations and growth projects; and the Corporation's ability to use the proceeds from the Transaction in the manners it intends and the impact thereof; economic, market and operating conditions, including commodity prices, crude oil and natural gas storage levels; interest rates, exchange rates, and inflation; factors that impact or may impact the value of SECURE's business and share price; ongoing compliance with debt covenants; the changes in market activity and growth will be consistent with industry activity in Canada and the U.S. and growth levels in similar phases of previous economic cycles; international or geopolitical events, including government responses related thereto and their impact on global energy pricing, oil and gas industry exploration and development activity levels and production volumes; the ability of the Corporation to realize the anticipated benefits of acquisitions or dispositions; anticipated sources of funding being available to SECURE on terms favourable to SECURE; the success of the Corporation's financial performance, operations and growth projects; the market value of SECURE's shares; the Corporation's competitive position; expectations in respect of operating, acquisition and sustaining costs; the Corporation's ability to attract and retain customers; that counterparties comply with contracts in a timely manner; that there are no unforeseen events preventing the performance of contracts or the completion and operation of the relevant facilities; that there are no unforeseen material costs in relation to the Corporation's facilities and operations; that prevailing regulatory, tax and environmental laws and regulations apply or are introduced as expected, and the timing of such introduction; increases to the Corporation's share price and market capitalization over the long term; the ability to repay debt and return capital to shareholders, including the manner thereof; the exercise of discretion of the Board in respect of capital allocation, including dividends and other methods of returning capital to shareholders; the Corporation's ability to obtain and retain qualified personnel (including those with specialized skills and knowledge), technology and equipment in a timely and cost-efficient manner; the Corporation's ability to access capital and insurance; operating and borrowing costs, including costs associated with the Transaction and maintenance of equipment and property; the ability of the Corporation and its subsidiaries to successfully market services in western Canada and the U.S.; an increased focus on ESG, sustainability and environmental considerations in the oil and gas industry; the impacts of climate-change on the Corporation's business; the current business environment remaining substantially unchanged; present and anticipated programs and expansion plans of other organizations operating in the energy service industry resulting in an increased demand for the Corporation's and its subsidiaries' services; future acquisition and maintenance costs; the Corporation's ability to achieve its ESG and sustainability targets and goals and the costs associated therewith; and other risks and uncertainties described in SECURE's current annual information form and from time to time in filings made by SECURE with securities regulatory authorities.

Forward-looking statements involve significant known and unknown risks and uncertainties, should not be read as guarantees of future performance or results, and will not necessarily be accurate indications of whether such results will be achieved. Readers are cautioned not to place undue reliance on these statements as a number of factors could cause actual results to differ materially from the results discussed in these forward-looking statements, including but not limited to: general global financial conditions, including general economic conditions in Canada and the U.S.; the completion and the timing of the Transaction; the receipt, in a timely manner and on acceptable terms, of the necessary regulatory and other third-party approvals, and to satisfy the other conditions to the closing of the Transaction; the ability to complete the Transaction on the terms contemplated, or at all; the ability of SECURE to realize the anticipated benefits of the Transaction, the timing thereof and the impact thereof on SECURE's business; consequences of not completing the Transaction, if applicable; risks inherent in the energy industry; the focus of management's time and attention on the Transaction and other disruptions arising from the Transaction; consequences of not completing the Transaction; management's time and attention on the Transaction and other disruptions arising from the Transaction; liabilities and risks, including environmental liabilities and risks, inherent in SECURE's operations; changes in the level of capital expenditures made by oil and natural gas producers and the resultant effect on demand for oilfield services during drilling and completion of oil and natural gas wells; volatility in market prices for oil and natural gas and the effect of this volatility on the demand for oilfield services generally; a transition to alternative energy sources; the Corporation's inability to retain customers; risks inherent in the energy industry, including physical climate-related impacts; the Corporation's ability to generate sufficient cash flow from operations to meet its current and future obligations; the accuracy of estimates of capital costs and allocations; the ability of the Corporation to continue dividend payments, renew its normal course issuer bid, or to complete other returns of capital to shareholders, as contemplated or at all; the ability to maintain relationships with partners; the focus the seasonal nature of the oil and gas industry; increases in debt service charges including changes in the interest rates charged under the Corporation's current and future debt agreements; inflation and supply chain disruptions; the Corporation's ability to access external sources of debt and equity capital and insurance; disruptions to the Corporation's operations resulting from events out of its control; the timing and amount of stimulus packages and government grants relating to site rehabilitation programs; the cost of compliance with and changes in legislation and the regulatory and taxation environment, including uncertainties with respect to implementing binding targets for reductions of emissions and the regulation of hydraulic fracturing services and services relating to the transportation of dangerous goods; uncertainties in weather and temperature affecting the duration of the oilfield service periods and the activities that can be completed; competition; impairment losses on physical assets; sourcing, pricing and availability of raw materials, consumables, component parts, equipment, suppliers, facilities, and skilled management, technical and field personnel; supply chain disruption; the Corporation's ability to effectively complete acquisition and divestiture transactions on acceptable terms or at all; a failure to realize the benefits of acquisitions, and risks related to the associated business integration, as applicable; the Corporation's ability to invest in and integrate technological advances and match advances of the Corporation's competition; the viability, economic or otherwise, of such technology; credit, commodity price and foreign currency risk to which the Corporation is exposed in the conduct of its business; compliance with the restrictive covenants in the Corporation's current and future debt agreements; the Corporation's or its customers' ability to perform their obligations under long-term contracts; misalignment with the Corporation's partners and the operation of jointly owned assets; the Corporation's ability to source products and services on acceptable terms or at all; the Corporation's ability to retain key or qualified personnel, including those with specialized skills or knowledge; uncertainty relating to trade relations and associated supply disruptions; the effect of changes in government and actions taken by governments in jurisdictions in which the Corporation operates; the effect of climate change and related activism on the Corporation's operations and ability to access capital and insurance; cyber security and other related risks; the Corporation's ability to bid on new contracts and renew existing contracts; potential closure and post-closure costs associated with landfills operated by the Corporation; the Corporation's ability to protect its proprietary technology and intellectual property rights; legal proceedings and regulatory actions to which the Corporation may become subject, including any claims for infringement of a third parties' intellectual property rights; the Corporation's ability to meet its ESG targets or goals and the costs associated therewith; claims by, and consultation with, Indigenous Peoples in connection with project approval; disclosure controls and internal controls over financial reporting; and other risk factors identified in SECURE's current annual information form and from time to time in filings made by the Corporation with securities regulatory authorities.

The guidance in respect of the Corporation's expectations of Adjusted EBITDA in 2024 and revised estimates for its 2024 capital program in this press release may be considered to be a financial outlook for the purposes of applicable Canadian securities laws. Such information is based on assumptions about future events, including economic conditions and proposed courses of action, based on management's assessment of the relevant information currently available, and which may become available in the future. These projections constitute forward-looking statements and are based on several material factors and assumptions set out above. Actual results may differ significantly from such projections. See above for a discussion of certain risks that could cause actual results to vary. The financial outlook contained in this press release has been approved by management as of the date of this press release. Readers are cautioned that any such financial outlook contained herein should not be used for purposes other than those for which it is disclosed herein. SECURE and its management believe that the financial outlook contained in this press release has been prepared based on assumptions that are reasonable in the circumstances, reflecting management's best estimates and judgments, and represents, to the best of management's knowledge and opinion, expected and targeted financial results. However, because this information is highly subjective, it should not be relied on as necessarily indicative of future results.

Although forward-looking statements contained in this press release are based upon what the Corporation believes are reasonable assumptions, the Corporation cannot assure investors that actual results will be consistent with these forward-looking statements. The forward-looking statements in this press release are made as of the date hereof and are expressly qualified by this cautionary statement. Unless otherwise required by applicable securities laws, SECURE does not intend, or assume any obligation, to update these forward-looking statements.

SECURE is a leading waste management and energy infrastructure business headquartered in Calgary, Alberta. The Corporation's extensive infrastructure network located throughout western Canada and North Dakota includes waste processing and transfer facilities, industrial landfills, metal recycling facilities, crude oil and water gathering pipelines, crude oil terminals and storage facilities. Through this infrastructure network, the Corporation carries out its principal business operations, including the processing, recovery, recycling and disposal of waste streams generated by our energy and industrial customers and gathering, optimization, terminalling and storage of crude oil and natural gas liquids. The solutions the Corporation provides are designed not only to help reduce costs, but also lower emissions, increase safety, manage water, recycle by-products and protect the environment.

SECURE's shares trade under the symbol SES and are listed on the Toronto Stock Exchange. For more information, visit www.SECURE-energy.com.

SOURCE SECURE Energy Services Inc.