News Releases

Stay in the know

- Adjusted EBITDA1 of $119 million ($0.40 per basic share1) and $270 million ($0.90 per basic share) for the three and six months ended June 30, 2023, respectively

- 5.5% of shares outstanding repurchased year to date

CALGARY, AB, July 27, 2023 /CNW/ - SECURE ENERGY Services Inc. ("SECURE" or the "Corporation") (TSX: SES), a leading environmental waste management and energy infrastructure business operating throughout western Canada and North Dakota, reported today the Corporation's financial and operating results for the three and six months ended June 30, 2023.

"Results in the second quarter reflected the recurring nature of volumes handled across our infrastructure network, demonstrating the resiliency of our operations," said Rene Amirault, Chief Executive Officer of SECURE. "We achieved strong Adjusted EBITDA of $119 million, equal to $0.40 per basic share, despite the impact of temporary facility shut-ins and lower customer production due to widespread wildfires across western Canada. SECURE would like to extend our gratitude to emergency responders, staff and industry partners for their hard work in protecting our communities in the midst of the wildfire situation.

"We are also pleased with the significant progress made in delivering on our capital allocation priorities during the quarter. We have returned $175 million in the first half of the year to shareholders through our quarterly $0.10 per share dividend and strategic share repurchases. In addition, we invested $67 million in capital expenditures year to date to advance previously announced infrastructure projects that are backed by strong commercial agreements, providing consistent cash flows to the Corporation throughout all business cycles. All this was achieved while continuing to maintain a solid Total Debt to EBITDA2 covenant ratio of less than 2.0x.

"On June 19, 2023, our appeal of the Competition Tribunal's March 3, 2023, decision ordering the divestiture of certain facilities acquired in connection with the 2021 merger with Tervita Corporation was heard by the Federal Court of Appeal, where we were able to present our arguments of both errors of law and errors of fact in the decision. Our team holds a strong sense of optimism regarding the success of the appeal arguments. We anticipate the issuance of the Federal Court of Appeal decision to be later this year."

SECOND QUARTER FINANCIAL HIGHLIGHTS

- Generated revenue (excluding oil purchase and resale) of $353 million, consistent with the second quarter of 2022.

- Recorded net income of $34 million or $0.11 per basic share, a 35% decrease from the second quarter of 2022. The decrease was primarily due to an adjustment in the prior year period resulting in lower than typical quarterly depreciation expense.

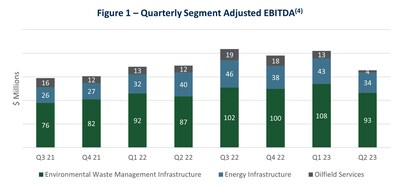

- Achieved Adjusted EBITDA of $119 million or $0.40 per basic share, down slightly from Adjusted EBITDA of $0.41 per basic share in the second quarter of 2022. Figure 1 outlines the quarterly results by reporting segment since the closing of the Tervita merger, underscoring the stability of SECURE's core infrastructure business.

- Recorded an Adjusted EBITDA margin1 of 34%, down from 36% in the second quarter of 2022, due to service mix and higher weather-related operating costs, partially offset by the full run rate of realized synergies in the quarter.

- Generated funds flow from operations of $80 million, consistent with the second quarter of 2022.

- Generated $42 million of discretionary free cash flow1, a 36% decrease from the second quarter of 2022 due to higher sustaining capital investments3 for capacity expansion at our landfills and replacement of key equipment in our metal recycling to achieve efficiency gains.

- Maintained a Total Debt to EBITDA covenant ratio of 1.9x.

SECOND QUARTER STRATEGIC HIGHLIGHTS

- Incurred $31 million of growth capital3 related primarily to the expansion of water disposal infrastructure in connection with the previously announced Montney water disposal and Clearwater oil pipeline and terminalling infrastructure projects.

- Paid a quarterly dividend of $0.10 per common share, resulting in a dividend payout ratio1 on a trailing twelve-month basis of 34%. At our current share price, the annual dividend provides an attractive yield of 6.0% on our common shares.

- Repurchased and cancelled 7,270,800 common shares at a weighted average price per share of $6.40 for a total of $47 million. In total, the Corporation has repurchased 5.5% of outstanding common shares this year.

- Released our 2022 Sustainability Report and inaugural Task Force on Climate-Related Financial Disclosures ("TCFD") reports, demonstrating our ongoing commitment to transparent reporting.

- Received an upgraded issuer rating from B+ (stable) to BB- (stable) from Fitch Ratings to reflect SECURE's better than expected financial performance following the July 2, 2021, merger with Tervita Corporation driving strong free cash flow and debt reduction capacity.

The Corporation's operating and financial highlights for the three and six months ended June 30, 2023 and 2022 can be summarized as follows:

Three months ended | Six months ended | |||||||||

($ millions except share and per share data) | 2023 | 2022 | % change | 2023 | 2022 | % change | ||||

Revenue (excludes oil purchase and resale) | 353 | 355 | (1) | 769 | 714 | 8 | ||||

Oil purchase and resale | 1,429 | 1,723 | (17) | 2,920 | 3,114 | (6) | ||||

Total revenue | 1,782 | 2,078 | (14) | 3,689 | 3,828 | (4) | ||||

Adjusted EBITDA (1) | 119 | 127 | (6) | 270 | 253 | 7 | ||||

Per share ($), basic (1) | 0.40 | 0.41 | (2) | 0.90 | 0.82 | 10 | ||||

Per share ($), diluted (1) | 0.40 | 0.41 | (2) | 0.89 | 0.81 | 10 | ||||

Adjusted EBITDA Margin (1) | 34 % | 36 % | (2) | 35 % | 35 % | — | ||||

Net income | 34 | 54 | (37) | 89 | 92 | (3) | ||||

Per share ($), basic | 0.11 | 0.17 | (35) | 0.30 | 0.30 | — | ||||

Per share ($), diluted | 0.11 | 0.17 | (35) | 0.29 | 0.29 | — | ||||

Funds flow from operations | 80 | 80 | — | 216 | 187 | 16 | ||||

Per share ($), basic | 0.27 | 0.26 | 4 | 0.72 | 0.60 | 20 | ||||

Per share ($), diluted | 0.27 | 0.26 | 4 | 0.71 | 0.60 | 18 | ||||

Discretionary free cash flow (1) | 42 | 66 | (36) | 163 | 166 | (2) | ||||

Per share ($), basic and diluted (1) | 0.14 | 0.21 | (33) | 0.54 | 0.54 | — | ||||

Capital expenditures (1) | 68 | 19 | 258 | 114 | 32 | 256 | ||||

Dividends declared per common share | 0.1000 | 0.0075 | 1,233 | 0.2000 | 0.0150 | 1,233 | ||||

Total assets | 2,796 | 2,931 | (5) | 2,796 | 2,931 | (5) | ||||

Long-term liabilities | 1,179 | 1,281 | (8) | 1,179 | 1,281 | (8) | ||||

Common shares - end of period | 293,629,841 | 309,868,588 | (5) | 293,629,841 | 309,868,588 | (5) | ||||

Weighted average common shares: | ||||||||||

Basic | 296,343,936 | 309,831,621 | (4) | 301,402,499 | 309,335,228 | (3) | ||||

Diluted | 298,407,348 | 313,071,825 | (5) | 304,185,069 | 312,560,669 | (3) | ||||

1 Non-GAAP financial measure/ratio. Refer to the "Non-GAAP and other specified financial measures" section herein. |

2 Calculated in accordance with the Corporation's credit facility agreements. Refer to the Q2 2023 Management's Discussion and Analysis ("MD&A"). |

3 The Corporation classifies capital expenditures as either growth, acquisition or sustaining capital. Refer to "Operational Definitions" in the MD&A for further information. |

4Excludes corporate costs. |

OUTLOOK

Throughout the remainder of 2023, SECURE continues to expect the current macro environment in both the industrial and energy sectors to remain strong. Energy industry activity is robust as producer discipline, balance sheet strength, cost optimization efforts and operational efficiency strategies facilitate ongoing development. Our infrastructure network continues to have significant capacity to help customers with increased volumes requiring processing, disposal, recycling, recovery and terminalling with minimal incremental fixed costs or additional capital. Overall, SECURE has a constructive outlook for volumes, activity levels and demand for SECURE's infrastructure for the remainder of 2023.

The rapid growth in the Montney and Clearwater regions has provided opportunities to partner with our customers where infrastructure and additional capacity are required to keep up with production growth. The $100 million of growth capital anticipated for 2023 provides SECURE with long-term contracted volumes in these areas, and provides our customers with cost-effective, reliable solutions for growth volumes, allowing them to free up resources to focus on other corporate initiatives.

SECURE's appeal of the decision of the Competition Tribunal of Canada (the "Tribunal") dated March 3, 2023 was heard by the Federal Court of Appeal on June 19, 2023. While a decision from the Federal Court of Appeal is not anticipated until later in 2023, the partial stay received with respect to the divestiture order allows the Corporation to operate status quo, providing strong cash flows during this period of uncertainty.

The Corporation remains optimistic that the appeal will be successful. However, if the Tribunal's decision stands after all appeals are exhausted and SECURE is required to sell the assets it has been ordered to sell by the Tribunal, we expect these asset sales to yield strong proceeds. The initial priority will be to use the proceeds of disposition to pay down debt, strengthening the Corporation's financial position and reducing interest expenses. Subsequently, SECURE expects to reinvest the proceeds to grow the business and direct towards additional shareholder returns, creating shareholder value.

2023 Expectations

- Growth capital expenditures of approximately $100 million, primarily related to the Clearwater oil pipeline and terminal and Montney water pipeline and disposal infrastructure. Both projects are on budget and expected to be in service in the fourth quarter of 2023.

- Sustaining capital expenditures of approximately $85 million, inclusive of landfill expansions, to meet current activity levels and in anticipation of increased abandonment spend obligations driven from government regulations.

- Asset retirement obligation expenditures of approximately $20 million.

- Annualized base dividend of $0.40 per share, which equates to a total of approximately $120 million for the year based on current issued and outstanding shares.

- Continued opportunistic share repurchases under the Corporation's Normal Course Issuer Bid, balanced with other capital allocation opportunities.

- Maintain a Total Debt to EBITDA covenant ratio of approximately 2.0x.

- Continued strong margins as we focus on optimizing the business, targeting additional operating efficiencies and continually improving operating cash flow. The wildfires did have a temporary impact on our margins in May 2023 due to short-term and intermittent facility closures. Although we currently have no facility closures, there continues to be significant fire risk across Western Canada and SECURE will continue to work closely with the Provincial authorities and support the communities where we operate.

SECURE remains committed to operational excellence and positioning itself for growth in the environmental waste management infrastructure and energy infrastructure markets. SECURE thanks our customers and our employees for their exceptional effort every day making Canada a global Environment, Social and Governance ("ESG") leader.

NON-GAAP AND OTHER SPECIFIED FINANCIAL MEASURES

The Corporation uses accounting principles that are generally accepted in Canada (the issuer's "GAAP"), which includes International Financial Reporting Standards ("IFRS"). This news release contains certain supplementary non-GAAP financial measures, such as Adjusted EBITDA and discretionary free cash flow and certain non-GAAP financial ratios, such as Adjusted EBITDA Margin, Adjusted EBITDA per share, discretionary free cash flow per share, and payout ratio which do not have any standardized meaning as prescribed by IFRS. These measures are intended as a complement to results provided in accordance with IFRS. The Corporation believes these measures provide additional useful information to analysts, shareholders and other users to understand the Corporation's financial results, profitability, cost management, liquidity and ability to generate funds to finance its operations.

However, these measures should not be used as an alternative to IFRS measures because they are not standardized financial measures under IFRS and therefore might not be comparable to similar financial measures disclosed by other companies. See the "Non-GAAP and other specified financial measures" section of the Corporation's MD&A for the three and six months ended June 30, 2023 and 2022 for further details, which is incorporated by reference herein and available on SECURE's profile at www.sedar.com and on our website at www.SECURE-energy.com.

Adjusted EBITDA, Adjusted EBITDA Margin and Adjusted EBITDA per share

Adjusted EBITDA is calculated as noted in the table below and reflects items that the Corporation considers appropriate to adjust given the irregular nature and relevance to comparable operations. Adjusted EBITDA margin is defined as Adjusted EBITDA divided by revenue (excluding oil purchase and resale). Adjusted EBITDA per basic and diluted share is defined as Adjusted EBITDA divided by basic and diluted weighted average common shares.

The following table reconciles the Corporation's net income, being the most directly comparable financial measure disclosed in the Corporation's financial statements, to Adjusted EBITDA for the three and six months ended June 30, 2023 and 2022.

Three months ended | Six months ended | |||||

2023 | 2022 | % Change | 2023 | 2022 | % Change | |

Net income | 34 | 54 | (37) | 89 | 92 | (3) |

Adjustments: | ||||||

Depreciation, depletion and amortization (1) | 47 | 21 | 124 | 101 | 77 | 31 |

Current tax expense | 1 | — | 100 | 4 | — | 100 |

Deferred tax expense | 9 | 14 | (36) | 24 | 23 | 4 |

Share-based compensation (1) | 5 | 5 | — | 14 | 10 | 40 |

Interest, accretion and finance costs | 24 | 24 | — | 47 | 49 | (4) |

Unrealized loss (gain) on mark to market transactions (2) | 3 | 1 | 200 | — | (1) | (100) |

Other income | (8) | (1) | 700 | (16) | (15) | 7 |

Transaction and related costs | 4 | 9 | (56) | 7 | 18 | (61) |

Adjusted EBITDA | 119 | 127 | (6) | 270 | 253 | 7 |

(1) Included in cost of sales and/or general and administrative expenses on the Consolidated Statements of Comprehensive Income. | ||||||

(2) Net balance. Includes amounts presented in revenue and cost of sales on the Consolidated Statements of Comprehensive Income. | ||||||

Discretionary Free Cash Flow and Discretionary Free Cash Flow per share

Discretionary free cash flow is defined as funds flow from operations adjusted for sustaining capital expenditures, and lease payments. The Corporation may deduct or include additional items in its calculation of discretionary free cash flow that are unusual, non-recurring, or non-operating in nature. Discretionary free cash flow per basic and diluted share is defined as discretionary free cash flow divided by basic and diluted weighted average common shares. For the three and six months ended June 30, 2023 and 2022, transaction and related costs have been adjusted as they are costs outside the normal course of business.

The following table reconciles the Corporation's funds flow from operations, being the most directly comparable financial measure disclosed in the Corporation's financial statements, to discretionary free cash flow.

Three months ended | Six months ended | |||||

2023 | 2022 | % Change | 2023 | 2022 | % Change | |

Funds flow from operations | 80 | 80 | — | 216 | 187 | 16 |

Adjustments: | ||||||

Sustaining capital (1) | (37) | (17) | 118 | (47) | (27) | 74 |

Lease liability principal payment | (5) | (6) | (17) | (13) | (12) | 8 |

Transaction and related costs | 4 | 9 | (56) | 7 | 18 | (61) |

Discretionary free cash flow | 42 | 66 | (36) | 163 | 166 | (2) |

(1) The Corporation classifies capital expenditures as either growth, acquisition or sustaining capital. Refer to "Operational Definitions" in the MD&A for further information. |

Dividend Payout Ratio

Dividend payout ratio is calculated as the most recent quarterly dividend declared to shareholders, annualized divided by trailing twelve-month discretionary free cash flow. This ratio is used to assess the sustainability of the Corporation's dividend payment program.

FINANCIAL STATEMENTS AND MD&A

The Corporation's consolidated financial statements and notes thereto and MD&A for the three and six months ended June 30, 2023 and 2022 are available on SECURE's website at www.SECURE-energy.com and on SEDAR at www.sedar.com.

SECOND QUARTER 2023 CONFERENCE CALL

SECURE will host a conference call Thursday, July 27, 2023, at 9:00 a.m. MST to discuss the second quarter results. To participate in the conference call, dial 416-764-8650 or toll free 1-888-664-6383. To access the simultaneous webcast, please visit www.SECURE-energy.com. For those unable to listen to the live call, a taped broadcast will be available at www.SECURE-energy.com and, until midnight MST on Thursday, August 3, 2023, by dialing 1-888-390-0541 and using the pass code 249248.

FORWARD-LOOKING STATEMENTS

Certain statements contained or incorporated by reference in this press release constitute "forward-looking statements and/or "forward-looking information" within the meaning of applicable securities laws (collectively referred to as "forward-looking statements"). When used in this press release, the words "achieve", "advance", "anticipate", "believe", "can be", "capacity", "commit", "continue", "could", "deliver", "drive", "enhance", "ensure", "estimate", "execute", "expect", "focus", "forecast", "forward", "future", "goal", "grow", "integrate", "intend", "may", "maintain", "objective", "ongoing", "opportunity", "outlook", "plan", "position", "potential", "prioritize", "realize", "remain", "result", "seek", "should", "strategy", "target" "will", "would" and similar expressions, as they relate to SECURE, its management are intended to identify forward-looking statements. Such statements reflect the current views of SECURE and speak only as of the date of this press release.

In particular, this press release contains or implies forward-looking statements pertaining but not limited to: SECURE's growth expenditures and the amount and timing thereof, allocating funds to growth opportunities, while maintaining a solid financial position; ongoing transparent reporting; a supportive macro environment driving higher volumes, activity levels, SECURE's business and demand for SECURE's products and services for the remainder of 2023; SECURE's infrastructure network capacity and costs to meet growing demand; commissioning new infrastructure and the timing thereof; increased industry activity, including related to abandonment, remediation and reclamation; SECURE's ability to help their customers; the effects, costs and results of the Tribunal decision and the appeal thereof; the timing of the Federal Court of Appeal's decision; SECURE's ability to operate status quo until the appeal of the Tribunal is complete; SECURE's grounds for appeal; the costs and the proceeds of sale should SECURE be required to divest any facilities and SECURE's ability to maximize such proceeds; the use of such proceeds of sale; SECURE's expectations for 2023, including growth and sustaining capital expenditures, asset retirement obligations, and shareholder returns; maintain a Total Debt to EBITDA covenant ratio of approximately 2.0x; and focusing on optimizing the business, targeting additional operating efficiencies and improving operating cash flows; the opportunities available to SECURE as a result of growth in the Montney and Clearwater regions; SECURE's commitment to operation excellence and ability to position itself for growth.

Forward-looking statements are based on certain assumptions that SECURE has made in respect thereof as at the date of this press release regarding, among other things: economic and operating conditions, including commodity prices, crude oil and natural gas storage levels, interest rates, exchange rates, and inflation; the changes in market activity and growth will be consistent with industry activity in Canada and the U.S. and growth levels in similar phases of previous economic cycles; the impact of the COVID-19 pandemic (including its variants) and geopolitical events, including government responses related thereto and their impact on global energy pricing, oil and gas industry exploration and development activity levels and production volumes; the ability of the Corporation to realize the anticipated benefits of acquisitions or dispositions, including the Tervita merger; the resolution of SECURE's appeal of the Tribunal's decision on terms acceptable to the Corporation and the impacts of the divestiture of facilities, if any, as a result thereof; SECURE's ability to successfully integrate Tervita's legacy business; anticipated sources of funding being available to SECURE on terms favourable to SECURE; the success of the Corporation's operations and growth projects; the Corporation's competitive position, operating, acquisition and sustaining costs remaining substantially unchanged; the Corporation's ability to attract and retain customers (including Tervita's historic customers); that counterparties comply with contracts in a timely manner; that there are no unforeseen events preventing the performance of contracts or the completion and operation of the relevant facilities; that there are no unforeseen material costs in relation to the Corporation's facilities and operations; that prevailing regulatory, tax and environmental laws and regulations apply or are introduced as expected, and the timing of such introduction; increases to the Corporation's share price and market capitalization over the long term; the Corporation's ability to repay debt and return capital to shareholders; the Corporation's ability to obtain and retain qualified personnel (including those with specialized skills and knowledge), technology and equipment in a timely and cost-efficient manner; the Corporation's ability to access capital and insurance; operating and borrowing costs, including costs associated with the acquisition and maintenance of equipment and property; the ability of the Corporation and our subsidiaries to successfully market our services in western Canada and the U.S.; an increased focus on ESG, sustainability and environmental considerations in the oil and gas industry; the impacts of climate-change on the Corporation's business; the current business environment remaining substantially unchanged; present and anticipated programs and expansion plans of other organizations operating in the energy service industry resulting in an increased demand for the Corporation's and our subsidiaries' services; future acquisition and maintenance costs; the Corporation's ability to achieve its ESG and sustainability targets and goals and the costs associated therewith; and other risks and uncertainties described in SECURE's current annual information form and from time to time in filings made by SECURE with securities regulatory authorities.

Forward-looking statements involve significant known and unknown risks and uncertainties, should not be read as guarantees of future performance or results, and will not necessarily be accurate indications of whether such results will be achieved. Readers are cautioned not to place undue reliance on these statements as a number of factors could cause actual results to differ materially from the results discussed in these forward-looking statements, including but not limited to: general global financial conditions, including general economic conditions in Canada and the U.S.; the effect of the COVID-19 pandemic (including its variants), inflation and geopolitical events and governmental responses thereto on economic conditions, commodity prices and the Corporation's business and operations; changes in the level of capital expenditures made by oil and natural gas producers and the resultant effect on demand for oilfield services during drilling and completion of oil and natural gas wells; volatility in market prices for oil and natural gas and the effect of this volatility on the demand for oilfield services generally; a transition to alternative energy sources; the Corporation's inability to retain customers; risks inherent in the energy industry, including physical climate-related impacts; the Corporation's ability to generate sufficient cash flow from operations to meet our current and future obligations; the seasonal nature of the oil and gas industry; increases in debt service charges including changes in the interest rates charged under the Corporation's current and future debt agreements; inflation and supply chain disruptions; the Corporation's ability to access external sources of debt and equity capital and insurance; disruptions to our operations resulting from events out of our control; the timing and amount of stimulus packages and government grants relating to site rehabilitation programs; the cost of compliance with and changes in legislation and the regulatory and taxation environment, including uncertainties with respect to implementing binding targets for reductions of emissions and the regulation of hydraulic fracturing services and services relating to the transportation of dangerous goods; uncertainties in weather and temperature affecting the duration of the oilfield service periods and the activities that can be completed; competition; impairment losses on physical assets; sourcing, pricing and availability of raw materials, consumables, component parts, equipment, suppliers, facilities, and skilled management, technical and field personnel; supply chain disruption; the Corporation's ability to effectively complete acquisition and divestiture transactions on acceptable terms or at all; a failure to realize the benefits of acquisitions, including the Tervita merger, and risks related to the associated business integration; the inaccuracy of pro forma information prepared in connection with acquisitions; risks related to a new business mix and significant shareholder; liabilities and risks, including environmental liabilities and risks, inherent in SECURE's operations, including those associated with the Tervita merger; the resolution of SECURE's appeal of the Tribunal's decision on terms acceptable to the Corporation and the impacts of the divestiture of facilities, if any, as a result thereof; the Corporation's ability to invest in and integrate technological advances and match advances of our competition; the viability, economic or otherwise, of such technology; credit, commodity price and foreign currency risk to which the Corporation is exposed in the conduct of our business; compliance with the restrictive covenants in the Corporation's current and future debt agreements; the Corporation's or our customers' ability to perform their obligations under long-term contracts; misalignment with our partners and the operation of jointly owned assets; the Corporation's ability to source products and services on acceptable terms or at all; the Corporation's ability to retain key or qualified personnel, including those with specialized skills or knowledge; uncertainty relating to trade relations and associated supply disruptions; the effect of changes in government and actions taken by governments in jurisdictions in which the Corporation operates, including in the U.S.; the effect of climate change and related activism on our operations and ability to access capital and insurance; cyber security and other related risks; the Corporation's ability to bid on new contracts and renew existing contracts; potential closure and post-closure costs associated with landfills operated by the Corporation; the Corporation's ability to protect our proprietary technology and our intellectual property rights; legal proceedings and regulatory actions to which the Corporation may become subject, including in connection with SECURE's appeal of the Tribunal's decision and any claims for infringement of a third parties' intellectual property rights; the Corporation's ability to meet its ESG targets or goals and the costs associated therewith; claims by, and consultation with, Indigenous Peoples in connection with project approval; disclosure controls and internal controls over financial reporting; and other risk factors identified in SECURE's current annual information form and from time to time in filings made by the Corporation with securities regulatory authorities.

Although forward-looking statements contained in this press release are based upon what the Corporation believes are reasonable assumptions, the Corporation cannot assure investors that actual results will be consistent with these forward-looking statements. The forward-looking statements in this press release are made as of the date hereof and are expressly qualified by this cautionary statement. Unless otherwise required by applicable securities laws, SECURE does not intend, or assume any obligation, to update these forward-looking statements.

ABOUT SECURE

SECURE is a leading environmental and energy infrastructure business headquartered in Calgary, Alberta. The Corporation's extensive infrastructure network located throughout western Canada and North Dakota includes waste processing and transfer facilities, industrial landfills, metal recycling facilities, crude oil and water gathering pipelines, crude oil terminals and storage facilities. Through this infrastructure network, the Corporation carries out its principal business operations, including the processing, recovery, recycling and disposal of waste streams generated by our energy and industrial customers and gathering, optimization, terminalling and storage of crude oil and natural gas liquids. The solutions the Corporation provides are designed not only to help reduce costs, but also lower emissions, increase safety, manage water, recycle by-products and protect the environment.

SECURE's shares trade under the symbol SES and are listed on the Toronto Stock Exchange. For more information, visit www.SECURE-energy.com.

SOURCE SECURE Energy Services Inc.