News Releases

Stay in the know

CALGARY, AB, June 19, 2023 /CNW/ - SECURE ENERGY Services Inc. ("SECURE" or the "Corporation") (TSX: SES), today announced that, in connection with its previously announced consent solicitation (the "Solicitation") with respect to proposed amendments (the "Proposed Amendments") to the indenture (the "Indenture") governing its 11.000% Senior Second Lien Secured Notes due 2025 (the "Notes"), SECURE had received, as of 5:00 p.m., New York City time, on June 16, 2023 (the "Expiration Time"), consents from the holders of more than 50% of the aggregate principal amount of the then outstanding Notes. SECURE and the subsidiary guarantors and the trustees party to the Indenture expect to enter into a fifth supplemental indenture (the "Fifth Supplemental Indenture") to the Indenture as soon as practicable, to give effect to the Proposed Amendments relating to the Indenture.

The purpose of the Proposed Amendments is to fully align the restricted payment section under the Indenture with the comparable terms under the indenture governing SECURE's outstanding $340 million aggregate principal amount of 7.25% unsecured notes due 2026, which facilitates SECURE's delivery of its capital allocation priorities, including the return of capital to shareholders in the form of its quarterly dividend and opportunistic share repurchases. Subject to the terms and conditions set forth in the Consent Solicitation Statement dated June 8, 2023, SECURE will pay to the Information and Tabulation Agent, for the benefit of eligible holders of Notes who validly delivered and did not validly revoke their consents on or prior to the Expiration Time, a cash payment equal to US$5.00 per US$1,000 in aggregate principal amount of the Notes consented (the "Consent Payment"). SECURE expects to make the Consent Payment upon or promptly after executing the Fifth Supplemental Indenture. The Proposed Amendments will not become operative unless the Consent Payment is made.

Barclays Capital Inc. acted as Sole Solicitation Agent for the Solicitation and D.F. King & Co., Inc. served as Information and Tabulation Agent for the Solicitation.

This announcement is for information purposes only and is neither an offer to sell nor a solicitation of a consent or an offer to buy or sell any security. This announcement is also not a solicitation of consents with respect to the Proposed Amendments or any securities. The Solicitation is not being made in any jurisdiction in which, or to or from any person to or from whom, it is unlawful to make such solicitation under applicable state or foreign securities or "blue sky" laws.

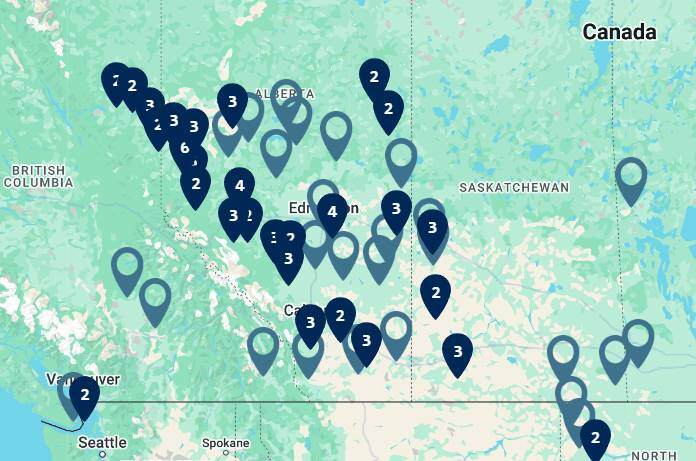

SECURE is a leading environmental and energy infrastructure business headquartered in Calgary, Alberta. The Corporation's extensive infrastructure network located throughout western Canada and North Dakota includes waste processing and transfer facilities, industrial landfills, metal recycling facilities, crude oil and water gathering pipelines, crude oil terminals and storage facilities. Through this infrastructure network, the Corporation carries out its principal business operations, including the processing, recovery, recycling and disposal of waste streams generated by our energy and industrial customers and gathering, optimization, terminalling and storage of crude oil and natural gas liquids. The solutions the Corporation provides are designed not only to help reduce costs, but also lower emissions, increase safety, manage water, recycle by-products and protect the environment.

SECURE's shares trade under the symbol SES and are listed on the Toronto Stock Exchange.

Certain statements contained in this news release constitute forward-looking information and statements (collectively, "forward-looking statements") including, but not limited to, statements concerning, among other things, entering into the Fifth Supplemental Indenture and the timing thereof, the proposed timing for payment of the Consent Payment, the effects of the Proposed Amendments and SECURE's ability to successfully effect the foregoing. The use of any of the words ''anticipate'', ''plan'', ''expect'', ''intend'', ''propose'', ''might'', ''may'', ''will'', ''shall'', ''should'', ''could'', ''would'', ''believe'', ''predict'', and similar expressions are intended to identify forward looking statements. These statements involve known and unknown risks, uncertainties and other factors that may cause actual results or events to differ materially from those anticipated in such forward-looking statements. No assurance can be given that these expectations will prove to be correct and such forward-looking statements included in this news release should not be unduly relied upon. These statements speak only as of the date of this news release. The Corporation does not undertake any obligations to publicly update or revise any forward-looking statements except as required by securities law. Although SECURE believes that the material factors, expectations and assumptions expressed in such forward-looking statements are reasonable based on information available to it on the date such statements were made, actual results could differ materially from those anticipated in these forward-looking statements as a result of numerous risks and uncertainties including, but not limited to, the risks and uncertainties described in "Forward-Looking Statements" and "Risk Factors" included in SECURE's current Annual Information Form, and other documents SECURE files with securities regulatory authorities from time to time, each as filed on SEDAR and available on SECURE's website at www.secure-energy.com.

SOURCE SECURE Energy Services Inc.