News Releases

Stay in the know

CALGARY, AB, June 8, 2023 /CNW/ - SECURE ENERGY Services Inc. ("SECURE" or the "Corporation") (TSX: SES), today announced that it has commenced a consent solicitation (the "Solicitation") with respect to proposed amendments (the "Proposed Amendments") to the indenture (the "Indenture") governing its 11.000% Senior Second Lien Secured Notes due 2025 (the "Notes") upon the terms and subject to the conditions set forth in the Consent Solicitation Statement dated June 8, 2023 (the "Statement"). SECURE is soliciting consents from holders of record of the Notes as at 5:00 p.m., New York City time, on June 7, 2023 ("Holders"). Subject to the terms and conditions set forth in the Statement, SECURE will pay eligible holders who validly deliver their consents on or prior to 5:00 p.m., New York City time, on June 16, 2023 (as such date and time may be extended or earlier terminated by SECURE in its sole discretion in accordance with the Statement, the "Expiration Time"), and do not validly revoke such consents on or prior to the earlier of the Effective Time (as defined below) and the Expiration Time, a cash payment equal to US$5.00 per US$1,000 in aggregate principal amount of the Notes consented (the "Consent Payment"). The Consent Payment will only be payable upon and subject to the occurrence of, among other things, the receipt of the Requisite Consents (as defined below).

SECURE is soliciting the consents to the Proposed Amendments for the purposes of fully aligning the restricted payment section under the Indenture with the comparable terms under the indenture governing SECURE's outstanding $340 million aggregate principal amount of 7.25% unsecured notes due 2026, which facilitates SECURE's delivery of its capital allocation priorities, including the return of capital to shareholders in the form of its quarterly dividend and opportunistic share repurchases.

The Solicitation is subject to certain conditions, including, among other things, the receipt of valid and unrevoked consents in respect of more than 50% of the aggregate principal amount outstanding of the Notes (other than Notes held by SECURE or any of its affiliates) (the "Requisite Consents") at or prior to the Expiration Time. The Proposed Amendments will be effected by a fifth supplemental indenture (the "Fifth Supplemental Indenture") to the Indenture, which will be executed after the receipt of the Requisite Consents, as described in more detail in the Statement. However, the Proposed Amendments will not become operative unless the Consent Payment is made. SECURE expects to make the Consent Payment upon or promptly after the time and date on which the Fifth Supplemental Indenture is executed and delivered (the "Effective Time").

Delivered consents may be validly revoked prior to the earlier of the Expiration Time and the Effective Time. Holders should note that the Effective Time may fall prior to the Expiration Time and Holders will not be given prior notice of such Effective Time. Holders will not be able to revoke their consents after the earlier of the Effective Time and the Expiration Time.

In the event that SECURE does not receive the Requisite Consents prior to the Expiration Time, no Consent Payment will be made by SECURE.

The Solicitation is being made solely on the terms and subject to the conditions set forth in the Statement. SECURE may, in its sole discretion, terminate, abandon, extend or amend the Solicitation as described in the Statement.

SECURE has retained Barclays Capital Inc. to act as solicitation agent in connection with the Solicitation. Questions may be directed to Barclays at +1 (800) 438-3242 (toll free) or 1 (212) 528-7581 (collect). SECURE has retained D.F. King & Co., Inc. to act as Information and Tabulation Agent in connection with the Solicitation. Questions and requests for additional documents may be directed to D.F. King & Co., Inc. at +1 (800) 848-3410 (toll free) or +1 (212) 269-5550 (bankers and brokers collect) or by e-mailing SES@dfking.com.

This announcement is for information purposes only and is neither an offer to sell nor a solicitation of a consent or an offer to buy or sell any security. This announcement is also not a solicitation of consents with respect to the Proposed Amendments or any securities. The Solicitation is not being made in any jurisdiction in which, or to or from any person to or from whom, it is unlawful to make such solicitation under applicable state or foreign securities or "blue sky" laws.

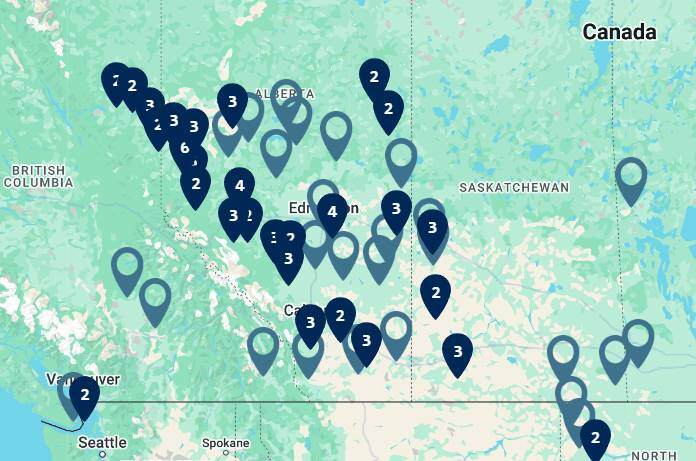

SECURE is a leading environmental and energy infrastructure business headquartered in Calgary, Alberta. The Corporation's extensive infrastructure network located throughout western Canada and North Dakota includes waste processing and transfer facilities, industrial landfills, metal recycling facilities, crude oil and water gathering pipelines, crude oil terminals and storage facilities. Through this infrastructure network, the Corporation carries out its principal business operations, including the processing, recovery, recycling and disposal of waste streams generated by our energy and industrial customers and gathering, optimization, terminalling and storage of crude oil and natural gas liquids. The solutions the Corporation provides are designed not only to help reduce costs, but also lower emissions, increase safety, manage water, recycle by-products and protect the environment.

SECURE's shares trade under the symbol SES and are listed on the Toronto Stock Exchange.

Certain statements contained in this news release constitute forward-looking information and statements (collectively, "forward-looking statements") including, but not limited to, statements concerning, among other things, SECURE's plans to complete the Solicitation and effect the Proposed Amendments to the Indenture and the effects thereof; the proposed timing for completion of the Solicitation and payment of the Consent Payment; SECURE's ability to successfully effect the foregoing; and other statements that are not historical facts. The use of any of the words ''anticipate'', ''plan'', ''expect'', ''intend'', ''propose'', ''might'', ''may'', ''will'', ''shall'', ''should'', ''could'', ''would'', ''believe'', ''predict'', and similar expressions are intended to identify forward looking statements. These statements involve known and unknown risks, uncertainties and other factors that may cause actual results or events to differ materially from those anticipated in such forward-looking statements. No assurance can be given that these expectations will prove to be correct and such forward-looking statements included in this news release should not be unduly relied upon. These statements speak only as of the date of this news release. The Corporation does not undertake any obligations to publicly update or revise any forward-looking statements except as required by securities law. Although SECURE believes that the material factors, expectations and assumptions expressed in such forward-looking statements are reasonable based on information available to it on the date such statements were made, actual results could differ materially from those anticipated in these forward-looking statements as a result of numerous risks and uncertainties including, but not limited to, the risks and uncertainties described in "Solicitation Considerations" included in the Statement and in "Forward-Looking Statements" and "Risk Factors" included in SECURE's current Annual Information Form, and other documents SECURE files with securities regulatory authorities from time to time, each as filed on SEDAR and available on SECURE's website at www.secure-energy.com.

TSX Symbol: SES

SOURCE SECURE Energy Services Inc.