News Releases

Stay in the know

- Adjusted EBITDA1 increased 20% to $151 million and 20% to $0.49 per share1

- 9,595,200 common shares repurchased at a weighted average price per share of $7.24

- 2023 planned growth expenditures increased to approximately $100 million (from $50 million previously announced) with additional infrastructure expansion projects backed by commercial agreements entered in Q1 2023

- Revised segment reporting following completion of Tervita post-merger integration

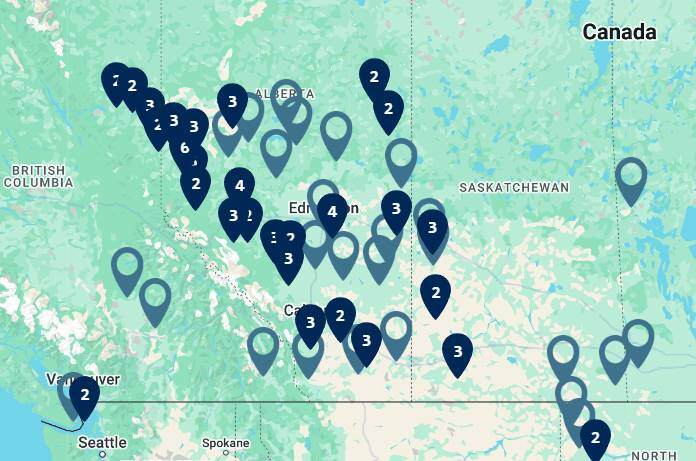

CALGARY, AB, April 27, 2023 /CNW/ - SECURE ENERGY Services Inc. ("SECURE" or the "Corporation") (TSX: SES), a leading environmental and energy infrastructure business operating throughout western Canada and North Dakota, reported today the Corporation's financial and operating results for the three months ended March 31, 2023.

"Our strong first quarter results reflect the continued momentum that supported our business throughout 2022, as higher volumes across our infrastructure network along with the full run rate of synergies realized from the Tervita merger led to a 20% increase in Adjusted EBITDA to $151 million," said Rene Amirault, Chief Executive Officer of SECURE. "We also delivered on our capital allocation framework, returning $100 million of capital to shareholders during the quarter, including the repurchase of 3% of SECURE's common shares, and allocating funds to growth opportunities backed by strong commercial agreements providing long-term reliable cash flows, while continuing to maintain a solid financial position."

FINANCIAL HIGHLIGHTS

- Generated revenue (excluding oil purchase and resale) of $416 million, an increase of 16% from Q1 2022 resulting from higher volumes at our waste processing facilities and increased demand for oilfield services due to strong energy industry fundamentals.

- Recorded net income of $55 million or $0.18 per basic share, up 45% from Q1 2022 reflecting higher revenue, strong operational performance and the full run rate of realized synergies.

- Achieved Adjusted EBITDA of $151 million or $0.49 per basic share, up 20% from Q1 2022, due to the same factors impacting net income.

- Recorded an Adjusted EBITDA margin1 of 36%, up from 35% in Q1 2022, due to strong revenue, improved fixed cost absorption and full run rate of realized synergies in the quarter, which were partially offset by inflationary related input price increases.

- Increased funds flow from operations to $136 million in Q1 2023, up 27% from Q1 2022.

- Generated $122 million of discretionary free cash flow1, up 22% from Q1 2022, which was primarily directed towards growth and shareholder returns during the quarter.

- Maintained a Total Debt to EBITDA2 covenant ratio of 1.9x.

STRATEGIC UPDATE/HIGHLIGHTS

- Entered into a 12-year commercial agreement with a senior E&P producer customer for water disposal in the Montney resource play. The agreement provides SECURE with take or pay commitments on nearly 90% of the facility's capacity, and the customer with guaranteed access to cost efficient water disposal.

- Incurred $36 million of growth capital3 related primarily to the expansion of water disposal infrastructure in connection with the commercial agreement noted above and progressing construction of the previously announced Clearwater oil pipeline and terminalling infrastructure.

- Optimized our portfolio through the sale of non-core assets for total proceeds of $22 million.

- Paid our first increased quarterly dividend of $0.10 per common share in January 2023, resulting in a dividend payout ratio1 on a trailing twelve-month basis of 34%. At our current share price, the annual dividend provides an attractive yield of 6.1% on our common shares.

- Repurchased and cancelled 9,595,200 common shares at a weighted average price per share of $7.24 for a total of $69 million in Q1 2023. Subsequent to quarter end, the Corporation has repurchased an additional 3,983,500 common shares, representing a total 4.4% of outstanding common shares repurchased this year.

- Revised our financial reporting structure to reflect changes following the completion of the Tervita post-merger integration and provide stakeholders with improved visibility and transparency for valuing the business. Operating segments with similar operating characteristics and economic prospects have been aggregated to form three reportable segments:

- Environmental Waste Processing Infrastructure comprised of waste processing, recovery, recycling and disposal operations offered through our network of waste processing facilities, produced water pipelines, industrial landfills, waste transfer and metal recycling facilities.

- Energy Infrastructure comprised of crude oil transportation, optimization, terminalling and storage solutions offered through our network of crude oil gathering pipelines, terminals and storage facilities.

- Oilfield Services comprised of drilling fluids, equipment rentals and onsite project management.

- SECURE has recast previously reported quarterly segment financial information in our MD&A for the years ended December 31, 2022 and 2021 to reflect its new reportable segments.

- Progressed the Corporation's board renewal with the appointment of Wendy Hanrahan effective March 15, 2023.

- Appealed the March 3, 2023, Competition Tribunal decision ordering the divestiture of 29 of the 103 facilities acquired in connection with the Tervita Corporation merger.

- Releasing our 2022 Sustainability Report and inaugural Task Force on Climate-Related Financial Disclosures ("TCFD") report in May 2023, demonstrating our ongoing commitment to transparent reporting.

With tomorrow's Annual General Meeting of Shareholders, two of the Corporation's long-standing directors, Kevin Nugent and Jay Thornton, will not be standing for re-election, marking the end of their term on the Board of Directors. Mr. Nugent joined SECURE's Board in 2007 and has been instrumental in establishing best in class governance practices and providing sound counsel over the past 15 years. Mr. Thornton was appointed to SECURE's Board in connection with the Tervita merger on July 2, 2021, and provided strategic leadership through the merger and integration and has continued to provide valuable counsel to the Board and management. Prior to his appointment to SECURE's Board, Mr. Thornton had been a director of Tervita since 2016. "Both individuals are accomplished business leaders who have brought an immeasurable wealth of industry experience and insight to SECURE's Board," said Mr. Amirault. "I want to thank Kevin and Jay for their valuable contributions as directors and wish them both the best in their retirement."

The Corporation's operating and financial highlights for the three and twelve months ended March 31, 2023 and 2022 can be summarized as follows:

Three months ended | |||

($ millions except share and per share data) | 2023 | 2022 | % change |

Revenue (excludes oil purchase and resale) | 416 | 359 | 16 |

Oil purchase and resale | 1,491 | 1,391 | 7 |

Total revenue | 1,907 | 1,750 | 9 |

Adjusted EBITDA (1) | 151 | 126 | 20 |

Per share ($), basic (1) | 0.49 | 0.41 | 20 |

Per share ($), diluted (1) | 0.49 | 0.40 | 23 |

Net income | 55 | 38 | 45 |

Per share ($), basic and diluted | 0.18 | 0.12 | 50 |

Funds flow from operations | 136 | 107 | 27 |

Per share ($), basic | 0.44 | 0.35 | 26 |

Per share ($), diluted | 0.44 | 0.34 | 29 |

Discretionary free cash flow (1) | 122 | 100 | 22 |

Per share ($), basic (1) | 0.40 | 0.32 | 25 |

Per share ($), diluted (1) | 0.39 | 0.32 | 22 |

Capital expenditures (1) | 46 | 13 | 254 |

Dividends declared per common share | 0.1000 | 0.0075 | 1,233 |

Total assets | 2,830 | 2,970 | (5) |

Long-term liabilities | 1,184 | 1,378 | (14) |

Common shares - end of period | 300,818,846 | 309,800,855 | (3) |

Weighted average common shares: | |||

Basic | 306,517,269 | 308,833,319 | (1) |

Diluted | 310,026,987 | 312,043,772 | (1) |

1 Non-GAAP financial measure/ratio. Refer to the "Non-GAAP and other specified financial measures" section herein. |

2 Calculated in accordance with the Corporation's credit facility agreements. Refer to the Q1 2023 Management's Discussion and Analysis ("MD&A"). |

3 The Corporation classifies capital expenditures as either growth, acquisition or sustaining capital. Refer to "Operational Definitions" in the MD&A for further information. |

OUTLOOK

"We expect a supportive macro environment will continue to drive higher volumes, activity levels and overall demand for SECURE's infrastructure during the remainder of 2023," said Mr. Amirault. "Our infrastructure network has significant capacity to help our customers with increased volumes requiring processing, disposal, recycling, recovery and terminalling with minimal incremental fixed costs or additional capital. We are also excited to work in partnership with our customers to commission new infrastructure this year, providing SECURE with long-term contracted volumes, and providing our customers with cost-effective, reliable solutions for growing volumes, allowing them to free up resources to focus on their own corporate initiatives."

Mr. Amirault continued, "While the Federal Court of Appeal decision in the Competition Act matter is not anticipated until the fourth quarter of 2023, the partial stay received with respect to the divestiture order allows us to operate status quo. We remain steadfast that the Tervita merger has achieved significant efficiencies by optimizing existing infrastructure assets and operations, and believe we have strong grounds for appeal. However, if required, we will be prepared to conduct a process to maximize sales proceeds from required divestitures which we can then use to strengthen the business through the repayment of debt, growth and additional shareholder returns."

2023 Expectations

- Growth capital expenditures of approximately $100 million. This has increased from the previously announced $50 million program supported by a new 12-year commercial agreement with an existing anchor tenant. The majority of the growth capital for 2023 relates to the following projects:

- Clearwater oil pipeline and terminalling infrastructure – Q3 2023 target completion

- Montney water pipeline and disposal infrastructure – Q4 2023 target completion

- Sustaining capital expenditures3 of approximately $60 million and $25 million of capital related to landfill expansions. The landfill expansions are in anticipation of increased abandonment spend obligations driven from government regulations.

- Asset retirement obligation expenditures of approximately $20 million.

- Annualized base dividend of $0.40 per share, which equates to a total of approximately $120 million for the year based on current issued and outstanding shares.

- Continued opportunistic share repurchases, balanced with other capital allocation opportunities.

- Exit the year with principal balance debt of $850 million to $950 million, resulting in a Total Debt to EBITDA covenant ratio of less than 2x.

- Continued strong margins as we focus on optimizing the business, targeting additional operating efficiencies and continually improving operating cash flow.

The Corporation continues to see margin improvement from ongoing optimization efforts at our facilities as well as achieving our full run rate of integration efficiencies. The growth in the Montney and Clearwater regions have provided opportunities to partner with our customers where infrastructure and additional capacity is required to keep up with production growth. Our current utilization of our waste processing facilities is approximately 65% on a trailing twelve-month basis, allowing us to meet the needs of our customers in all other market areas.

SECURE remains committed to operational excellence and positioning itself for growth in the environmental waste management and energy infrastructure markets. SECURE thanks our customers and our employees for their exceptional effort every day making Canada an ESG leader.

NON-GAAP AND OTHER SPECIFIED FINANCIAL MEASURES

The Corporation uses accounting principles that are generally accepted in Canada (the issuer's "GAAP"), which includes International Financial Reporting Standards ("IFRS"). This news release contains certain supplementary non-GAAP financial measures, such as Adjusted EBITDA and discretionary free cash flow and certain non-GAAP financial ratios, such as Adjusted EBITDA Margin, Adjusted EBITDA per share, discretionary free cash flow per share, and payout ratio which do not have any standardized meaning as prescribed by IFRS. These measures are intended as a complement to results provided in accordance with IFRS. The Corporation believes these measures provide additional useful information to analysts, shareholders and other users to understand the Corporation's financial results, profitability, cost management, liquidity and ability to generate funds to finance its operations.

However, these measures should not be used as an alternative to IFRS measures because they are not standardized financial measures under IFRS and therefore might not be comparable to similar financial measures disclosed by other companies. See the "Non-GAAP and other specified financial measures" section of the Corporation's MD&A for the three months ended March 31, 2023 and 2022 for further details, which is incorporated by reference herein and available on SECURE's profile at www.sedar.com and on our website at www.SECURE-energy.com.

Adjusted EBITDA, Adjusted EBITDA Margin and Adjusted EBITDA per share

Adjusted EBITDA is calculated as noted in the table below and reflects items that the Corporation considers appropriate to adjust given the irregular nature and relevance to comparable operations. Adjusted EBITDA margin is defined as Adjusted EBITDA divided by revenue (excluding oil purchase and resale). Adjusted EBITDA per basic and diluted share is defined as Adjusted EBITDA divided by basic and diluted weighted average common shares.

The following table reconciles the Corporation's net income (loss), being the most directly comparable financial measure disclosed in the Corporation's financial statements, to Adjusted EBITDA for the three months ended March 31, 2023 and 2022.

Three months ended March 31, | |||

2023 | 2022 | % Change | |

Net income | 55 | 38 | 45 |

Adjustments: | |||

Depreciation, depletion and amortization (1) | 54 | 56 | (4) |

Current tax expense | 3 | — | 100 |

Deferred tax expense | 15 | 9 | 67 |

Share-based compensation (1) | 9 | 5 | 80 |

Interest, accretion and finance costs | 23 | 25 | (8) |

Unrealized gain on mark to market transactions (2) | (3) | (2) | 50 |

Other income | (8) | (14) | (43) |

Transaction and related costs | 3 | 9 | (67) |

Adjusted EBITDA | 151 | 126 | 20 |

(1) Included in cost of sales and/or general and administrative expenses on the financial statement's Consolidated Statements of Comprehensive Income. |

(2) Net balance. Includes amounts presented in revenue and cost of sales on the financial statement's Consolidated Statements of Comprehensive Income. |

Discretionary Free Cash Flow and Discretionary Free Cash Flow per share

Discretionary free cash flow is defined as funds flow from operations adjusted for sustaining capital expenditures, and lease payments (net of sublease receipts). The Corporation may deduct or include additional items in its calculation of discretionary free cash flow that are unusual, non-recurring, or non-operating in nature. Discretionary free cash flow per basic and diluted share is defined as discretionary free cash flow divided by basic and diluted weighted average common shares. For the three months ended March 31, 2023 and 2022, transaction and related costs have been adjusted as they are costs outside the normal course of business.

The following table reconciles the Corporation's funds flow from operations, being the most directly comparable financial measure disclosed in the Corporation's financial statements, to discretionary free cash flow.

Three months ended March 31, | ||||||

2023 | 2022 | % Change | ||||

Funds flow from operations | 136 | 107 | 27 | |||

Adjustments: Sustaining capital (1) | (10) | (10) | — | |||

Lease liability principal payment | (7) | (6) | 17 | |||

Transaction and related costs | 3 | 9 | (67) | |||

Discretionary free cash flow | 122 | 100 | 22 | |||

(1) Refer to the "Operational Definitions" section in the MD&A for further information. |

Dividend Payout Ratio

Dividend payout ratio is calculated as the most recent quarterly dividend declared to shareholders, annualized divided by discretionary free cash flow. This ratio is used to assess the sustainability of the Corporation's dividend payment program.

FINANCIAL STATEMENTS AND MD&A

The Corporation's consolidated financial statements and notes thereto and MD&A for the three months ended March 31, 2023 and 2022 are available on SECURE's website at www.SECURE-energy.com and on SEDAR at www.sedar.com.

FIRST QUARTER 2023 CONFERENCE CALL

SECURE will host a conference call Thursday, April 27, 2023, at 1:00 p.m. MST to discuss the first quarter results. To participate in the conference call, dial 416-764-8650 or toll free 1-888-664-6383. To access the simultaneous webcast, please visit www.SECURE-energy.com. For those unable to listen to the live call, a taped broadcast will be available at www.SECURE-energy.com and, until midnight MST on Thursday, May 4, 2023, by dialing 1-888-390-0541 and using the pass code 070266.

FORWARD-LOOKING STATEMENTS

Certain statements contained or incorporated by reference in this press release constitute "forward-looking statements and/or "forward-looking information" within the meaning of applicable securities laws (collectively referred to as "forward-looking statements"). When used in this press release, the words "achieve", "advance", "anticipate", "believe", "can be", "capacity", "commit", "continue", "could", "deliver", "drive", "enhance", "ensure", "estimate", "execute", "expect", "focus", "forecast", "forward", "future", "goal", "grow", "integrate", "intend", "may", "maintain", "objective", "ongoing", "opportunity", "outlook", "plan", "position", "potential", "prioritize", "realize", "remain", "result", "seek", "should", "strategy", "target" "will", "would" and similar expressions, as they relate to SECURE, its management are intended to identify forward-looking statements. Such statements reflect the current views of SECURE and speak only as of the date of this press release.

In particular, this press release contains or implies forward-looking statements pertaining but not limited to: SECURE's growth expenditures and the amount and timing thereof, allocating funds to growth opportunities, while maintaining a solid financial position; the release of SECURE's 2022 Sustainability Report and inaugural TCFD report; ongoing transparent reporting; a supportive macro environment driving higher volumes, activity levels, SECURE's business and demand for SECURE's products and services for the remainder of 2023; SECURE's infrastructure network capacity; commission new infrastructure and the timing thereof; increased industry activity, including related to abandonment, remediation and reclamation and the impacts thereof; SECURE's long-term take or pay contracts; SECURE's ability to help their customers; the effects, costs and results of the Tribunal decision and the appeal thereof; the timing of the Federal Court of Appeal's decision; SECURE's ability to operate status quo until the appeal of the Tribunal is complete; SECURE's grounds for appeal; the costs and the proceeds of sale should SECURE be required to divest any facilities and SECURE's ability to maximize such proceeds; the use of such proceeds of sale; SECURE's expectations for 2023, including growth and sustaining capital expenditures, asset retirement obligations, and shareholder returns; achieving SECURE's principal balance debt target; the timing thereof; and focusing on optimizing the business, targeting additional operating efficiencies and improving operating cash flows; the opportunities available to SECURE as a result of growth in the Montney and Clearwater regions; SECURE's commitment to operation excellence and ability to position itself for growth.

Forward-looking statements are based on certain assumptions that SECURE has made in respect thereof as at the date of this press release regarding, among other things: economic and operating conditions, including commodity prices, crude oil and natural gas storage levels, interest rates, exchange rates, and inflation; the changes in market activity and growth will be consistent with industry activity in Canada and the U.S. and growth levels in similar phases of previous economic cycles; the impact of the COVID-19 pandemic (including its variants) and geopolitical events, including government responses related thereto and their impact on global energy pricing, oil and gas industry exploration and development activity levels and production volumes; the ability of the Corporation to realize the anticipated benefits of acquisitions or dispositions, including the Tervita merger; the resolution SECURE's appeal of the Tribunal's decision on terms acceptable to the Corporation; SECURE's ability to successfully integrate Tervita's legacy business; anticipated sources of funding being available to SECURE on terms favourable to SECURE; the success of the Corporation's operations and growth projects; the Corporation's competitive position, operating, acquisition and sustaining costs remaining substantially unchanged; the Corporation's ability to attract and retain customers (including Tervita's historic customers); that counterparties comply with contracts in a timely manner; that there are no unforeseen events preventing the performance of contracts or the completion and operation of the relevant facilities; that there are no unforeseen material costs in relation to the Corporation's facilities and operations; that prevailing regulatory, tax and environmental laws and regulations apply or are introduced as expected, and the timing of such introduction; increases to the Corporation's share price and market capitalization over the long term; the Corporation's ability to repay debt and return capital to shareholders; the Corporation's ability to obtain and retain qualified personnel (including those with specialized skills and knowledge), technology and equipment in a timely and cost-efficient manner; the Corporation's ability to access capital and insurance; operating and borrowing costs, including costs associated with the acquisition and maintenance of equipment and property; the ability of the Corporation and our subsidiaries to successfully market our services in western Canada and the U.S.; an increased focus on ESG, sustainability and environmental considerations in the oil and gas industry; the impacts of climate-change on the Corporation's business; the current business environment remaining substantially unchanged; present and anticipated programs and expansion plans of other organizations operating in the energy service industry resulting in an increased demand for the Corporation's and our subsidiaries' services; future acquisition and maintenance costs; the Corporation's ability to achieve its ESG and sustainability targets and goals and the costs associated therewith; and other risks and uncertainties described in SECURE's current annual information form and from time to time in filings made by SECURE with securities regulatory authorities.

Forward-looking statements involve significant known and unknown risks and uncertainties, should not be read as guarantees of future performance or results, and will not necessarily be accurate indications of whether such results will be achieved. Readers are cautioned not to place undue reliance on these statements as a number of factors could cause actual results to differ materially from the results discussed in these forward-looking statements, including but not limited to: general global financial conditions, including general economic conditions in Canada and the U.S.; the effect of the COVID-19 pandemic (including its variants), inflation and geopolitical events and governmental responses thereto on economic conditions, commodity prices and the Corporation's business and operations; changes in the level of capital expenditures made by oil and natural gas producers and the resultant effect on demand for oilfield services during drilling and completion of oil and natural gas wells; volatility in market prices for oil and natural gas and the effect of this volatility on the demand for oilfield services generally; a transition to alternative energy sources; the Corporation's inability to retain customers; risks inherent in the energy industry, including physical climate-related impacts; the Corporation's ability to generate sufficient cash flow from operations to meet our current and future obligations; the seasonal nature of the oil and gas industry; increases in debt service charges including changes in the interest rates charged under the Corporation's current and future debt agreements; inflation and supply chain disruptions; the Corporation's ability to access external sources of debt and equity capital and insurance; disruptions to our operations resulting from events out of our control; the timing and amount of stimulus packages and government grants relating to site rehabilitation programs; the cost of compliance with and changes in legislation and the regulatory and taxation environment, including uncertainties with respect to implementing binding targets for reductions of emissions and the regulation of hydraulic fracturing services and services relating to the transportation of dangerous goods; uncertainties in weather and temperature affecting the duration of the oilfield service periods and the activities that can be completed; competition; impairment losses on physical assets; sourcing, pricing and availability of raw materials, consumables, component parts, equipment, suppliers, facilities, and skilled management, technical and field personnel; supply chain disruption; the Corporation's ability to effectively complete acquisition and divestiture transactions on acceptable terms or at all; a failure to realize the benefits of acquisitions, including the Tervita Merger, and risks related to the associated business integration; the inaccuracy of pro forma information prepared in connection with acquisitions; risks related to a new business mix and significant shareholder; liabilities and risks, including environmental liabilities and risks, inherent in SECURE's operations, including those associated with the Tervita Merger; the resolution of SECURE's appeal of the Tribunal's decision on terms acceptable to the Corporation and the impacts of the divestiture of facilities, if any, as a result thereof; the Corporation's ability to invest in and integrate technological advances and match advances of our competition; the viability, economic or otherwise, of such technology; credit, commodity price and foreign currency risk to which the Corporation is exposed in the conduct of our business; compliance with the restrictive covenants in the Corporation's current and future debt agreements; the Corporation's or our customers' ability to perform their obligations under long-term contracts; misalignment with our partners and the operation of jointly owned assets; the Corporation's ability to source products and services on acceptable terms or at all; the Corporation's ability to retain key or qualified personnel, including those with specialized skills or knowledge; uncertainty relating to trade relations and associated supply disruptions; the effect of changes in government and actions taken by governments in jurisdictions in which the Corporation operates, including in the U.S.; the effect of climate change and related activism on our operations and ability to access capital and insurance; cyber security and other related risks; the Corporation's ability to bid on new contracts and renew existing contracts; potential closure and post-closure costs associated with landfills operated by the Corporation; the Corporation's ability to protect our proprietary technology and our intellectual property rights; legal proceedings and regulatory actions to which the Corporation may become subject, including in connection with SECURE's appeal of the Tribunal's decision and any claims for infringement of a third parties' intellectual property rights; the Corporation's ability to meet its ESG targets or goals and the costs associated therewith; claims by, and consultation with, Indigenous Peoples in connection with project approval; disclosure controls and internal controls over financial reporting; and other risk factors identified in SECURE's current annual information form and from time to time in filings made by the Corporation with securities regulatory authorities.

Although forward-looking statements contained in this press release are based upon what the Corporation believes are reasonable assumptions, the Corporation cannot assure investors that actual results will be consistent with these forward-looking statements. The forward-looking statements in this press release are expressly qualified by this cautionary statement. Unless otherwise required by applicable securities laws, SECURE does not intend, or assume any obligation, to update these forward-looking statements.

ABOUT SECURE

SECURE is a leading environmental and energy infrastructure business headquartered in Calgary, Alberta. The Corporation's extensive infrastructure network located throughout western Canada and North Dakota includes waste processing and transfer facilities, industrial landfills, metal recycling facilities, crude oil and water gathering pipelines, crude oil terminals and storage facilities. Through this infrastructure network, the Corporation carries out its principal business operations, including the processing, recovery, recycling and disposal of waste streams generated by our energy and industrial customers and gathering, optimization, terminalling and storage of crude oil and natural gas liquids. The solutions the Corporation provides are designed not only to help reduce costs, but also lower emissions, increase safety, manage water, recycle by-products and protect the environment.

SECURE's shares trade under the symbol SES and are listed on the Toronto Stock Exchange. For more information, visit www.SECURE-energy.com.

SOURCE SECURE Energy Services Inc.