News Releases

Stay in the know

CALGARY, AB, Dec. 8, 2022 /CNW/ - SECURE Energy Services Inc. ("SECURE" or the "Corporation") (TSX: SES) announced today that the Toronto Stock Exchange ("TSX") has accepted for filing the Corporation's notice of intention to make a normal course issuer bid ("NCIB").

Pursuant to the NCIB, SECURE may repurchase from time to time up to a maximum of 22,055,749 common shares of the Corporation ("common shares"), representing approximately 7.1% of the 309,999,030 common shares outstanding as at December 7, 2022, or 10% of the Corporation's public float. Purchases under the NCIB may be made through open market transactions on the TSX and any alternative Canadian trading platforms on which the common shares are traded, based on the prevailing market price, at such times and in such quantities as the Corporation may determine, subject to applicable regulatory restrictions. Under TSX rules, not more than 165,968 common shares (being 25% of the average daily trading volume on the TSX of 663,874 common shares for the six months ended November 2022) can be purchased on the TSX on any single trading day under the NCIB, except that one block purchase in excess of the daily maximum is permitted per calendar week. Any common shares purchased under the NCIB will be cancelled.

The NCIB period will commence on December 14, 2022, and end on December 13, 2023, or such earlier date as the NCIB is completed or is terminated at the Corporation's election.

Transactions under the NCIB will depend on future market conditions. SECURE retains discretion whether to make purchases under the NCIB, and to determine the timing, amount and acceptable price of any such purchases, subject at all times to applicable TSX and other regulatory requirements.

The NCIB provides the Corporation with an additional capital allocation alternative to acquire common shares under the appropriate circumstances, with a view to long-term shareholder value. The Board of Directors and senior management believe that, from time to time, the prevailing market price of the common shares may not fully reflect the underlying value of SECURE's business and future business prospects. In such circumstances, the repurchase of common shares under the NCIB represents an attractive investment for the Corporation and an opportunity to enhance shareholder value.

ABOUT SECURE

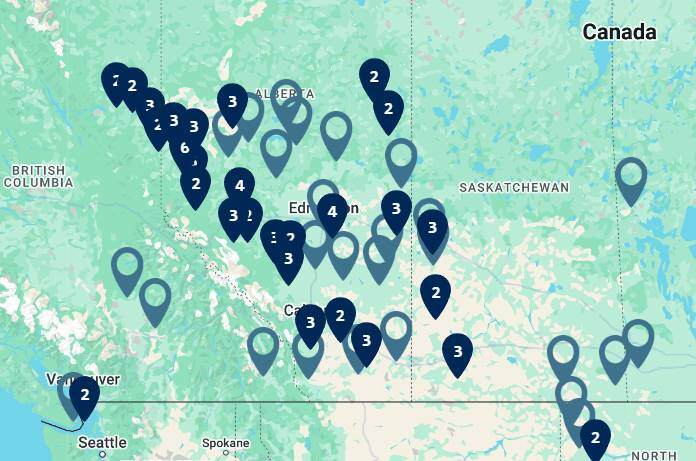

SECURE is a publicly traded energy infrastructure and environmental business listed on the TSX. SECURE provides industry leading midstream infrastructure and environmental and fluid management to predominantly upstream oil and natural gas companies operating in western Canada and certain regions in the U.S. SECURE's Midstream Infrastructure business segment includes a network of midstream processing and storage facilities, crude oil and water pipelines, and crude by rail terminals located throughout key resource plays in western Canada, North Dakota and Oklahoma. SECURE's midstream infrastructure operations generate cash flows from oil production processing and disposal, produced water disposal, and crude oil storage, logistics, and marketing. SECURE's Environmental and Fluid Management business segment includes a network of industrial landfills, hazardous and non-hazardous waste management and disposal, onsite abandonment, environmental solutions for site remediation and reclamation, bio-remediation and technologies, waste treatment & recycling, emergency response, rail services, metal recycling services, as well as fluid management for drilling, completion and production activities.

FORWARD-LOOKING STATEMENTS

Certain statements contained in this news release constitute forward-looking information and statements (collectively, "forward-looking statements") including, but not limited to, statements concerning the NCIB, including the duration of the NCIB, the number of common shares which may be purchased under the NCIB, the timing, amount and price of purchases of common shares under the NCIB, SECURE's business and future prospects and related matters. All statements other than statements of historical fact are forward-looking statements. The use of any of the words ''anticipate'', ''plan'', ''contemplate'', ''continue'', ''estimate'', ''expect'', ''intend'', ''propose'', ''might'', ''may'', ''will'', ''shall'', ''project'', ''should'', ''could'', ''would'', ''believe'', ''predict'', ''forecast'', ''pursue'', ''potential'' and ''capable'' and similar expressions are intended to identify forward looking statements. These statements involve known and unknown risks, uncertainties and other factors that may cause actual results or events to differ materially from those anticipated in such forward-looking statements. No assurance can be given that these expectations will prove to be correct and such forward-looking statements included in this news release should not be unduly relied upon. These statements speak only as of the date of this news release. In addition, this news release may contain forward-looking statements and forward-looking information attributed to third party industry sources. The Corporation does not undertake any obligations to publicly update or revise any forward-looking statements except as required by securities law. Actual results could differ materially from those anticipated in these forward-looking statements as a result of numerous risks and uncertainties including, but not limited to, the risks and uncertainties described in "Forward-Looking Statements" and "Risk Factors" included in the Company's Annual Information Form dated March 2, 2022, as filed on SEDAR and available on the SECURE website at www.secure-energy.com.

TSX Symbol: SES

SOURCE SECURE Energy Services Inc.