News Releases

Stay in the know

- Record results with Adjusted EBITDA1 of $105 million in the third quarter, up 184% compared to Q3 2020, and up 47% on a per share basis, demonstrating the strength and scale of the combined business.

- Successfully closed the Tervita merger transaction on July 2, 2021, creating a large-scale midstream infrastructure and environmental solutions business.

- Realized $31 million of annualized synergies from Tervita merger in Q3 2021.

- On track to achieve at least $75 million in annualized synergies by the end of 2022.

- Generated discretionary free cash flow1 of $76 million in Q3 2021 and $149 million on a trailing twelve-month basis, available to be directed towards SECURE's key near-term priority of debt repayment.

- Set 2022 Scope 1 greenhouse gas emission reduction target of 5%.

- Improved financial structure with issuances of C$340 million of 7.25% 2026 unsecured notes used in part to redeem US$200 million of 11% Tervita notes, resulting in interest cost savings of approximately $9 million per year.

- Capital expenditures of $13 million in Q3, comprised of $10 million in sustaining capital and $3 million in growth capital. SECURE expects capital expenditures of $7-10 million for the remainder of 2021.

__________ |

1 Refer to the "Non-GAAP Measures" section herein. |

CALGARY, AB, Oct. 28, 2021 /CNW/ - SECURE ENERGY Services Inc. ("SECURE" or the "Corporation") (TSX: SES) reported the Corporation's operational and financial results for the three and nine months ended September 30, 2021.

"We are extremely pleased with the strong results for the third quarter of 2021, as higher commodity prices and increased activity levels translated to increased volumes at our facilities and landfills as well as stronger demand for our drilling and completions services," said Rene Amirault, President and Chief Executive Officer of SECURE. "Our first quarter as a combined company with Tervita demonstrates that, as expected, our increased size and scope is generating significant free cash flow, improving our overall leverage and enhancing our ability to deliver greater returns to our shareholders.

"The integration is progressing well and synergies are on track with the combination of the two companies delivering exactly the kind of incremental benefits we had envisioned. We expect annualized run rate synergies of $35-38 million by the end of 2021, and to deliver at least $75 million of annualized synergies by the end of next year.

"We're encouraged by the strong momentum across all our business lines. With increased free cash flow generation capabilities and a strengthened balance sheet, we're as well positioned as we've ever been to capitalize on upside growth potential and the positive trends of our industry as our markets continue to improve."

OPERATING AND FINANCIAL HIGHLIGHTS

The Corporation's operating and financial highlights for the three and nine months ended September 30, 2021 and 2020 can be summarized as follows:

Three months ended Sept 30, | Nine months ended Sept 30, | ||||||

($ million's except share and per share data) | 2021 | 2020 | % change | 2021 | 2020 | % change | |

Revenue (excludes oil purchase and resale) | 317 | 103 | 208 | 566 | 341 | 66 | |

Oil purchase and resale | 936 | 349 | 168 | 1,860 | 1,008 | 85 | |

Total revenue | 1,253 | 452 | 177 | 2,426 | 1,349 | 80 | |

Adjusted EBITDA (1) | 105 | 37 | 184 | 175 | 100 | 75 | |

Per share ($), basic and diluted | 0.34 | 0.23 | 47 | 0.84 | 0.63 | 33 | |

Net loss attributable to shareholders of SECURE (2) | (22) | (5) | 340 | (37) | (46) | (20) | |

Per share ($), basic and diluted | (0.07) | (0.03) | 128 | (0.18) | (0.30) | (39) | |

Cash flows from operating activities | 1 | 38 | (97) | 46 | 107 | (57) | |

Per share ($), basic and diluted | 0.00 | 0.24 | (100) | 0.22 | 0.67 | (67) | |

Discretionary free cash flow (1) | 76 | 27 | 181 | 123 | 70 | 76 | |

Per share ($), basic and diluted | 0.25 | 0.17 | 46 | 0.59 | 0.44 | 33 | |

Capital expenditures (1) | 13 | 10 | 30 | 26 | 62 | (58) | |

Dividends per common share | 0.0075 | - | 100 | 0.0225 | 0.0950 | (76) | |

Total assets (2) | 3,141 | 1,423 | 121 | 3,141 | 1,423 | 121 | |

Long-term liabilities (2) | 1,487 | 539 | 176 | 1,487 | 539 | 176 | |

Common shares - end of period | 308,110,429 | 158,629,808 | 94 | 308,110,429 | 158,629,808 | 94 | |

Weighted average common shares - basic and diluted | 306,474,523 | 158,577,224 | 93 | 209,329,456 | 158,526,801 | 32 | |

(1) Refer to "Non-GAAP Measures" for further information. |

(2) Prior year amounts have been restated, refer to the "Accounting Policies" section in the MD&A for the third quarter of 2021 for additional information. |

OPERATIONAL AND FINANCIAL RESULTS

The following should be read in conjunction with the Corporation's management's discussion and analysis ("MD&A") for the three and nine months ended September 30, 2021, and the condensed consolidated financial statements and notes thereto for the three and nine months ended September 30, 2021, which are available on SEDAR at www.sedar.com.

THIRD QUARTER HIGHLIGHTS

- Revenue (excluding oil purchase and resale) of $317 million - an increase of 208% compared to the third quarter of 2020. The increase was primarily due to additional revenue associated with the operations acquired from Tervita. Both the Midstream Infrastructure segment and Environmental and Fluid Management segment also benefited from improved industry activity levels, driving incremental volumes and demand for drilling and completion related services;

- Net loss attributable to shareholders of $22 million - an increase of $17 million compared to the third quarter of 2020. The increase was primarily driven by the impact of the Tervita transaction ("the Transaction") including incurring $18 million of transaction costs (which included costs associated with the integration of the Tervita business), $17 million of higher finance costs associated with debt assumed during the Transaction and higher depreciation, depletion and amortization ("DD&A"), partially offset by higher period over period Adjusted EBITDA as described below.

- Adjusted EBITDA of $105 million - an increase of 184% compared to the third quarter of 2020, primarily due to contributions as a result of the Transaction, which demonstrates the strength and scale of the combined business. In addition, higher oil prices resulted in increased activity levels in the Corporation's operating areas, which led to higher processing and disposal volumes at our Midstream Infrastructure facilities and landfills and increased demand for drilling and completion services within the Environmental and Fluid Management segment;

- Discretionary free cash flow of $76 million - which was used to pay costs associated with the Transaction, increased working capital acquired from Tervita and associated with higher activity levels, fund growth capital expenditures, as well as the Corporation's quarterly dividend. Net cash flows from operating activities after changes in non-cash working capital were $1 million in the quarter;

- Integration cost savings of $31 million on an annualized basis - achieved $7 million of cost savings impacting Adjusted EBITDA in the third quarter of 2021, and $31 million on an annual run-rate basis for realized cost savings approaching 50% of the $75 million target after three months of integration of the business and operations of Tervita following completion of the Transaction. The $7 million achieved in the quarter is a result of a reduction of headcount, reduced public company costs and operational optimizations. In the three and nine months ended September 30, 2021, costs of $18 million and $29 million, respectively, related to the Transaction and integration of the business acquired from Tervita were incurred;

- Adjusted EBITDA margin2 of 33% - which remained in line with the Adjusted EBITDA margin of 36% for the third quarter of 2020, which benefited from wage subsidies under the Canada Emergency Wage Subsidy ("CEWS") program;

- Midstream Infrastructure segment profit margin2 of 64% - Maintained strong segment profit margins as a percentage of revenue (excluding oil purchase and resale) during the third quarter of 2021;

- Environmental and Fluid Management segment profit margin2 of 26% - Increased from 24% in the third quarter of 2020 due to the positive impact of the Transaction and continued focus on managing costs;

- G&A expense before depreciation, depletion, amortization and share-based compensation expense as a percentage of revenue (excluding oil purchase and resale) was 9%, consistent with the third quarter of 2020;

- Private offerings of $340 million - Completed a private offering of $200 million aggregate principal amount of 7.25% unsecured notes due December 30, 2026 ("2026 unsecured notes"), which were released from escrow on July 2, 2021. On July 16, 2021, SECURE used a portion of these proceeds to fund the redemption of US$100 million of the US$500 million aggregate principal amount of 11.00% senior second lien secured notes of Tervita due December 1, 2025 (the "2025 senior secured notes"), at a redemption price of 105.5%. The remaining proceeds have been used to repay indebtedness, pay fees and expenses incurred in connection with the note issuance and for general corporate purposes.

On October 4, 2021, the Corporation closed an additional private offering of $140 million aggregate principal amount of 2026 unsecured notes at an issue price of $100.75, representing a yield of approximately 7%. The proceeds were primarily used to redeem another US$100 million in aggregate principal amount of 2025 senior secured notes at a redemption price of 105.5%, plus accrued but unpaid interest to, but not including, the redemption date. The redemptions were completed on October 7 and 8, 2021.

The redemptions of 2025 senior secured notes in July and October 2021 are anticipated to result in annual interest cost savings of approximately $9 million.

- Declared dividends of $2 million - representing $0.0075 (0.75 cents) per common share for the quarter.

- Continued to prioritize the advancement of SECURE's Environmental, Social and Governance ("ESG") practices:

- Established the new Board of Directors upon closing of the Transaction, consisting of four members from each of the previous SECURE and Tervita Boards, representing the strengths and capabilities of each organization. The new Board will continue to follow SECURE's existing best in class governance practices. In addition, the Board now has an independent Chairman, and seven of the eight (87.5%) directors are independent.

- On July 2, 2021, SECURE appointed Rhonda Rudnitski as VP, ESG. This newly established senior leadership position affirms SECURE's commitment to sustainability. In her position, Ms. Rudnitski will provide strategic and functional direction for ESG initiatives and monitor SECURE's performance on key sustainability indicators. She previously held the role of VP, Health, Safety, Environment, Regulatory and Engineering with Tervita.

- Advanced the development of short and mid-term energy usage and emissions targets as we map out milestones towards achieving our long-term objectives of reducing carbon intensity in half by 2030 and achieving net zero emissions by 2050.

- Received the following credit ratings from S&P Global Ratings ("S&P"), Fitch Ratings ("Fitch") and Moody's Investor Service, Inc. ("Moody's"), providing increased transparency and comparability for debt investors and other capital market participants:

S&P | Fitch | Moody's | |

Corporate Rating | B | B+ | B1 |

2025 senior secured notes | BB- | BB | B1 |

2026 unsecured notes | B | B+ | B3 |

Prior to completion of the Transaction, the 2025 senior secured notes were rated CCC+ by S&P and B3 by Moody's.

- Competition Tribunal hearings set for second quarter of 2022; with findings expected near the end of 2022.

__________ |

2 Refer to the "Non-GAAP Measures" section herein. |

OUTLOOK

For the remainder of the year, higher crude oil and natural gas prices should continue to provide significant improvement in overall industry activity in the fourth quarter of 2021 and into 2022. Oil and gas producing countries, including Canada, have under spent on developing oil and gas resources since 2014. As a result, decline rates, and in particular higher decline rates associated with shale reserves, have created a tighter balance between supply and demand for crude oil and natural gas. In 2021, capital spending has been focused on attempting to offset high decline wells. For the remainder of 2021 and 2022 we expect to see producer capital spent on both maintaining and growing production levels in a disciplined manner. This should lead to a positive impact on both drilling and completion activity and new production in 2022. Based on current macroeconomic conditions and commodity prices, SECURE also anticipates higher year over year discretionary free cash flow for the remainder of 2021 and 2022 based on the following expectations:

- Increased drilling and completion activity. Since April, the monthly active rig counts in the WCSB have been trending relatively in line with 2019 levels, a substantial increase compared to 2020. SECURE anticipates producers will continue to seek to add production to offset natural declines in order to maintain flat production levels or increase production modestly. As a result, SECURE expects increased utilization at our midstream infrastructure processing facilities as higher drilling, completion and production volumes from increased activity levels require treating, processing, terminalling and disposal. The Corporation has significant capacity to increase facility throughput and disposal with minimal incremental fixed costs or additional capital.

- Increased activity levels in the Environmental and Fluid Management segment with higher volumes at the Corporation's landfills, as a result of drilling, abandonment, remediation and reclamation activity. In addition, the Canadian Federal Government's $1.7 billion stimulus package to help fund the closure and reclamation of orphan and inactive wells in the WCSB, as well as new direction from the Alberta Energy Regulator requiring energy producers and other companies that have retirement obligations related to non-producing wells and facilities to spend an amount each year to settle those obligations. SECURE expects increased abandonment, remediation and reclamation activity to positively impact all Canadian operations over the term of the program, as a result of higher demand for environmental site assessments, onsite abandonment, remediation and reclamation management and decommissioning work.

- Realization of additional synergies in the fourth quarter, with a full year target of annualized cost savings of between $35-38 million, comprised primarily of corporate headcount reductions, public company cost savings and facility rationalizations.

Integration Cost Savings and Synergies

SECURE's priority for the next 12-15 months is to successfully integrate the Tervita facilities and operating networks and deliver on expected integration cost savings to become a more resilient, profitable, and efficient business. Annual integration cost savings impacting Adjusted EBITDA of at least $75 million are expected to be achieved by the end of 2022. At September 30, 2021, $31 million of annualized savings, or 41%, of the target has been achieved, and we expect to end the year having achieved between $35-38 million of annualized savings. The Corporation expects the integration cost savings will be attained through operational optimizations (approximately 60%), including increased facility utilization, reduced field overhead, field office closures, transportation savings and operating cost efficiencies, as well as corporate overhead reductions (approximately 40%). Additional savings through initiatives such as optimizing our capital structure are expected to provide incremental discretionary free cash flow beyond our $75 million cost savings target that impact Adjusted EBITDA.

Improvement and Progression of the Capital Structure

The Corporation's revised capital structure following the close of the Transaction provides increased stability with no near–term maturities, as well as enhanced flexibility with early redemption options available on the 2026 unsecured notes, and capacity on the revolving credit facility, subject to covenant restrictions. The Corporation's current capital structure includes:

- $800 million revolving credit facility (matures July 2024). Total amount drawn on the revolving credit facility as at September 30, 2021 was $451 million. Letters of Credit issued against the revolving credit facility in the amount of $68 million reduce the amount available to be drawn under the facility. As a result, at September 30, 2021, the Corporation had availability of $281 million on the revolving credit facility, subject to covenant restrictions. The Corporation expects to incur an average interest rate of approximately 4.2% for funds drawn on the facility for the remainder of 2021.

- $30 million new SECURE LC facility guaranteed by Export Development Canada. At September 30, 2021, SECURE has issued LCs in the amount of approximately $24 million against this new SECURE LC facility.

- Subsequent to September 30, 2021, SECURE redeemed an additional US$100 million in aggregate principal amount of its 2025 senior secured notes through issuing $140 million aggregate principal amount of 2026 unsecured notes, which will result in additional interest savings of approximately $5 million per year. Combined with an earlier redemption of US$100 million in aggregate principal amount of the 2025 senior secured notes in July 2021, our combined annual interest savings realized since completing the Transaction are now approximately $9 million. Our current fixed debt portfolio consists of:

- US$300 million aggregate principal amount of 2025 senior secured notes.

- $340 million aggregate principal amount of 2026 unsecured notes.

Throughout the remainder of this year and 2022, the Corporation will continue to focus on maintaining financial resiliency and prioritize the repayment of debt to best position the Corporation for long-term success.

The Corporation continues to take a prudent approach to capital spending for the remainder of the year. The capital expenditure budget for the fourth quarter of 2021 is expected to be approximately $7-10 million, which includes approximately $5-8 million of sustaining capital, including that associated with the acquired Tervita facilities.

A full evaluation of SECURE and Tervita's combined capital project opportunities is ongoing, and the capital budget may be revised in accordance with opportunities to connect producers to existing midstream infrastructure to further increase volumes and utilization on a long-term basis. We expect sustaining capital in 2022 to be approximately $40 million, and additional sustaining capital related to landfill expansions of approximately $15 million, which assumes growth in industry activity from current levels. We anticipate that the majority of our growth capital in 2022 will be focused on projects that both reduce our customer's costs and lower emissions as we execute oil and water gathering pipelines. Assisting customers to recycle and reduce wherever possible continues to be part of our long-term strategy and other long-term opportunities such as carbon dioxide sequestration infrastructure will continue to be evaluated as part of our ESG goals.

Enhanced ESG platform

The Corporation's business is uniquely positioned to deliver economic and environmental benefits that make the oil and gas industry more efficient and sustainable. We are committed to continuing to work with our customers to challenge what's possible and develop innovative solutions that lower their cost structure, improve capital efficiency, and minimize the environmental impacts associated with the development of our shared resources. The Transaction provides the increased size and scale, utilization, and efficiencies to enhance the services and capabilities the Corporation can provide to our customers to help achieve their objectives of responsible development, while reducing costs.

SECURE will continue to take proactive measures to reduce the environmental impact of our own operations, and positively contribute to the health, safety, and economic wellbeing of our employees and communities where we live and work. The Transaction elevates our position to accelerate the Corporation's environmental and social sustainability initiatives for the benefit of all stakeholders. During the remainder of 2021, SECURE expects to continue to explore opportunities to further reduce our carbon footprint so that we can continue to positively contribute to the efforts to mitigate climate change and integrate two strong ESG frameworks into a single one that will provide the roadmap to establish SECURE as an ESG leader. We will continue to help our customers find innovative ways to support their ESG goals. We believe that, by working collaboratively, Canada's energy industry can have the lowest cost structure and operate with the highest ESG standards in the world.

FINANCIAL STATEMENTS AND MD&A

The Corporation's condensed consolidated financial statements and notes thereto for the three and nine months ended September 30, 2021, and MD&A are available on SECURE's website at www.secure-energy.com and on SEDAR at www.sedar.com.

THIRD QUARTER 2021 CONFERENCE CALL

SECURE will host a conference call on Friday, October 29, 2021 at 9:00 a.m. MST to discuss the third quarter results. To participate in the conference call, dial 416-764-8650 or toll free 888-664-6383. To access the simultaneous webcast, please visit www.secure-energy.com. For those unable to listen to the live call, a taped broadcast will be available at www.secure-energy.com and, until midnight MST on Friday, November 5, 2021 by dialing 888-390-0541 and using the pass code 94293#.

FORWARD-LOOKING STATEMENTS

Certain statements contained in this press release constitute "forward-looking statements and/or "forward-looking information" within the meaning of applicable securities laws (collectively referred to as "forward-looking statements"). When used in this press release, the words "achieve", "advance", "anticipate", "believe", "can be", "capacity", "commit", "continue", "could", "deliver", "drive", "enhance", "ensure", "estimate", "execute", "expect", "focus", "forecast", forward", "future", "grow", "integrate", "intend", "may", "maintain", "objective", "ongoing", "opportunity", "outlook", "plan", "position", "potential", "prioritize", "realize", "result", "seek", "should", "strategy", "target" "will", and similar expressions, as they relate to SECURE, its management, or the combined company, are intended to identify forward-looking statements. Such statements reflect the current views of SECURE and speak only as of the date of this press release.

In particular, this press release contains or implies forward-looking statements pertaining but not limited to: the expected benefits of the Transaction and the Corporation following the Transaction, including expectations with respect to the strength of the Corporation; the Corporation's access to capital markets and the resulting effect on its future growth and acquisition plans; the relevance of SECURE's credit ratings to debt investors and capital market participants; the complementary nature of the Corporation's asset base and environmental service lines following the Transaction, and the ability to enhance scale and increase utilization as a result thereof; SECURE's ability to partner with its customers to execute on growth projects; the Corporation's expected discretionary free cash flow profile; expected annual integration cost savings from the Transaction and the methods and timing thereof; improvements to SECURE's cost structure to serve a growing customer base; debt repayment plans; ongoing cooperation with the Competition Bureau and Competition Tribunal; the resolution of any proceedings under the Competition Act (Canada) and the materiality thereof, including the impact on the Corporation's asset base and Adjusted EBITDA; prioritizing the advancement of SECURE's ESG goals; governance practices and priorities of SECURE's new board of directors; plans to reduce carbon intensity in half by 2030 and achieving net zero emissions by 2050; SECURE's ability to deliver economic and environmental benefits; future ESG goals and the ability of the Transaction to accelerate SECURE's environmental and social sustainability initiatives; Canada's energy industry's ability to win the race to lowest emissions by 2050 and operate with the highest ESG standards in the world; maintaining strict cost control measures and a prudent approach to capital spending; SECURE's capital structure and benefits thereof; the outlook for oil and liquids prices; the oil and natural gas industry in Canada and the United States., including expectations about crude oil and natural gas prices, and drilling, completion and production activity levels in the Corporation's operating areas for the remainder of 2021 and beyond, and the related impact on SECURE's business, operations and financial results; increased year over year discretionary free cash flow; the effect of the current economic conditions on the future demand for SECURE's services and the impact on SECURE's cash flows and impairment charges on long-term assets; SECURE's financial resiliency and corporate priorities, including the integration of Tervita's business, debt repayment, and strategies to achieve such priorities; increased contribution to Adjusted EBITDA from the realization of synergies and the timing thereof; the benefits of contracted and/or fee-for-service contracts on SECURE's cash flow and the expected stability of such sources; the anticipated focus of the Corporation's growth capital expenditures; capacity at the Corporation's existing facilities; the impact the Canadian Federal Government's orphan and inactive well fund may have to the business, operations and results of the Corporation; increased abandonment and reclamation activity in the oil and gas industry and the related effect on SECURE's results of operations and the timing thereof; the Corporation's 2021 capital budget and the future evaluation of the Corporation's capital project opportunities; future dividend plans and opportunities to increase dividend payments after the successful integration of the business and operations of SECURE and Tervita; debt service and the Corporation's ability to meet obligations and commitments and operate within any credit facility restrictions, including the financial covenants related to our debt facilities; the sufficiency of the Corporation's liquidity and expectations that our capital investment, working capital, debt repayment, share repurchases and cash dividends will be funded from internally generated cash flows; the Corporation's credit risk levels; expected benefits customers will receive from our midstream and environmental solutions; key factors driving the Corporation's success; demand for the Corporation's services and products; industry fundamentals driving the success of SECURE's core operations; future capital needs; and access to capital.

Forward-looking statements are based on certain assumptions that SECURE has made in respect thereof as at the date of this press release regarding, among other things: the resolution of applications made under the Competition Act (Canada) on terms acceptable to SECURE; SECURE's ability to successfully integrate the previous standalone businesses of SECURE and Tervita; sources of funding that each of SECURE and Tervita have relied upon in the past continue to be available to SECURE on terms favorable to SECURE; the impact of COVID-19, including government responses related thereto and lower global energy pricing on oil and gas industry exploration and development activity levels and production volumes (including as a result of demand and supply shifts caused by COVID-19 and the actions of OPEC and non-OPEC countries); the success of SECURE's operations and growth projects; the Corporation's competitive position remaining substantially unchanged; future acquisition and sustaining costs will not significantly increase from past acquisition and sustaining costs; SECURE's ability to retain Tervita's previous customers; that counterparties comply with contracts in a timely manner; that there are no unforeseen events preventing the performance of contracts or the completion and operation of the relevant facilities; that there are no unforeseen material costs in relation to the Corporation's facilities and operations; that prevailing regulatory, tax and environmental laws and regulations apply; increases SECURE's share price and market capitalization over the long term; SECURE's ability to repay debt and return capital to shareholders; SECURE's ability to obtain and retain qualified staff and equipment in a timely and cost-efficient manner; and other risks and uncertainties described from time to time in filings made by SECURE with securities regulatory authorities.

Forward-looking statements involve significant known and unknown risks and uncertainties, should not be read as guarantees of future performance or results, and will not necessarily be accurate indications of whether such results will be achieved. Readers are cautioned not to place undue reliance on these statements as a number of factors could cause actual results to differ materially from the results discussed in these forward-looking statements, including but not limited to: SECURE's ability to realize the anticipated benefits of, and synergies and savings from, the Transaction and the timing thereof; actions taken by government entities or others seeking to prevent or alter the terms of the Transaction; the ongoing evaluation of SECURE's credit ratings; legal claims resulting from the completion of the Transaction; negative reactions to the Transaction, including from customers, suppliers or employees; potential undisclosed liabilities unidentified during the due diligence process; the accuracy of the pro forma financial information of the Corporation; the interpretation of the Transaction by tax authorities; the success of integration of the previous standalone businesses of SECURE and Tervita; the entry into new business activities and the resulting business mix of the Corporation upon completion of the Transaction; the focus of management's time and attention on the Transaction and other disruptions arising from the Transaction; and those factors referred to under the heading "Risk Factors" in the AIF and the Joint Information Circular. In addition, the effects and impacts of the COVID–19 outbreak, the efficacy of vaccinations in reducing the spread of COVID-19 and its variants, the rapid decline in global energy prices and the length of time to significantly reduce the global threat of COVID-19 on SECURE's business, the global economy and markets are unknown at this time and could cause SECURE's actual results to differ materially from the forward-looking statements contained in this press release.

Although forward-looking statements contained in this press release are based upon what the Corporation believes are reasonable assumptions, the Corporation cannot assure investors that actual results will be consistent with these forward- looking statements. The forward-looking statements in this press release are expressly qualified by this cautionary statement. Unless otherwise required by applicable securities laws, SECURE does not intend, or assume any obligation, to update these forward-looking statements.

NON-GAAP MEASURES

The Corporation uses accounting principles that are generally accepted in Canada (the issuer's "GAAP"), which includes International Financial Reporting Standards ("IFRS"). This news release contains certain supplementary measures, such as Adjusted EBITDA, discretionary free cash flow, and segment profit margin, which do not have any standardized meaning as prescribed by IFRS. These measures are intended as a complement to results provided in accordance with IFRS. The Corporation believes these measures provide additional useful information to analysts, shareholders and other users to understand the Corporation's financial results, profitability, cost management, liquidity and ability to generate funds to finance its operations. However, they should not be used as an alternative to IFRS measures because they do not have a standardized meaning under IFRS and therefore may not be comparable to similar measures presented by other companies. See the MD&A available on SECURE's profile at www.sedar.com for further details, including reconciliations of the Non-GAAP measures and additional GAAP measures to the most directly comparable measures calculated in accordance with IFRS.

ABOUT SECURE

SECURE is a publicly traded energy infrastructure and environmental business listed on the Toronto Stock Exchange ("TSX"). SECURE provides industry leading midstream infrastructure and environmental and fluid management to upstream oil and natural gas companies operating in western Canada and certain regions in the United States ("U.S.").

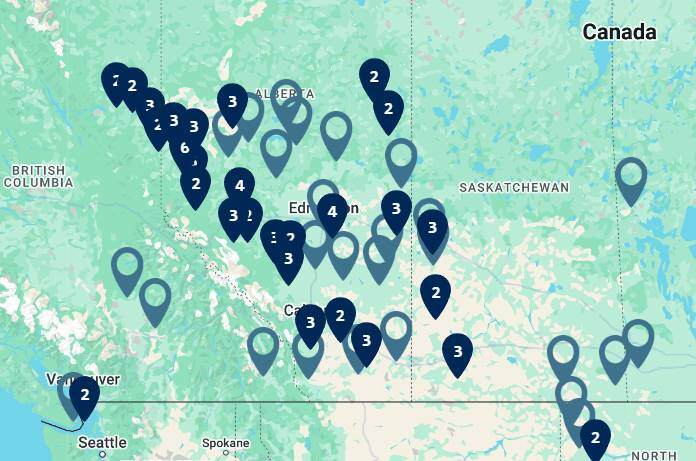

SECURE's Midstream Infrastructure business segment includes a network of midstream processing and storage facilities, crude oil and water pipelines, and crude by rail terminals located throughout key resource plays in western Canada, North Dakota and Oklahoma. SECURE's midstream infrastructure operations generate cash flows from oil production processing and disposal, produced water disposal, and crude oil storage, logistics, and marketing.

SECURE's Environmental and Fluid Management business segment includes a network of industrial landfills, hazardous and non-hazardous waste management and disposal, onsite abandonment, environmental solutions for site remediation and reclamation, bio-remediation and technologies, water treatment & recycling, emergency response, rail services, metal recycling services, as well as fluid management for drilling, completion and production activities.

TSX Symbol: SES

SOURCE SECURE Energy Services Inc.