News Releases

Stay in the know

/NOT FOR DISTRIBUTION IN THE UNITED STATES OR FOR DISSEMINATION

ON TO UNITED STATES NEWSWIRE SERVICES./

(All financial figures are approximate and in Canadian dollars unless otherwise noted)

CALGARY, AB, Oct. 4, 2021 /CNW/ - SECURE Energy Services Inc. ("SECURE") (TSX: SES), announced today that it has successfully closed its previously announced private offering (the "Offering") of $140 million aggregate principal amount of 7.25% senior unsecured notes due December 30, 2026 (the "Notes") at an issue price of $100.75, representing a yield of approximately 7%. The Offering was underwritten by National Bank Financial Markets.

As previously disclosed, SECURE intends to use the net proceeds of the Offering to fund partial redemptions (collectively, the "Redemptions"), of US$100 million aggregate principal amount of the outstanding US$400 million aggregate principal amount of 11.000% senior second lien secured notes due 2025 (the "2025 Notes") previously issued by Tervita Corporation ("Tervita"), in respect of which SECURE became the obligor following its acquisition of all of the issued and outstanding securities of Tervita on July 2, 2021. The Redemptions are anticipated to occur on October 7 and 8, 2021. Upon completion of the Redemptions, US$300 million aggregate principal amount of the 2025 Notes are expected to be outstanding. Any remaining net proceeds from the Offering will be used to pay fees and expenses incurred in connection with the Offering and for general corporate purposes.

The Notes were conditionally offered for sale in Canada on a private placement basis pursuant to certain prospectus exemptions. The Notes have not been registered under the U.S. Securities Act of 1933 (the "U.S. Securities Act"), or any state securities laws, and are being offered and sold in the United States only to qualified institutional buyers in reliance on Rule 144A under the U.S. Securities Act and applicable state securities laws and outside the United States in offshore transactions in reliance on Regulation S under the U.S. Securities Act.

This press release does not constitute an offer to sell, or a solicitation of an offer to buy, any security and shall not constitute an offer, solicitation or sale in any jurisdiction in which such an offer, solicitation, or sale would be unlawful.

Forward-Looking Statements

Certain statements contained in this press release constitute "forward-looking statements" and/or "forward-looking information" within the meaning of applicable securities laws (collectively referred to as "forward-looking statements"). When used in this press release, the words "achieve", "anticipate", "expect", "intend" and "will", and similar expressions, as they relate to SECURE and its management, are intended to identify forward-looking statements. Such statements reflect the current views of SECURE with respect to future events and operating performance and speak only as of the date of this press release.

In particular, this press release contains or implies forward-looking statements pertaining but not limited to: the use of proceeds of the Offering , the terms and timing of the Redemptions, and the principal amount of 2025 Notes outstanding upon completion of the Redemptions.

Forward-looking statements involve significant known and unknown risks and uncertainties, should not be read as guarantees of future performance or results, and will not necessarily be accurate indications of whether such results will be achieved. Readers are cautioned not to place undue reliance on these statements as a number of factors could cause actual results to differ materially from the results discussed in these forward-looking statements, including but not limited to those factors referred to under the heading "Risk Factors" in SECURE's Annual Information Form for the year ended December 31, 2020, and the joint information circular of SECURE and Tervita dated May 6, 2021, each of which is available on SEDAR at www.sedar.com.

Although forward-looking statements contained in this press release are based upon what SECURE believes are reasonable assumptions, SECURE cannot assure investors that actual results will be consistent with these forward-looking statements. The forward-looking statements in this press release are expressly qualified by this cautionary statement. Unless otherwise required by law, SECURE does not intend, or assume any obligation, to update these forward-looking statements.

About SECURE

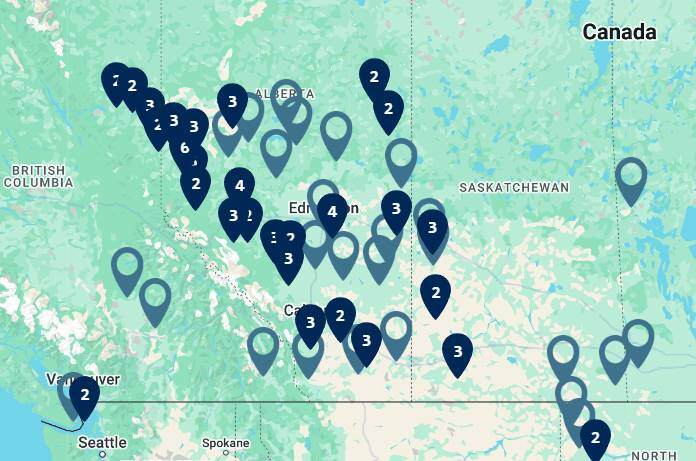

SECURE is a publicly traded energy business listed on the Toronto Stock Exchange ("TSX") providing industry leading customer solutions to upstream oil and natural gas companies operating in western Canada and certain regions in the U.S. through its network of midstream processing and storage facilities, crude oil and water pipelines, and crude by rail terminals located throughout key resource plays in western Canada, North Dakota and Oklahoma. SECURE's core midstream infrastructure operations generate cash flows from oil production processing and disposal, produced water disposal, and crude oil storage, logistics, and marketing. SECURE also provides comprehensive environmental and fluid management for landfill disposal, hazardous and non-hazardous waste management and disposal, onsite abandonment, site remediation and reclamation, bio-remediation and technologies, water treatment, emergency response, rail services, recycling services, as well as drilling, completion and production operations for oil and gas producers in western Canada. Recycling services include the purchase and processing of ferrous and non-ferrous metals recovered from demolition sites and other locations.

SOURCE SECURE Energy Services Inc.