News Releases

Stay in the know

CALGARY, AB, Sept. 22, 2021 /CNW/ - SECURE Energy Services Inc. ("SECURE") (TSX: SES) announced today that it has delivered conditional notices of redemption (the "Redemption Notices") to holders of its outstanding US$400 million aggregate principal amount of 11.000% Senior Second Lien Secured Notes due 2025 (the "Notes") to redeem, in aggregate, US$100 million principal amount of Notes, each at a redemption price of 105.5% plus accrued and unpaid interest on the Notes being redeemed to the applicable redemption date, all in accordance with the provisions of the indenture governing the Notes. The Notes were previously issued by Tervita Corporation ("Tervita") and SECURE became the obligor in respect thereof in connection with its acquisition of Tervita on July 2, 2021. The Redemption Notices are being delivered through the facilities of DTC.

Under the terms of the indenture governing the Notes (the "Indenture"), until December 1, 2021, the Company may, at its option, redeem up to 20% of the then outstanding aggregate principal amount of Notes at a redemption price equal to 105.500% of the aggregate principal amount thereof, plus accrued and unpaid interest thereon to the redemption date, with the net cash proceeds of one or more incurrences of unsecured Indebtedness (as defined in the Indenture); provided that at least US$300 million aggregate principal amount of Notes remains outstanding immediately after the occurrence of each such redemption.

As provided in the Redemption Notices, SECURE intends to redeem: (i) US$80 million principal amount of the Notes (the "Initial Redemption") on October 7, 2021 (the "Initial Redemption Date"), subject to the completion of the previously announced offering by SECURE of CAD$140 million aggregate principal amount of 7.25% senior unsecured notes due 2026 on or prior to the Initial Redemption Date (the "Offering"); and (ii) US$20 million principal amount of the Notes (the "Subsequent Redemption" and together with the Initial Redemption, the "Redemptions") on October 8, 2021, subject to completion of the Offering and the Initial Redemption.

This press release does not constitute a notice of redemption of the Notes. Information concerning the terms and conditions of the Redemptions are described in the Redemption Notices distributed to holders of the Notes by Deutsche Bank Trust Company Americas, the U.S. trustee with respect to the Notes. Beneficial holders with any questions about the Redemptions should contact their respective brokerage firm or financial institution.

This press release does not constitute an offer to sell or a solicitation of an offer to purchase the Notes or any other security, and there will not be any offer, solicitation or sale of the Notes or any other security in any state or jurisdiction in which such an offer, solicitation or sale would be unlawful.

Forward-Looking Statements

Certain information included herein is forward-looking. Many of these forward looking statements can be identified by words such as "believe", "expects", "expected", "will", "intends", "projects", "projected", "anticipates", "estimates", "continues", "objective" or similar words and include, but are not limited to, statements regarding the Redemptions, the Offering and the timing thereof. SECURE believes the expectations reflected in such forward-looking statements are reasonable but no assurance can be given that these expectations will prove to be correct and such forward-looking statements should not be unduly relied upon.

About SECURE

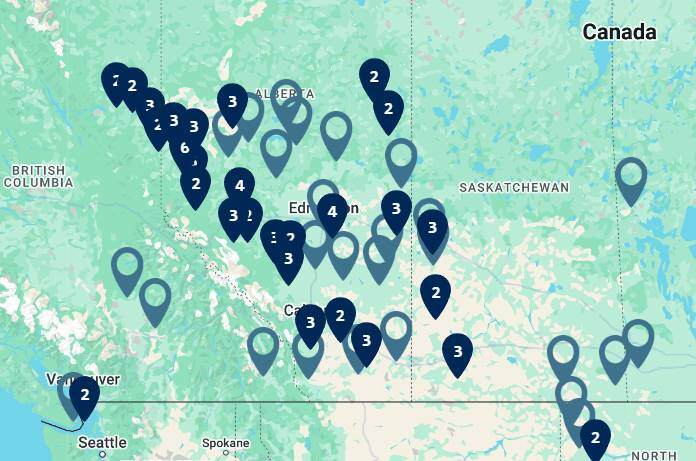

SECURE is a publicly traded energy business listed on the Toronto Stock Exchange ("TSX") providing industry leading customer solutions to upstream oil and natural gas companies operating in western Canada and certain regions in the U.S. through its network of midstream processing and storage facilities, crude oil and water pipelines, and crude by rail terminals located throughout key resource plays in western Canada, North Dakota and Oklahoma. SECURE's core midstream infrastructure operations generate cash flows from oil production processing and disposal, produced water disposal, and crude oil storage, logistics, and marketing. SECURE also provides comprehensive environmental and fluid management for landfill disposal, hazardous and non-hazardous waste management and disposal, onsite abandonment, site remediation and reclamation, bio-remediation and technologies, water treatment, emergency response, rail services, recycling services, as well as drilling, completion and production operations for oil and gas producers in western Canada. Recycling services include the purchase and processing of ferrous and non-ferrous metals recovered from demolition sites and other locations.

SOURCE SECURE Energy Services Inc.