News Releases

Stay in the know

CALGARY, AB, June 14, 2021 /CNW/ - SECURE Energy Services Inc. ("SECURE", the "Corporation") (TSX: SES) today announced that it has entered into a binding agreement with its syndicate of lenders to increase the size of the previously announced senior secured revolving credit facility available at closing of the business combination with Tervita Corporation ("Tervita") from $725 million to $800 million.

On March 8, 2021, SECURE and Tervita entered into an arrangement agreement to combine in an all-share transaction, creating a stronger midstream infrastructure and environmental solutions business (the "Transaction"). The combined company will operate as SECURE and remain listed on the Toronto Stock Exchange ("TSX") as TSX: SES.

SECURE has commitments from nine financial institutions and Chartered Banks to provide the combined company with financing by way of an $800 million three-year credit facility (the "Credit Facility"), subject to the satisfaction of certain conditions precedent. The Credit Facility will be utilized to replace and repay SECURE's existing first and second lien credit facilities and Tervita's first lien credit facility. Tervita's second lien notes will remain outstanding and enable capital structure optimization while maintaining adequate liquidity. The effectiveness of the Credit Facility will itself be subject to certain financial covenants, liquidity criteria and customary conditions being met, including completion of the Transaction. It is anticipated that each of the conditions to the effectiveness of the Credit Facility, other than the proposed amalgamation of SECURE and Tervita, will be satisfied prior to completion of the Transaction.

"The increase to the Credit Facility that will be in place upon completion of our merger with Tervita provides enhanced financial flexibility for the combined company," said Chad Magus, Chief Financial Officer. "We appreciate the support of our lenders and look forward to our continued relationship."

As previously stated, SECURE will continue to focus on debt repayment following the closing of the Transaction to achieve the combined company's target debt to EBITDA ratio of less than 2.5x, which is expected to be achieved within two years of closing of the Transaction.

SECURE is also pleased to announce that it has a binding commitment for a new $30 million unsecured letter of credit facility guaranteed by Export Development Canada (the "LC Facility"), providing additional stability and capacity to the company's capital structure. SECURE had issued letters of credit in the amount of approximately $37 million at March 31, 2021. Any letters of credit issued above the capacity of the LC Facility are expected to reduce the amount available to be drawn under the Credit Facility following completion of the Transaction.

Special Meeting of Shareholders

On June 15, 2021, SECURE and Tervita will each hold special meetings of shareholders virtually, via live webcasts, with SECURE's shareholders and Tervita's securityholders voting on respective resolutions in connection with the Transaction (the "Meetings").

Further information on how to attend the Meetings, along with voting instructions for shareholders of record on May 4, 2021, were included in the joint information circular of SECURE and Tervita dated May 6, 2021 (the "Joint Information Circular") which was delivered to the applicable securityholders and filed on SEDAR at www.sedar.com on May 11, 2021.

FORWARD-LOOKING STATEMENTS

Certain statements contained in this press release constitute "forward-looking statements" and/or "forward-looking information" within the meaning of applicable securities laws (collectively referred to as "forward-looking statements"). When used in this press release, the words "achieve", "enhance", "expect", "plan", "position", "priority", "realize", "result", "strategy", "target" and "will", and similar expressions, as they relate to SECURE or the combined company, or their respective management, are intended to identify forward-looking statements. Such statements reflect the current views of SECURE with respect to future events and operating performance and speak only as of the date of this press release.

In particular, this press release contains or implies forward-looking statements pertaining to: the satisfaction of the conditions necessary to be met in order for the Credit Facility to be entered into and the timing thereof; the expected terms of the Credit Facility, the conditions thereto and the use of proceeds therefrom; expectations with respect to the strength and financial flexibility of the combined company; debt repayment plans; the ability to achieve the combined company' target debt to EBITDA ratio of less than 2.5x; the stability and financial flexibility of the combined company's capital structure; and the meetings of each of SECURE's shareholders and Tervita's securityholders.

Forward-looking statements involve significant known and unknown risks and uncertainties, should not be read as guarantees of future performance or results, and will not necessarily be accurate indications of whether such results will be achieved. Readers are cautioned not to place undue reliance on these statements as a number of factors could cause actual results to differ materially from the results discussed in these forward-looking statements, including but not limited to those factors referred to under the heading "Risk Factors" in our Annual Information Form for the year ended December 31, 2020, and the Joint Information Circular, each of which are available on SEDAR at www.sedar.com.

Although forward-looking statements contained in this press release are based upon what the Corporation believes are reasonable assumptions, including that the conditions in order for the Credit Facility to be entered into will be satisfied and the timing thereof, the Corporation cannot assure investors that actual results will be consistent with these forward-looking statements. The forward-looking statements in this press release are expressly qualified by this cautionary statement. Unless otherwise required by law, SECURE does not intend, or assume any obligation, to update these forward-looking statements.

ABOUT SECURE

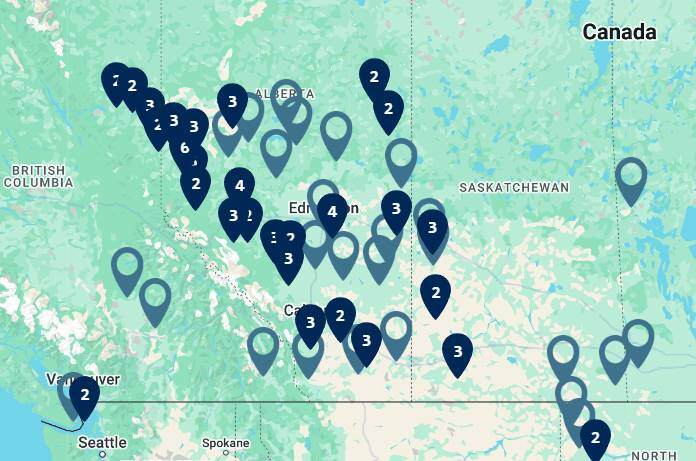

SECURE is a publicly traded energy business listed on the Toronto Stock Exchange providing industry leading customer solutions to upstream oil and natural gas companies operating in western Canada and certain regions in the United States through its network of midstream processing and storage facilities, crude oil and water pipelines, and crude by rail terminals located throughout key resource plays in western Canada, North Dakota and Oklahoma. SECURE's core midstream infrastructure operations generate cash flows from oil production processing and disposal, produced water disposal, and crude oil storage, logistics, and marketing. SECURE also provides comprehensive environmental and fluid management for landfill disposal, onsite abandonment, remediation and reclamation, drilling, completion and production operations for oil and gas producers in western Canada.

Website: www.secure-energy.com

TSX Symbol: SES

SOURCE SECURE Energy Services Inc.