News Releases

Stay in the know

CALGARY, AB, April 27, 2021 /CNW/ - SECURE ENERGY Services Inc. ("SECURE") (TSX: SES) reported today its operational and financial results for the three months ended March 31, 2021, highlighted by Adjusted EBITDAi of $39.2 million.

The following press release should be read in conjunction with the Corporation's management's discussion and analysis ("MD&A") for the three months ended March 31, 2021, and the condensed consolidated financial statements and notes thereto for the three months ended March 31, 2021, which are available on SEDAR at www.sedar.com.

FIRST QUARTER HIGHLIGHTS

- Achieved Adjusted EBITDA of $39.2 million for the three months ended March 31, 2021. This reflects the level of SECURE's production and contracted volumes and the significant measures taken following the first quarter of 2020 to reduce operating and general and administrative ("G&A") expenses to adjust the Corporation's cost structure to levels consistent with activity levels.

- Recorded a net loss of $1.1 million, compared to a net loss of $22.4 million for the three months ended March 31, 2020. The net loss in the current year period includes transaction costs of $3.1 million associated with legal and advisory fees related to the Tervita Merger (refer to "Tervita Merger" section below).

- Reduced G&A expenses (excluding depreciation, depletion and amortization and share-based compensation) by 30% from the prior year comparative period. As a percentage of revenue (excluding oil purchase and resale), G&A expenses were 10% for the three months ended March 31, 2021.

- Generated discretionary free cash flowi of $27.5 million, which was used primarily to repay debt, as well as fund the Corporation's quarterly dividend, maintenance and capital program. Net cash flows from operating activities were $24.6 million in the quarter.

- Reduced the amount drawn on the Corporation's credit facilities, net of cash held, by $17.0 million. As a result, SECURE reported Total Debt to trailing twelve-month EBITDAii of 3.1x, well within the Corporation's 5.0x covenant restriction.

- Declared dividends of $1.2 million, representing $0.0075 (0.75 cents) per common share for the quarter.

- Continued to prioritize the advancement of SECURE's Environmental, Social and Governance ("ESG") practices. During the three months ended March 31, 2021, in addition to publishing our 2020 Sustainability Report, initiatives taken by SECURE included:

- Establishing a framework for an ESG education and awareness program for employees;

- Progressing development of a framework of short and mid-term energy usage and emissions targets as we map out milestones towards achieving our long-term objectives of reducing carbon intensity in half by 2030 and achieving net zero emissions by 2050;

- Expanding vendor involvement and compliance with SECURE's ESG practices; and

- Establishing ESG targets for short and long-term executive compensation.

TERVITA MERGER

On March 8, 2021, SECURE entered into an arrangement agreement (the "Arrangement Agreement") with Tervita Corporation ("Tervita") to combine in an all-share transaction pursuant to which SECURE will acquire all of the issued and outstanding common shares of Tervita on the basis of 1.2757 common shares of SECURE for each outstanding common share of Tervita (the "Tervita Merger"). The combined company will operate as SECURE and remain listed on the TSX as TSX: SES.

The Tervita Merger combines highly complementary midstream infrastructure asset bases and environmental service lines, which are expected to materially enhance scale and utilization and provide operating efficiencies for the combined company's customers. Significant estimated annual integration cost savings of approximately $75 million are expected to be realizable within 12 to 18 months after closing, contributing to a strong pro forma discretionary free cash flow profile.

In connection with entering into the Arrangement Agreement, SECURE entered into a binding agreement with a syndicate of banks to provide the combined company with committed financing by way of a $725 million three-year credit facility available upon closing of the Tervita Merger (the "new SECURE Credit Facility"), subject to the satisfaction of certain conditions precedent. The new SECURE Credit Facility will be utilized to replace and repay SECURE's existing first and second lien credit facilities and Tervita's first lien credit facilities.

On April 12, 2021, SECURE received an initial issuer credit rating of 'B' from S&P Global Ratings with a positive outlook following the announcement of the Tervita Merger. This represents the Corporation's first public credit rating and the rating is expected to increase transparency and comparability for debt investors and other capital market participants.

On April 16, 2021, Tervita obtained the requisite consents from the holders of Tervita's outstanding US$500 million aggregate principal amount of 11% senior second lien secured notes due 2025 to facilitate completion of the Tervita Merger (the "Tervita Noteholder Consent"). Obtaining the Tervita Noteholder Consent was a condition to the effectiveness of the new SECURE Credit Facility.

Completion of the Tervita Merger is subject to, among other things: (i) obtaining the requisite approvals of securityholders of Tervita and shareholders of SECURE; (ii) the approval by the Court of Queen's Bench of Alberta; (iii) the new SECURE Credit Facility becoming effective on the completion of the Tervita Merger; (iv) receipt of requisite approvals under the Competition Act (Canada); (v) conditional approval by the Toronto Stock Exchange of the listing of the SECURE common shares issuable to Tervita shareholders pursuant to the Tervita Merger; and (viii) other customary closing conditions.

OPERATING AND FINANCIAL SUMMARY

The Corporation's operating and financial highlights for the three-month periods ended March 31, 2021 and 2020 can be summarized as follows:

Three months ended March 31, | ||||

($000's except share and per share data) | 2021 | 2020 | % change | |

Revenue (excludes oil purchase and resale) | 132,135 | 172,022 | (23) | |

Oil purchase and resale | 529,077 | 433,555 | 22 | |

Total revenue | 661,212 | 605,577 | 9 | |

Adjusted EBITDA (1) | 39,153 | 42,094 | (7) | |

Per share ($), basic | 0.25 | 0.27 | (7) | |

Net loss attributable to shareholders of SECURE | (630) | (21,952) | (97) | |

Per share ($), basic and diluted | - | (0.14) | (100) | |

Cash flows from operating activities | 24,585 | 45,850 | (46) | |

Per share ($), basic | 0.15 | 0.29 | (48) | |

Discretionary free cash flow(1) | 27,509 | 30,854 | (11) | |

Per share ($), basic | 0.17 | 0.19 | (11) | |

Capital expenditures (1) | 6,427 | 41,360 | (84) | |

Dividends per common share | 0.0075 | 0.0675 | (89) | |

Total assets | 1,415,717 | 1,574,420 | (10) | |

Long-term liabilities | 538,354 | 609,122 | (12) | |

Common shares - end of period | 160,137,641 | 158,444,194 | 1 | |

Weighted average common shares - basic and diluted | 159,540,722 | 158,513,800 | 1 | |

(1)Refer to "Non-GAAP measures" for further information. | ||||

- REVENUE OF $661.2 MILLION FOR THE THREE MONTHS ENDED MARCH 31, 2021

- Midstream Infrastructure segment revenue (excluding oil purchase and resale) decreased 31% to $51.3 million during the three months ended March 31, 2021, from the 2020 comparative period. Despite higher crude oil and liquids pricing and an uptick in field activity levels over recent quarters, producers remained cautious deploying their 2021 capital programs. The active rig count remained approximately 25% below the prior year comparative period in the Western Canadian Sedimentary Basin ("WCSB") as producers navigated increasing COVID-19 restrictions and a period of significantly cold weather in February. Reduced drilling, completion and production volumes at the Corporation's facilities negatively impacted treating and disposal revenues.

- Oil purchase and resale revenue for the three months ended March 31, 2021, increased 22% from the 2020 comparative period to $529.1 million. The increase in revenue is a result of a 32% increase in Canadian light oil benchmark pricing during the three-month period ended March 31, 2021, over the 2020 comparative period, partially offset by reduced marketing activity as a result of lower production volumes and less volatile differentials.

- Environmental and Fluid Management segment revenue decreased 17% during the three months ended March 31, 2021, from the 2020 comparative to $80.9 million. Environmental management project work was negatively impacted by job shut-downs or deferrals resulting from public health measures taken to limit the spread of COVID-19 and the 25% reduction in drilling and completion activity in the WCSB from the prior comparative quarter. The extent of the revenue decrease in the segment was partially mitigated by stable revenue from production chemicals as the Corporation continues to win new bids and gain market share, and increased revenue generated as a result of government abandonment and reclamation stimulus programs.

- ADJUSTED EBITDA OF $39.2 MILLION FOR THE THREE MONTHS ENDED MARCH 31, 2021

- Adjusted EBITDA decreased 7% to $39.2 million during the three months ended March 31, 2021, from the 2020 comparative period. The impact of a 23% reduction to revenue (excluding oil purchase and resale) as described above was partially offset by cost reductions taken since the first quarter of 2020 to reduce operating and G&A expenses to adjust the Corporation's cost structure to levels consistent with activity levels.

- NET LOSS ATTRIBUTABLE TO SHAREHOLDERS OF SECURE OF $0.6 MILLION FOR THE THREE MONTHS ENDED MARCH 31, 2021

- Net loss attributable to shareholders of SECURE was $0.6 million during the three months ended March 31, 2021, compared to a net loss of $22.0 million for the 2020 comparative period. The variance is primarily a result of expenses recorded by the Corporation in the prior year comparative period associated with the sudden onset of the economic downturn in March 2020. These expenses included a $15.7 million non-cash impairment charge on intangible assets and $9.4 million of one-time costs related to restructuring initiatives to align the Corporation's fixed cost structure with anticipated activity levels.

- CASH FLOWS FROM OPERATING ACTIVITIES OF $24.6 MILLION FOR THE THREE MONTHS ENDED MARCH 31, 2021

- The Corporation generated cash flows from operating activities of $24.6 million during the three months ended March 31, 2021, a decrease of 46% from the prior year comparative period. The variance was primarily a result of a $21.3 million change in non-cash working capital. In the prior year comparative period, the Corporation had a large working capital recovery as a result of reduced accounts receivable and accrued receivables at March 31, 2020 compared to December 31, 2019, following the decline in crude oil prices in March 2020. At March 31, 2021, SECURE carried total net working capital, excluding cash, of $58.1 million, relatively consistent with the balance at December 31, 2020.

- CAPITAL EXPENDITURES OF $6.4 MILLION FOR THE THREE MONTHS ENDED MARCH 31, 2021

- Total capital expenditures for the three months ended March 31, 2021, included $4.5 million of expansion capital related primarily to connecting an additional segment of the East Kaybob oil pipeline.

- Sustaining capital incurred in the three months ended March 31, 2021, of $1.9 million relates primarily to well maintenance, and asset integrity and inspection programs.

- FINANCIAL FLEXIBILITY

- During the three months ended March 31, 2021, the Corporation paid down its credit facilities, net of cash held, by $17.0 million. The reduction is primarily a result of SECURE's efforts to direct discretionary free cash flow, net of the first quarter 2021 capital program, against outstanding debt. As at March 31, 2021, the Corporation had drawn $393.1 million on its credit facilities, resulting in availability of $336.9 million, subject to covenant restrictions.

- The following table outlines SECURE's Senior and Total Debt to trailing twelve-month EBITDA ratio at March 31, 2021, and December 31, 2020. SECURE remains well within compliance of all covenants related to its credit facilities.

Mar 31, 2021 | Dec 31, 2020 | Covenant | |||||

Senior Debt to EBITDA | 2.1 | 2.2 | 3.5 | ||||

Total Debt to EBITDA | 3.1 | 3.2 | 5.0 |

- DIVIDENDS OF $1.2 MILLION FOR THE THREE MONTHS ENDED MARCH 31, 2021

- During the three months ended March 31, 2021, the Corporation declared dividends of $1.2 million to holders of common shares, representing a quarterly dividend of $0.0075 (0.75 cents) per share.

- SECURE believes sharing excess cash flows with shareholders is a core business principle; as a result, management and the Board of Directors of the Corporation will continue to monitor the Corporation's dividend policy with respect to forecasted Adjusted EBITDA, debt, capital expenditures and other investment opportunities, as well as expected interest, lease, tax and transaction costs, and will look for opportunities to increase the dividend after the successful integration with Tervita and as business conditions warrant.

MIDSTREAM INFRASTRUCTURE SEGMENT HIGHLIGHTS

Three months ended March 31, | |||

($000's) | 2021 | 2020 | % Change |

Midstream Infrastructure services revenue (a) | 51,264 | 74,627 | (31) |

Oil purchase and resale | 529,077 | 433,555 | 22 |

Midstream Infrastructure Revenue | 580,341 | 508,182 | 14 |

Cost of sales excluding items noted below | 21,163 | 30,865 | (31) |

Depreciation and amortization | 19,034 | 23,502 | (19) |

Oil purchase and resale | 529,077 | 433,555 | 22 |

Midstream Infrastructure Cost of Sales | 569,274 | 487,922 | 17 |

Segment Profit Margin (1) | 30,101 | 43,762 | (31) |

Segment Profit Margin (1) as a % of revenue (a) | 59% | 59% | |

(1)Calculated as revenue less cost of sales excluding depreciation and amortization. Refer to "Non-GAAP Measures" for further information. |

- Revenue generated from Midstream Infrastructure services of $51.3 million decreased 31% for the three months ended March 31, 2021, from the 2020 comparative period. The decrease was due to lower processing and disposal volumes tied to drilling and completion activity compared to the first two months of 2020, prior to the large decrease in oil prices and corresponding activity levels. Produced water, emulsion treating and terminalling volumes at the Corporation's midstream processing facilities also decreased primarily as a result of natural production declines in the WCSB, continued production shut-ins in North Dakota, and limited overflow volumes from producers with capacity to handle their own product. Recovered oil revenue was relatively flat in the three months ended March 31, 2021, compared to the 2020 comparative period as higher average crude oil prices were offset by reduced volumes. Less volatile differentials limited the upside for price optimization at the Corporation's pipeline connected FSTs compared to the three months ended March 31, 2020, resulting in reduced crude oil marketing revenue.

- Disposal volumes decreased 39% during the three months ended March 31, 2021, from the 2020 comparative period as a result of lower waste water volumes corresponding to reduced producer completion activity, limited overflow volumes from producers with capacity to handle their own product, and customer storage of production water for anticipated completions.

- Processing volumes decreased 22% during the three months ended March 31, 2021, from the 2020 comparative period due primarily to lower waste processing volumes corresponding to the decrease in drilling and completion activity compared to the first two months of 2020. Emulsion treating volumes were also down due to lower overall production levels, particularly in North Dakota where activity levels have been slow to recover.

- Oil volumes recovered through our processing operations decreased 33% during the three months ended March 31, 2021, from the 2020 comparative period, consistent with lower overall volumes received at the Corporation's midstream processing facilities as described above. The impact of lower volumes on recovered oil revenue was largely offset by a 32% improvement in benchmark oil pricing in the current year period.

- Crude oil terminalling and pipeline volumes decreased 14% during the three months ended March 31, 2021, from the 2020 comparative period. The decrease was a result of reduced terminalling at certain facilities due to lower production, partially offset by the addition of the East Kaybob oil pipeline in June 2020, and stability of volumes associated with the contracted Kerrobert crude oil pipeline.

- Oil purchase and resale revenue in the Midstream Infrastructure segment increased 22% to $529.1 million for the three months ended March 31, 2021, from the 2020 comparative period. The increase corresponds to the increase in benchmark oil prices, partially offset by reduced marketing activities compared to the prior year comparative period.

- The Midstream Infrastructure segment's profit margin decreased 31% to $30.1 million for the three months ended March 31, 2021, from the 2020 comparative period due to the factors described above. As a percentage of Midstream Infrastructure services revenue, segment profit margin was 59% for both the three months ended March 31, 2021 and 2020. Lower revenue in the current year period was offset by fixed cost structure reductions.

- G&A expense decreased by 31% to $4.6 million for the three months ended March 31, 2021, from the 2020 comparative period. The decrease is mainly due to lower personnel costs resulting from the restructuring initiatives taken to right-size the Corporation's workforce to anticipated activity levels beginning at the end of March 2020, and strict cost control measures restricting discretionary spending. Excluding depreciation and amortization, G&A expense as a percentage of the segment's services revenue was 8% for the three months ended March 31, 2021, compared to 6% for the three months ended March 31, 2020, as a result of lower revenue.

- Income before tax of $6.3 million for the three months ended March 31, 2021, decreased $3.6 million compared to the income before tax of $9.9 million in the prior year comparative period. The decrease is a result of lower segment profit margin, partially offset by lower depreciation and amortization expense and G&A expense in the 2021 period, as well as a $3.4 million restructuring charge incurred in the prior year period related to right sizing the Corporation's workforce to anticipated activity levels and streamlining business processes resulting in termination of certain functions.

ENVIRONMENTAL AND FLUID MANAGEMENT SEGMENT

Three months ended March 31, | |||

($000's) | 2021 | 2020 | % Change |

Environmental and Fluid Management Revenue | 80,871 | 97,395 | (17) |

Cost of sales excluding items noted below | 59,345 | 74,408 | (20) |

Depreciation, depletion and amortization | 8,361 | 12,089 | (31) |

Impairment | - | 15,723 | (100) |

Environmental and Fluid Management Cost of Sales | 67,706 | 102,220 | (34) |

Segment Profit Margin (1) | 21,526 | 22,987 | (6) |

Segment Profit Margin (1) as a % of revenue | 27% | 24% | |

(1)Calculated as revenue less cost of sales excluding depreciation, depletion, amortization, and impairment. Refer to "Non-GAAP Measures" for further information. |

- The Environmental and Fluid Management segment revenue decreased 17% to $80.9 million for the three months ended March 31, 2021, from the 2020 comparative period. Reduced producer spending in the first quarter of 2021 decreased drilling and completion activity, lowering drilling waste volumes at the Corporation's landfills and demand for fluid management associated with drilling and completions. Additionally, project work was negatively impacted by job shut-downs or deferrals resulting from public health measures taken to limit the spread of COVID-19. New revenue generated from the government stimulus programs partially offset the impact of reduced project job volumes on the Corporation's Environmental business units.

- The extent of the revenue decrease in the Environmental and Fluid Management segment was also partially mitigated by relatively stable revenue from production chemicals as the Corporation continues to win new bids and gain market share. SECURE has experience and expertise in key production fields where producers have been the most active in WCSB. As a result, the Corporation can provide tailored solutions and improved product formulations that optimize production, provide flow assurance and maintain the integrity of production assets.

- Segment profit margin decreased 6% to $21.5 million for the three months ended March 31, 2021, from the 2020 comparative period. For the three months ended March 31, 2021, segment profit margin as a percentage of revenue of 27% increased from 24% in the prior year comparative period. The profit margin increase was primarily a result of service mix, including higher production enhancement stimulation work, as well as fixed cost reductions following the first quarter of 2020 which also contributed to improvements in segment profit margin.

- G&A expenses decreased 36% to $5.2 million for the three months ended March 31, 2021, from the 2020 comparative period. The decrease is primarily due to lower personnel related costs and reduced discretionary spending as the Corporation manages costs to correspond to current industry activity levels. Excluding depreciation and amortization, G&A expenses as a percentage of the segment's revenue was 6% for the three months ended March 31, 2021, compared to 8% in the prior comparative period.

- The Environmental and Fluid Management segment recorded income before tax of $8.0 million for the three months ended March 31, 2021, compared to a loss before tax of $17.8 million for the three months ended March 31, 2020. For the three months ended March 31, 2020, the segment's loss before tax included a non-cash impairment charge of $15.7 million, as well as restructuring costs of $4.8 million incurred related to organizational restructuring.

OUTLOOK

Over the next few months, the Corporation will work with Tervita to achieve the remaining major milestones required for the closing of the Tervita Merger. Completion of the Tervita Merger is subject to, among other things: (i) obtaining the requisite approvals of securityholders of Tervita and shareholders of SECURE; (ii) the approval by the Court of Queen's Bench of Alberta; (iii) the new SECURE Credit Facility becoming effective on the completion of the Tervita Merger; (iv) receipt of requisite approvals under the Competition Act (Canada); (v) conditional approval by the Toronto Stock Exchange of the listing of the SECURE common shares issuable to Tervita shareholders pursuant to the Tervita Merger; and (viii) other customary closing conditions.

A joint information circular regarding the Tervita Merger and the meetings of SECURE and Tervita's securityholders, which are each scheduled for June 15, 2021, is expected to be mailed in mid-May 2021. Closing of the Tervita Merger is expected to occur during the third quarter of 2021. The key benefits of the arrangement include:

- Highly complementary midstream infrastructure asset bases and environmental service lines provide for enhanced scale, utilization, efficiencies, and expanded services for the combined company's customers.

- Significant estimated annual integration cost savings of approximately $75 million are expected to be realizable within 12 to 18 months after closing.

- Expected to be immediately accretive to cash flow from operations and discretionary free cash flow per share for all shareholders of the combined company.

- Significantly improved cost structure to serve a growing and consolidating customer base through the full business cycle.

- Strong pro forma financial position with attractive discretionary free cash flow generation expected to reduce debt and help achieve the combined company's target debt to EBITDA ratio of less than 2.5x, which is expected to be achieved within two years of closing.

- Enhanced scale anticipated to provide greater access to capital markets and the ability to partner with our customers to execute on a strong pipeline of organic growth projects.

- Combines two strong corporate cultures driven by highly talented teams with shared commitments to environmental, social and governance principles, safety, performance, customer service and profitability.

- Elevates position to advance and deliver on environmental, social and governance initiatives for the combined company and its customers.

Both the Corporation and Tervita are committed to a successful integration of the two companies and their facility and operating networks. Post-closing, the combined entity will be focused on achieving the estimated annual integration cost savings of approximately $75 million, of which approximately 40% relates to Corporate costs and 60% relates to operational cost savings.

Until closing of the Tervita Merger, SECURE will continue to operate our business independently and competitively. As always, we remain dedicated to working with our customers to deliver innovative midstream and environmental solutions that reduce their costs, lower emissions, and improve safety.

While near-term COVID-19 lockdowns and COVID-19 variants create considerable uncertainty with regards to the outlook on short-term oil demand, successful vaccine deployment, the introduction of rapid COVID-19 testing, and higher crude oil and liquids prices provide optimism for overall industry improvements in the second half of 2021. Based on current macroeconomic conditions and commodity prices, SECURE anticipates higher year over year discretionary free cash flow for the remainder of 2021 based on the following expectations:

- Continued stability from our core Midstream Infrastructure business, of which approximately 35% is underpinned by contracted volumes associated with the Corporation's oil and water pipelines, which provides a base level of cash flows. Additionally, SECURE's business remains highly concentrated on production volumes and related services that historically represent approximately 75% of the Corporation's Adjusted EBITDA.

- Higher producer cash flows resulting from improved commodity prices. As a result, the Corporation expects an increase in drilling and completion activity from 2020 levels for the remainder of the year as producers seek to add production to offset natural declines that occurred in 2020 in order to maintain flat production levels. SECURE anticipates that producers will remain focused on controlling costs and improving balance sheet strength in favor of production growth in the short-term.

- Increased utilization at our midstream processing facilities and landfills as higher drilling, completion and production volumes from increased activity levels require treating, processing and disposal. The Corporation has significant capacity to increase facility throughput and disposal with minimal fixed costs or additional capital.

- Increased abandonment, remediation and reclamation activity in the second half of 2021 as a result of the Canadian Federal Government's $1.7 billion stimulus package to help fund the closure and reclamation of orphan and inactive wells in the WCSB. SECURE expects increased abandonment, remediation and reclamation activity to positively impact all Canadian operations over the term of the program, particularly within our Environmental Management group as a result of higher demand for environmental site assessments, onsite abandonment, remediation and reclamation management and decommissioning work.

Waste volumes resulting from these activities will also require disposal; SECURE owns and operates six industrial landfills in Alberta capable of handling this waste. - Continued prudent approach to capital spending. The Corporation expects to spend less than $20 million in 2021, which includes approximately $12 million of sustaining capital. The capital budget will be reviewed quarterly in 2021 and may be revised in accordance with opportunities to connect producers to existing midstream infrastructure to further increase volumes and utilization on a long-term basis. A full evaluation of SECURE and Tervita's combined capital project opportunities will be conducted immediately following close of the Tervita Merger.

Throughout 2021, the Corporation will continue to focus on maintaining financial resiliency and prioritize the repayment of debt, which we expect will also contribute to a strong pro forma financial position upon closing of the Tervita Merger.

Our business is uniquely positioned to deliver economic and environmental benefits that make the oil and gas industry more efficient and sustainable. We are committed to working with our customers to challenge what's possible and develop innovative solutions that are both cost effective and minimize the environmental impacts associated with the development of our shared resources. The Tervita Merger provides the increased size and scale, utilization, and efficiencies to enhance the services and capabilities we can provide to our customers to help achieve their objectives of responsible development, while reducing costs.

Additionally, SECURE will continue to take proactive measures to reduce the environmental impact of our own operations, and positively contribute to the health, safety, and economic wellbeing of our employees and communities where we live and work. The Tervita Merger elevates our position to accelerate the Corporation's environmental and social sustainability initiatives for the benefit of all stakeholders.

FINANCIAL STATEMENTS AND MD&A

The Corporation's condensed consolidated financial statements and notes thereto for the three months ended March 31, 2021 and 2020 and MD&A for the three months ended March 31, 2021 and 2020 are available immediately on SECURE's website at www.secure-energy.com. The condensed consolidated financial statements and MD&A will be available tomorrow on SEDAR at www.sedar.com.

FORWARD-LOOKING STATEMENTS

Certain statements contained in this document constitute "forward-looking statements" and/or "forward-looking information" within the meaning of applicable securities laws (collectively referred to as "forward-looking statements"). When used in this document, the words "achieve", "advance", "anticipate", "believe", "commit", "could", "deliver", "drive", "enhance", "estimate", "execute", "expect", "focus", "integrate", "intend", "may", "opportunity", "plan", "position", "prioritize", "realize", "result", "strategy", "target" "will", and similar expressions, as they relate to SECURE, its management, or the combined company, are intended to identify forward-looking statements. Such statements reflect the current views of SECURE and speak only as of the date of this document.

In particular, this document contains or implies forward-looking statements pertaining but not limited to: expectations with respect to the strength of the combined company; the combined company's access to capital markets and the resulting effect on its future growth and acquisition plans; the relevance of SECURE's credit rating to debt investors and capital market participants; the complementary nature of the combined company's asset base and environmental service lines, and the ability to enhance scale and increase utilization as a result thereof; the combined company's expected discretionary free cash flow profile; expected annual integration cost savings of the combined company and the timing thereof; debt repayment plans; the ability to achieve the combined company's target debt to EBITDA ratio of less than 2.5x and the timing thereof; anticipated closing conditions and regulatory approvals required pursuant to the Tervita Merger; future ESG goals and the ability of the Tervita Merger to accelerate Tervita's environmental and social sustainability initiatives; the meetings of each of SECURE's and Tervita's shareholders; the joint information circular prepared in connection therewith and the expected publication date thereof; the timing and completion of the Tervita Merger, including the expected closing date of the Tervita Merger; management's expectations with respect to the duration of the COVID-19 pandemic and related restrictions and the related effect on demand for oil, supply and demand balance, and our operations generally; the outlook for oil and liquids prices; the oil and natural gas industry in Canada and the U.S., including drilling, completion and production activity levels for 2021 and beyond in the Corporation's operating areas, and the related impact on SECURE's business, operations and financial results; increased year over year discretionary free cash flow; the effect of the current economic conditions on the future demand for SECURE's services and the impact on SECURE's cash flows and impairment charges on long-term assets; SECURE's financial resiliency and corporate priorities, including debt repayment , and strategies to achieve such priorities; the benefits of contracted and/or fee-for-service contracts on SECURE's cash flow and the expected stability of such sources; capacity at the Corporation's existing facilities; increases to the Corporation's throughput at existing facilities and costs thereof; the impact the Canadian Federal Government's orphan and inactive well fund may have to the business, operations and results of the Corporation; increased abandonment and reclamation activity in the oil and gas industry and the related effect on SECURE's results of operations and the timing thereof; the Corporation's 2021 capital budget and the future evaluation of SECURE's and Tervita's combined capital project opportunities following close of the Tervita Merger; future dividend plans and opportunities to increase dividend payments after the successful integration with Tervita; debt service and the Corporation's ability to meet obligations and commitments and operate within any credit facility restrictions, including the financial covenants related to our debt facilities; the sufficiency of the Corporation's liquidity and expectations that our capital investment, working capital, debt repayment, share repurchases and cash dividends will be funded from internally generated cash flows; the Corporation's credit risk levels; expected benefits customers will receive from our midstream and environmental solutions; key factors driving the Corporation's success; demand for the Corporation's services and products; industry fundamentals driving the success of SECURE's core operations; future capital needs; and access to capital.

Forward-looking statements are based on certain assumptions that SECURE has made in respect thereof as at the date of this document regarding, among other things: the satisfaction of the conditions to closing of the Tervita Merger in a timely manner, including the entering into of the new credit facility and the receipt of all necessary approvals under the Competition Act (Canada) on terms acceptable to SECURE and Tervita; the satisfaction of the conditions to entering into the new credit facility; the combined company's ability to successfully integrate the businesses of SECURE and Tervita; sources of funding that each of SECURE and Tervita have relied upon in the past continue to be available to the combined company on terms favorable to the combined company; the impact of COVID-19, including related government responses related thereto and lower global energy pricing on oil and gas industry exploration and development activity levels and production volumes (including as a result of demand and supply shifts caused by COVID-19 and the actions of OPEC and non-OPEC countries); the success of SECURE's operations and growth projects; the Corporation's competitive position remaining substantially unchanged; future acquisition and sustaining costs will not significantly increase from past acquisition and sustaining costs; that counterparties comply with contracts in a timely manner; that there are no unforeseen events preventing the performance of contracts or the completion and operation of the relevant facilities; that there are no unforeseen material costs in relation to the Corporation's facilities and operations; that prevailing regulatory, tax and environmental laws and regulations apply; increases to the combined company's share price and market capitalization over the long term; the ability of the combined company to repay debt and return capital to shareholders; the combined company's ability to obtain and retain qualified staff and equipment in a timely and cost-efficient manner; and other risks and uncertainties described from time to time in filings made by SECURE with securities regulatory authorities.

Forward-looking statements involve significant known and unknown risks and uncertainties, should not be read as guarantees of future performance or results, and will not necessarily be accurate indications of whether such results will be achieved. Readers are cautioned not to place undue reliance on these statements as a number of factors could cause actual results to differ materially from the results discussed in these forward-looking statements, including but not limited to: the ability of SECURE and Tervita to receive, in a timely manner, the necessary regulatory, court, shareholder, lender, stock exchange and other third-party consents and approvals and to satisfy the other conditions to the closing of the Tervita Merger; the ability to satisfy the conditions to the new credit facility becoming effective; interloper risk; the ability to complete the Tervita Merger on the terms contemplated by SECURE and Tervita or at all; the ability of the combined company to realize the anticipated benefits of, and synergies and savings from, the Tervita Merger and the timing thereof; consequences of not completing the Tervita Merger, including the volatility of the share prices of SECURE, negative reactions from the investment community and the required payment of certain costs related to the Tervita Merger; actions taken by government entities or others seeking to prevent or alter the terms of the Tervita Merger; the potential that a significant number of Tervita shareholders exercise dissent or appraisal rights; the ongoing evaluation of the credit rating of the combined company; legal claims resulting from the announcement or completion of the Tervita Merger; negative reactions to the Tervita Merger, including from customers, suppliers or employees; potential undisclosed liabilities unidentified during the due diligence process; the accuracy of the pro forma financial information of the combined company; the interpretation of the Tervita Merger by tax authorities; the success of business integration; the entry into new business activities and the resulting business mix of the combined company; the focus of management's time and attention on the Tervita Merger and other disruptions arising from the Tervita Merger; and those factors referred to under the heading "Risk Factors" in the Annual Information Form for the year ended December 31, 2020. In addition, the effects and impacts of the COVID–19 outbreak, the rapid decline in global energy prices and the length of time to significantly reduce the global threat of COVID-19 on SECURE's business, the global economy and markets are unknown at this time and could cause SECURE's or the combined company's actual results to differ materially from the forward-looking statements contained in this document.

Although forward-looking statements contained in this document are based upon what the Corporation believes are reasonable assumptions, the Corporation cannot assure investors that actual results will be consistent with these forward- looking statements. The forward-looking statements in this document are expressly qualified by this cautionary statement. Unless otherwise required by applicable securities laws, SECURE does not intend, or assume any obligation, to update these forward-looking statements.

NON-GAAP MEASURES

The Corporation uses accounting principles that are generally accepted in Canada (the issuer's "GAAP"), which includes International Financial Reporting Standards ("IFRS"). This news release contains certain supplementary measures, such as Adjusted EBITDA, discretionary free cash flow, and segment profit margin, which do not have any standardized meaning as prescribed by IFRS. These measures are intended as a complement to results provided in accordance with IFRS. The Corporation believes these measures provide additional useful information to analysts, shareholders and other users to understand the Corporation's financial results, profitability, cost management, liquidity and ability to generate funds to finance its operations. However, they should not be used as an alternative to IFRS measures because they do not have a standardized meaning under IFRS and therefore may not be comparable to similar measures presented by other companies. See the MD&A available at www.sedar.com for further details, including reconciliations of the Non-GAAP measures and additional GAAP measures to the most directly comparable measures calculated in accordance with IFRS.

ABOUT SECURE

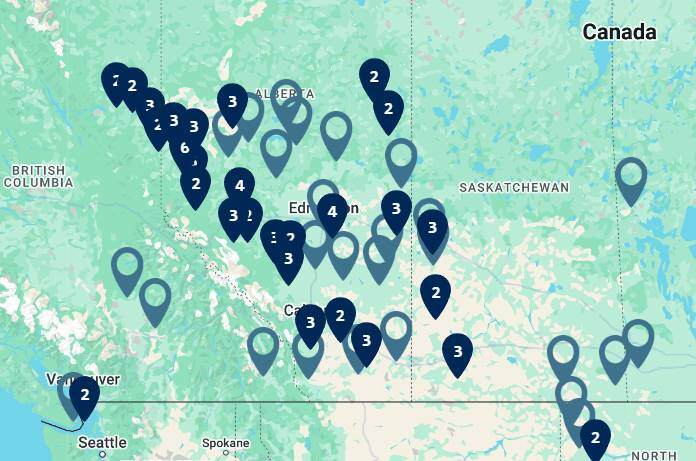

SECURE is a publicly traded energy business listed on the Toronto Stock Exchange ("TSX") providing industry leading customer solutions to upstream oil and natural gas companies operating in western Canada and certain regions in the United States ("U.S.") through its network of midstream processing and storage facilities, crude oil and water pipelines, and crude by rail terminals located throughout key resource plays in western Canada, North Dakota and Oklahoma. SECURE's core midstream infrastructure operations generate cash flows from oil production processing and disposal, produced water disposal, and crude oil storage, logistics, and marketing. SECURE also provides comprehensive environmental and fluid management for landfill disposal, onsite abandonment, remediation and reclamation, drilling, completion and production operations for oil and gas producers in western Canada.

______________________________ |

i Refer to the "Non-GAAP Measures" section herein. |

ii Refer to the "Liquidity and Capital Resources" section herein for details on the Corporation's covenant calculations. |

SOURCE SECURE Energy Services Inc.