News Releases

Stay in the know

Strategic combination of highly complementary businesses expected to unlock significant shareholder value

CALGARY, AB, March 9, 2021 /CNW/ - SECURE Energy Services Inc. ("SECURE") (TSX: SES) and Tervita Corporation ("Tervita") (TSX: TEV) are pleased to announce a transaction to create a stronger midstream infrastructure and environmental solutions business that is expected to provide enhanced free cash flow generation resulting from greater scale and significant annual integration cost savings of $75 million, unlocking value for all shareholders.

The combined company will have an implied total enterprise value of approximately $2.3 billion. Upon completion of the transaction, SECURE and Tervita shareholders will own approximately 52% and 48%, respectively, of the combined company.

The companies have entered into an arrangement agreement (the "Arrangement Agreement") to combine in an all-share transaction pursuant to which SECURE will acquire all of the issued and outstanding common shares of Tervita (the "Tervita Shares") on the basis of 1.2757 common shares of SECURE (the "SECURE Shares") for each outstanding Tervita Share (the "Transaction"). The combined company will operate as SECURE and remain listed on the Toronto Stock Exchange ("TSX") as TSX: SES. The combined company will remain headquartered in Calgary, Alberta.

Transaction Highlights

- Highly complementary midstream infrastructure asset bases and environmental service lines provide for enhanced scale, utilization, efficiencies, and expanded services for the combined company's customers;

- Significant estimated annual integration cost savings of $75 million are expected to be realizable within 12 to 18 months after closing;

- Expected to be immediately accretive to cash flow from operations and discretionary free cash flow per share for all shareholders of the combined company;

- Significantly improved cost structure to serve our growing and consolidating customer base through the full business cycle;

- Strong pro forma financial position with attractive discretionary free cash flow generation expected to reduce debt and help achieve the combined company's target debt to EBITDA ratio of less than 2.5x, which is expected to be achieved within two years of closing;

- Enhanced scale anticipated to provide greater access to capital markets and the ability to partner with our customers to execute on a strong pipeline of organic growth projects;

- Combines two strong corporate cultures driven by highly talented teams with shared commitments to environmental, social and governance ("ESG"), safety, performance, customer service and profitability; and

- Elevates position to advance and deliver on environmental and social sustainability initiatives for the combined company and our customers.

Rene Amirault, Chairman, President, and Chief Executive Officer of SECURE, stated "We are pleased to announce the combination of these two great companies, resulting in the creation of a larger scale midstream infrastructure and environmental solutions business. Together, our highly talented teams will be better positioned to serve our customers, optimize existing infrastructure assets and operations and to drive greater discretionary free cash flow to the bottom line. We look forward to working with the Tervita Board of Directors and team, and we are excited about the value creation opportunities of this Transaction for all stakeholders."

"The merger results in the combination of complementary midstream infrastructure asset bases and environmental service lines, providing for enhanced scale and relevance, benefiting our shareholders, customers, suppliers, and the communities in which we operate," said John Cooper, President and Chief Executive Officer of Tervita. "In SECURE, we have a partner who is equally committed to an employee centric culture with a focus on ESG, safety, performance and customer value, with whom we are eager to join forces to leverage our combined resources and strengths, which will drive a successful integration."

Strategic Rationale

The combined company is expected to be stronger, more capable, more efficient and more profitable than either company on its own.

- Greater Capabilities to Serve Customers

- Combined complementary midstream infrastructure asset bases and environmental service lines of SECURE and Tervita expected to result in increased size and scale, utilization, efficiencies, and expected enhancement of services and capabilities for the combined company's customers.

- Greater Scale and Capital Market Relevance

- Creates a larger, more investable entity for all equity and debt holders, providing greater liquidity and scale to the combined company's investors.

- Combined market capitalization of approximately $1.0 billion and enterprise value of approximately $2.3 billion, based on SECURE's share price as at March 8, 2021 and the exchange ratio pursuant to the Transaction, with pro forma annual Adjusted EBITDA of greater than $400 million, including expected annual integration cost savings.

- Sizeable Integration Cost Savings Enhance Opportunity for Value Creation

- Annual integration cost savings estimated at $75 million (representing ~22% of pro forma 2020 Adjusted EBITDA) expected to be realizable in 12 to 18 months after closing.

- Integration cost savings consist of general and administrative cost reductions, optimization of field, asset and operational overhead and corporate savings.

- Immediately Accretive to All Shareholders and Strong Discretionary Free Cash Flow

- Transaction expected to be immediately accretive to cash flow from operations and discretionary free cash flow per share.

- Strong discretionary free cash flow profile of the pro forma entity and integration cost savings realization are anticipated to be directed to maximizing shareholder returns through debt repayment, followed by return of shareholder capital and investment in strategic, high-return growth projects.

- The combined company expects to maintain SECURE's quarterly dividend of 0.75 cents ($0.0075) per share, subject to the approval of the combined company's Board of Directors.

- Strong Balance Sheet and Financial Position

- Pro forma as of December 31, 2020, the combined company will be well capitalized with a pro forma net debt to 2020 Adjusted EBITDA ratio of 3.1x, inclusive of $75 million of annual integration cost savings.

- In conjunction with the Transaction, SECURE has entered into a binding agreement with ATB Financial (as administrative agent), National Bank of Canada, Toronto-Dominion Bank, Canadian Imperial Bank of Commerce, and Bank of Montreal, collectively acting as co-lead arrangers and joint bookrunners, to provide the combined company with committed financing by way of a $725 million three-year credit facility available at closing of the Transaction (the "Credit Facility"). The Credit Facility will be utilized to replace and repay SECURE's existing first and second lien credit facilities and Tervita's first lien credit facilities. Tervita's second lien notes will remain outstanding and enable capital structure optimization while maintaining adequate liquidity.

- The combined company is well positioned with the right assets and the right people in place to respond to and capitalize upon increasing industry activity with minimal additional investment.

- Enhanced ESG Leadership

- Commitments to ESG leadership will remain core to the combined company. Leading safety practices, strong governance, minimizing environmental impacts, and making positive contributions in the communities where we live and work will drive the combined company's ESG initiatives.

- The combined company will continue to pursue the long-term climate targets established by SECURE of reducing carbon intensity in half by 2030 and achieving net zero emissions by 2050.

- The combined company's talented employees will drive sustainability priorities and performance.

Select Pro Forma Financial Information(1)

Common Shares Outstanding(2) | 307 million |

Market Capitalization(3) | $1.0 billion |

Net Debt | $1.3 billion |

Enterprise Value(2)(3) | $2.3 billion |

2020 Adjusted EBITDA (Including Integration Cost Savings) | $419 million |

Total Assets | $2.9 billion |

Total PP&E | $2.0 billion |

(1) | All figures are approximate and as at December 31, 2020 unless otherwise noted. |

(2) | Based on outstanding shares as at March 8, 2021 and the exchange ratio pursuant to the Transaction. |

(3) | Based on SECURE's closing share price on the TSX as at March 8, 2021. |

- Increased size and scale of the pro forma entity is expected to improve access to capital markets and asset coverage.

- Expect to achieve target of less than 2.5x debt to EBITDA ratio within two years of closing, supported by integration cost savings and a strong discretionary free cash flow profile.

- Both companies prioritizing debt repayment in 2021 before the Transaction is expected to close.

Governance and Leadership

The combined company will be led by a proven management team that reflects the strengths and capabilities of both organizations. Rene Amirault will serve as Chief Executive Officer, John Cooper will support the transition as Chief Integration Officer, Chad Magus will serve as Chief Financial Officer, and Allen Gransch as Chief Operating Officer of Midstream. Additional senior leaders will be selected from the teams at both organizations and will be determined before the close of the Transaction.

The Board of Directors will consist of eight members, with equal representation from the existing SECURE and Tervita Board of Directors. Grant Billing, current Chairman of Tervita, will be Chairman of the combined company. Rene Amirault will also serve on the Board of Directors of the combined company.

Transaction Terms

Under the terms of the Arrangement Agreement, the Transaction will be structured through a plan of arrangement of Tervita under the Business Corporations Act (Alberta).

The Transaction will require approval by at least 66⅔ percent of holders of the Tervita Shares represented in person or by proxy at a special meeting of Tervita shareholders to be called to consider the Transaction (the "Tervita Meeting").

The issuance of the SECURE Shares pursuant to the Transaction will require approval by a simple majority of SECURE Shares represented in person or by proxy at a special meeting of SECURE shareholders to be called to consider the issuance of SECURE Shares pursuant to the Transaction (the "SECURE Meeting"), pursuant to the requirements of the TSX.

In addition, the Transaction is subject to approval by the TSX and the Alberta Court of Queen's Bench, requisite approvals under the Competition Act (Canada) being obtained and other customary closing conditions being met, as well as the entering into of the Credit Facility by SECURE and its syndicate of lenders. The effectiveness of the Credit Facility will itself be subject to certain financial covenants, liquidity criteria and customary conditions being met, as well as Tervita obtaining from the holders of its outstanding US$500 million aggregate principal amount of senior second lien secured notes due 2025 (the "Tervita Notes") certain consents and approvals such as the waiver of the change of control offer required to be made for the Tervita Notes in connection with the change of control of Tervita resulting from the Transaction, together with certain other amendments to the indenture governing the Tervita Notes (the "Tervita Noteholder Consent").

The Arrangement Agreement includes customary provisions relating to non-solicitation and a fiduciary-out in the event a financially superior offer is received by either party, subject to the other party's right to match such superior offer. The Arrangement Agreement also provides for mutual non-completion fees in the event that the Transaction is not completed or is terminated by either party in certain circumstances.

Further details regarding the Transaction will be contained in a joint management information circular (the "Information Circular") to be sent to SECURE and Tervita shareholders in connection with the SECURE Meeting and the Tervita Meeting. The Information Circular is expected to be mailed to shareholders within the next six to eight weeks with the meetings of the respective shareholders to be held thereafter.

All SECURE and Tervita shareholders are urged to read the Information Circular once available as it will contain additional important information concerning the Transaction.

Support for the Transaction

The Board of Directors of each of SECURE and Tervita have unanimously approved the Arrangement Agreement and support the Transaction.

All of the directors and officers of SECURE, collectively holding approximately 5% of the SECURE Shares, have entered into support agreements with SECURE pursuant to which they have agreed to vote their respective SECURE Shares in favour of the Transaction at the SECURE Meeting.

All of the directors and officers of Tervita, as well as Solus Alternative Asset Management LP ("Solus"), collectively holding approximately 43% of the total Tervita Shares, have entered into support agreements with Tervita pursuant to which they have agreed to, among other things, vote their respective Tervita Shares in favour of the Transaction at the Tervita Meeting. In addition, Solus has agreed to, with respect to the portion of Tervita Notes held by it, consent to or vote in favour of the Tervita Noteholder Consent.

In addition to the support agreement, SECURE and Solus have entered into a standstill agreement, pursuant to which Solus will be subject to certain voting requirements, as well as certain standstill restrictions, each taking effect at closing of the Transaction. Solus will also be subject to certain transfer restrictions for a nine-month period following closing of the Transaction, provided that Solus may sell up to 50%, 75% and 100% of its holdings of the combined company shares on the three-, six- and nine- month anniversary of closing of the Transaction, respectively. Solus is also permitted to sell up to 100% of its holdings of the combined company shares in one or more privately negotiated transactions during the nine-month period, provided that no third party would hold 10% or more of the combined company shares as a result of such sale.

In addition, all shareholders holding 10% or more of the combined company shares at closing of the Transaction, including Solus, will be provided with customary pre-emptive and registration rights upon request.

Advisors

Peters & Co. Limited and BMO Capital Markets are acting as financial advisors to SECURE. Each of Peters & Co. Limited and BMO Capital Markets has provided a verbal opinion to SECURE's Board of Directors to the effect that the exchange ratio under the arrangement is fair, from a financial point of view, to SECURE and is subject to the assumptions made as well as the limitations and qualifications, which will be included in the written opinion of each of Peters & Co. Limited and BMO Capital Markets.

Bennett Jones LLP and Blake, Cassels & Graydon LLP (Competition) are acting as SECURE's legal advisors.

CIBC Capital Markets and TD Securities Inc. are acting as financial advisors to Tervita. TD Securities Inc. has provided a verbal opinion to Tervita's Board of Directors that the exchange ratio under the arrangement is fair, from a financial point of view, to the Tervita shareholders and is subject to the assumptions made, as well as the limitations and qualifications, which will be included in the written opinion of TD Securities Inc.

Norton Rose Fulbright Canada LLP is acting as Tervita's legal advisors.

Conference Call

SECURE and Tervita will host a conference call today, March 9, 2021, starting at 6:30 am MT (8:30 am ET). To participate please dial:

- Toll Free North America: 1-888-664-6383

- Toronto (local): 416-764-8650

- Calgary (local): 587-880-2171

- Confirmation #: 87670039

About SECURE

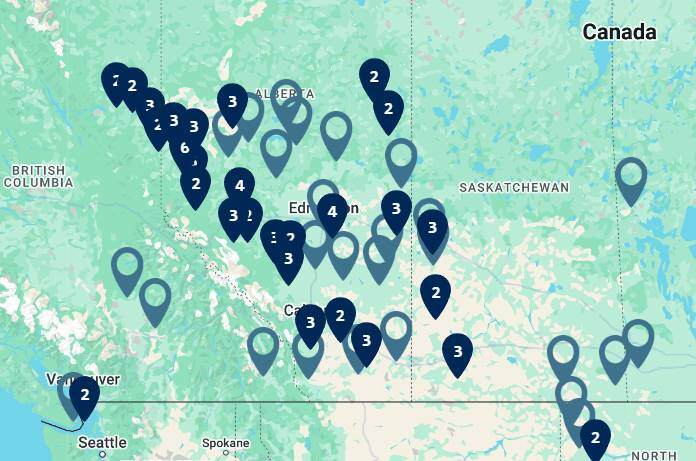

SECURE is a publicly traded energy business listed on the TSX providing industry leading customer solutions to upstream oil and natural gas companies operating in western Canada and certain regions in the United States through its network of midstream processing and storage facilities, crude oil and water pipelines, and crude by rail terminals located throughout key resource plays in western Canada, North Dakota and Oklahoma. SECURE's core midstream infrastructure operations generate cash flows from oil production processing and disposal, produced water disposal, and crude oil storage, logistics, and marketing. SECURE also provides comprehensive environmental and fluid management for landfill disposal, onsite abandonment, remediation and reclamation, drilling, completion and production operations for oil and gas producers in western Canada. SECURE trades on the TSX as SES. For more information, visit www.secure-energy.com.

About Tervita

Tervita is an environmentally-focused waste service provider in Canada, providing a broad and integrated array of services and environmental management solutions for customers in the energy, industrial, and natural resource sectors, predominantly in Western Canada. For over 40 years, Tervita has been focused on delivering safe and efficient solutions through all phases of a project while minimizing impact, maximizing returns™. Tervita's dedicated and experienced employees are trusted sustainability partners to our clients. Safety is our top priority: it influences our actions and shapes our culture. Tervita trades on the TSX as TEV. For more information, visit www.tervita.com.

Advisories

Basis of Presentation

All financial figures and information have been prepared in Canadian dollars (which includes references to "$"), except where another currency has been indicated, and in accordance with International Financial Reporting Standards ("IFRS") as issued by the International Accounting Standards Board.

Non-GAAP Measures and Operational Definitions

Certain financial measures in this news release do not have a standardized meaning as prescribed by generally accepted accounting principles in Canada, which includes International Financial Reporting Standards. These supplementary measures include discretionary free cash flow and discretionary free cash flow per share, Adjusted EBITDA, and net debt. These non-GAAP measures may not be comparable to similar measures presented by other issuers. These measures have been described and presented in order to provide shareholders, potential investors and analysts with additional measures for analyzing the Transaction. This additional information should not be considered in isolation or as a substitute for measures prepared in accordance with IFRS.

Discretionary free cash flow is a non-GAAP measure defined as cash flows from operating activities, adjusted for changes in non–cash working capital, sustaining capital expenditures, and lease payments. Additional items that are unusual, non–recurring, or non–operating in nature may be deducted or included in this calculation. Management of SECURE and Tervita believe discretionary free cash flow is a useful supplemental measure to assess the level of cash flow generated from ongoing operations and the adequacy of internally generated cash flow to manage debt levels, invest in the growth and expansion of the business, or return capital to shareholders.

Adjusted EBITDA is a non-GAAP measure defined as net earnings or loss before finance costs, taxes, depreciation, depletion, amortization, non–cash impairments or impairment reversals on non–current assets, unrealized gains or losses on mark to market commodity transactions, equity-settled share–based compensation, other income/expenses, and certain items that are considered non-recurring in nature, including restructuring costs and transaction costs. Management of SECURE and Tervita believe that Adjusted EBITDA is a useful supplemental measure to evaluate the results of the combined company's principal business activities prior to consideration of how those activities are financed and the impacts of foreign exchange, taxation, depreciation, depletion and amortization, and other non-cash charges that add volatility to financial results (such as impairment expenses, share-based compensation, and other transactions that are non-recurring in nature).

Net-debt is a non-GAAP measure defined as funds drawn on first and second lien credit facilities, the principal amount of the Tervita Notes (in the case of Tervita), derivative liabilities associated with the Tervita Notes (in the case of Tervita), lease liabilities, including onerous lease contracts, net of cash and cash equivalents. Net debt is a commonly used non-GAAP measures to assess overall indebtedness and capital structure.

Forward-Looking Statements

This news release contains "forward-looking statements" and/or "forward-looking information" within the meaning of applicable securities laws (collectively referred to as "forward-looking statements"). When used in this document, the words "achieve", "advance", "anticipate", "commit", "deliver", "drive", "enhance", "execute", "expect", "focus", "integrate", "opportunity", "optimize", "plan", "position", "priority", "realize", "reach", "result", "strategy", "target" and "will", and similar expressions, as they relate to SECURE, Tervita or the combined company, or their respective management, are intended to identify forward-looking statements. Forward-looking statements included or implied herein may include: expectations with respect to the business, financial prospects and future opportunities for the combined company, including its ability to increase profitability and market relevance; the combined company's access to capital markets and the resulting effect on its future growth and acquisition plans; the complementary nature of the combined company's asset base and environmental service lines, and the ability to enhance scale, increase utilization, efficiencies and geographic coverage, and consolidate SECURE's and Tervita's customer bases as a result thereof; the combined company's expected discretionary free cash flow and discretionary free cash flow per share; expected returns for the combined company's investors; increased trading liquidity of the combined company's shares and publicly traded debt; the combined company's access to capital; expected market capitalization, enterprise value and annual Adjusted EBITDA of the combined company; expected annual integration cost savings of the combined company, including from operational efficiencies, optimization of overhead and corporate savings, and the timing thereof; debt repayment and return of capital plans, and expectations that they will be funded from internally generated cash flows; the ability to achieve the combined company' target debt to EBITDA ratio of less than 2.5x; future capital investment plans and the expected returns therefrom; pro forma financial and operational information; the capitalization of the combined company; the expected terms of the Credit Facility, conditions thereto and the use of proceeds therefrom; the positioning of the combined company and its ability to respond to increased industry activity; long-term environmental objectives, including a 50% reduction in carbon intensity by 2030 and reaching net zero emissions by 2050; the pro forma equity ownership of the combined company; SECURE's ability to issue securities pursuant to the Transaction; the combined company's dividend plans following closing of the Transaction; the composition of the combined company's Board of Directors and management following closing of the Transaction; anticipated closing conditions and regulatory approvals required pursuant to the Transaction; future ESG goals; the combined company's capital structure, including expected financial ratios; the diversity and credit worthiness of the combined company's expected customer base; the meetings of each of SECURE's and Tervita's shareholders, the Information Circular sent in connection therewith and the expected mailing date thereof; and the timing and completion of the Transaction, including the expected closing date of the Transaction.

Forward-looking statements are based upon, among other things, factors, expectations and assumptions that SECURE and Tervita have made as at the date of this news release regarding, among other things: the satisfaction of the conditions to closing of the Transaction in a timely manner, including the entering into of the Credit Facility and the receipt of all necessary approvals under the Competition Act (Canada) on terms acceptable to SECURE and Tervita; the satisfaction of the conditions to entering into the Credit Facility, including the receipt of all required consents from holders of Tervita's outstanding notes on terms acceptable to SECURE and Tervita; the combined company's ability to successfully integrate the businesses of SECURE and Tervita; sources of funding that each of SECURE and Tervita have relied upon in the past continue to be available to the combined company on terms favorable to the combined company; future acquisition and sustaining costs will not significantly increase from past acquisition and sustaining costs and the combined company will have access to sufficient capital to pursue future development plans; the impact of COVID-19 and government responses related thereto; the impact of lower global energy pricing on oil and gas industry exploration and development activity levels and production volumes (including as a result of demand and supply shifts caused by COVID-19 and the actions of OPEC and non-OPEC countries); that counterparties comply with contracts in a timely manner; that prevailing regulatory, tax and environmental laws and regulations apply; increases to the combined company's share price and market capitalization over the long term; the ability of the combined company to repay debt and return capital to shareholders; the combined company's ability to obtain and retain qualified staff and equipment in a timely and cost-efficient manner; and other risks and uncertainties described from time to time in filings made by SECURE and Tervita with securities regulatory authorities. Each of SECURE and Tervita believe that the factors, expectations and assumptions reflected in the forward-looking statements are reasonable; however, no assurances can be given that these factors, expectations and assumptions will prove to be correct.

Forward-looking statements involve significant known and unknown risks and uncertainties, should not be read as guarantees of future performance or results, and will not necessarily be accurate indications of whether such results will be achieved. Readers are cautioned not to place undue reliance on these statements as a number of factors could cause actual results to differ materially from the results discussed in these forward-looking statements, including but not limited to: the completion and the timing of the Transaction; the ability of SECURE and Tervita to receive, in a timely manner, the necessary regulatory, court, shareholder, noteholder, lender, stock exchange and other third-party approvals and to satisfy the other conditions to the closing of the Transaction; the ability to satisfy the conditions to the Credit Facility becoming effective; interloper risk; the ability to complete the Transaction on the terms contemplated by SECURE and Tervita or at all; the ability of the combined company to realize the anticipated benefits of, and synergies and savings from, the Transaction and the timing thereof; consequences of not completing the Transaction, including the volatility of the share prices of SECURE and Tervita, negative reactions from the investment community and the required payment of certain costs related to the Transaction; actions taken by government entities or others seeking to prevent or alter the terms of the Transaction; potential undisclosed liabilities unidentified during the due diligence process; the accuracy of the pro forma financial information of the combined company; the interpretation of the Transaction by tax authorities; the success of business integration; the focus of management's time and attention on the Transaction and other disruptions arising from the Transaction; the ability to maintain desirable financial ratios; the ability to access various sources of debt and equity capital, generally, and on acceptable terms; the ability to utilize tax losses in the future; the ability to maintain relationships with partners and to successfully manage and operate integrated businesses; risks associated with technology and equipment, including potential cyberattacks; the occurrence of unexpected events such as pandemics, war, terrorist threats and the instability resulting therefrom; risks associated with existing and potential future lawsuits, shareholder proposals and regulatory actions; and those factors referred to under the heading "Risk Factors" in each of SECURE's and Tervita's annual information form for the year ended December 31, 2020 located on SEDAR. In addition, the effects and impacts of the COVID-19 outbreak, the rapid decline in global energy prices and the length of time to significantly reduce the global threat of COVID-19 on SECURE's, Tervita's and the combined company's respective businesses, the global economy and markets are unknown and cannot be reasonably be estimated at this time and could cause SECURE's, Tervita's or the combined company's actual results to differ materially from the forward-looking statements contained in this news release.

Although forward-looking statements contained in this news release are based upon what each of SECURE and Tervita believe are reasonable assumptions, SECURE and Tervita cannot assure investors that actual results will be consistent with these forward-looking statements. The forward-looking statements in this news release are expressly qualified by this cautionary statement. Unless otherwise required by law, SECURE and Tervita do not intend, or assume any obligation, to update these forward-looking statements.

SOURCE SECURE Energy Services Inc.