News Releases

Stay in the know

CALGARY, April 27, 2020 /CNW/ - Secure Energy Services Inc. ("SECURE" or the "Corporation") (TSX – SES) announced today the retirement of Murray Cobbe and David Johnson from the Corporation's Board of Directors, reported its operational and financial results for the three months ended March 31, 2020, and provided an outlook for the remainder of 2020.

RETIREMENT OF LONG-TIME DIRECTORS

Messrs. Murray Cobbe and David Johnson, two of SECURE's longest serving directors, are not standing for re-election at the Corporation's Annual Meeting of Shareholders to be held on April 28, 2020, which will mark the end of their term on the Corporation's Board of Directors (the "Board"). The addition of Rick Wise and Deanna Zumwalt to the Board last year allowed for the orderly retirement of these long-time directors as Mr. Wise and Ms. Zumwalt gained familiarity and experience with the affairs of the Corporation.

"Both Murray and David are accomplished business leaders who have brought an immeasurable wealth of industry experience and insight to SECURE's Board," said Rene Amirault, Chairman, President and CEO. "Their leadership and guidance over the past 14 years have been instrumental in growing and defining SECURE into the company it is today. On behalf of the Board and management, we would like to thank Murray and David for their valuable contributions as directors. We wish them both all the best in their retirement."

FIRST QUARTER SUMMARY

The following should be read in conjunction with the Corporation's management's discussion and analysis ("MD&A") and the audited consolidated financial statements and notes thereto which are available on SEDAR at www.sedar.com.

Global oil prices declined radically in the latter part of the first quarter of 2020 as a result of reduced demand driven by the novel coronavirus ("COVID-19") health pandemic, including government responses thereto, and over supply concerns stemming from failed negotiations between OPEC+ countries on production curtailments. As a result of the weak macro-economic environment, the prudent response from SECURE's customers has been to employ increased financial and capital discipline, resulting in reduced activity levels during March 2020 and a significant reduction to planned capital spending during the remainder of 2020.

Financial results

During the three months ended March 31, 2020, the Corporation recorded Adjusted EBITDAi of $42.1 million, down 24% from the prior year comparative period. Higher year over year drilling and completion activity levels during January and February contributed to higher facility volumes and increased revenues from fluid management. However, this was more than offset by activity slowdowns in March as a result of the market conditions described above, and reduced year over year Adjusted EBITDA from marketing activities and crude-by-rail transactions.

The Corporation recognized a net loss of $22.4 million during the three months ended March 31, 2020, compared to income of $1.3 million during the prior year comparative period. In addition to lower Adjusted EBITDA, the Corporation incurred a non-cash impairment charge on intangible assets and one-time costs related to restructuring efforts, as described below, for a total of $25.1 million.

Cost reduction initiatives

At the end of March 2020, SECURE undertook prudent measures to reduce our cost structure in response to further anticipated activity declines. These measures included reducing personnel costs by approximately 25%, to levels consistent with anticipated activity levels. Measures taken to reduce personnel costs included layoffs, salary reductions, modified work schedules and job sharing. SECURE recorded $9.4 million of severance and related costs as a result of these measures and other restructuring plans underway during the three months ended March 31, 2020.

Solid financial position

Maintaining a strong balance sheet has always been a priority of SECURE as this allows the Corporation to effectively manage the business through periods of lower commodity pricing and industry activity. At March 31, 2020, the Corporation has $272.7 million of available capacity on our First Lien Credit Facility, subject to covenant restrictions. The following table outlines SECURE's Senior and Total Debt to trailing twelve-month EBITDA ratiosii at March 31, 2020, compared to the covenant thresholds outlined in our credit facility agreements. SECURE remains well within compliance of all covenants related to its credit facilities.

Mar 31, 2020 | Threshold | |

Senior Debt to EBITDA | 2.1 | 3.5 |

Total Debt to EBITDA | 2.9 | 5.0 |

In addition, SECURE has a $75 million letter of credit facility with $45.8 million available for use under this facility as of March 31, 2020.

Low counterparty risk

The Corporation extends credit to customers, primarily comprised of oil and gas exploration and production companies, in the normal course of operations. SECURE has a robust credit review process and has successfully prevented any material credit losses during previous market downturns. Historically, bad debt expenses have been limited to specific customer circumstances. However, the sudden and severe decline in oil prices may result in higher collection risk on trade receivables. As a result, the Corporation has increased our expected credit loss provision at March 31, 2020, to $3.3 million, an increase of $1.9 million from December 31, 2019. The resulting loss allowance for expected credit losses has been included with general and administrative ("G&A") expenses during the three months ended March 31, 2020.

Contracted midstream growth

During the first quarter of 2020, SECURE progressed construction of the East Kaybob Oil Pipeline, a 120-kilometre pipeline system gathering light oil and condensate from multiple producers and terminating at the Corporation's Fox Creek midstream processing facility. The project provides SECURE with long-term fee-for-service revenues from pipeline tariffs, and reliable volumes at the Fox Creek facility. The pipeline is expected to be operational by the start of the third quarter.

Resilient business

SECURE's midstream infrastructure growth over the past several years, including strategic investments in oil feeder pipelines, pipeline-connected produced water disposal facilities, and crude oil storage, have helped transform the nature and reliability of the Corporation's cash flows by significantly increasing the Corporation's exposure to production-based revenues supported by long-term contracts. The Corporation expects a certain degree of cash flow stability from our midstream infrastructure that is expected to partially offset the impact of reduced industry activity on drilling and completion volumes and demand for associated services throughout the remainder of the year. Please refer to 'Outlook' section of this press release.

Moving to a quarterly dividend

After the June monthly dividend expected to be paid on or about June 15, 2020, the Corporation will be moving to a quarterly dividend, with the first planned payment of 0.75 cents per share to occur on or about October 15, 2020, to shareholders of record on October 1, 2020.

REPORTING CHANGES

During the three months ended March 31, 2020, the Corporation realigned its reporting structure to reflect changes in the aggregation of operating segments based on the economic prospects of these operating segments. The results of the Corporation are now being reported in the following two reportable segments:

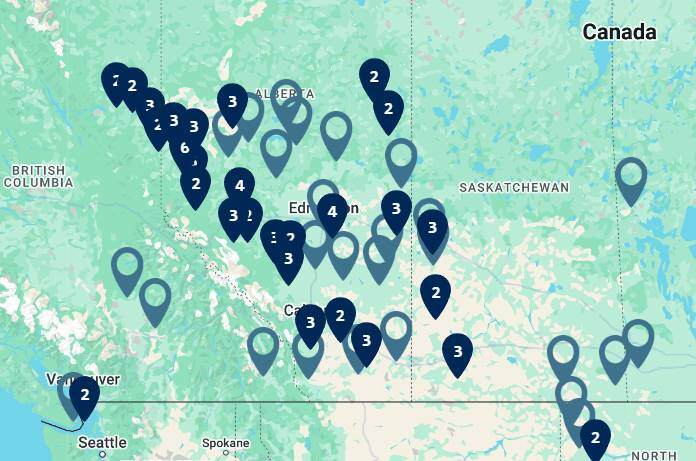

- Midstream Infrastructure includes a network of midstream infrastructure assets that includes oil and water pipelines, midstream processing facilities, oil storage terminals, and crude by rail terminals throughout western Canada, North Dakota and Oklahoma. The Midstream Infrastructure segment services include clean oil terminalling and storage, rail transloading, pipeline transportation, crude oil marketing, custom treating of crude oil, produced and waste water disposal, oilfield waste processing, and oil purchase/resale service. The only change to this segment from prior periods is the removal of landfills.

- Environmental and Fluid Management includes a network of landfill disposal facilities; onsite abandonment, remediation and reclamation management; a suite of comprehensive environmental management solutions provided by the Corporation to a diversified customer base; and drilling, completion and production fluid operations management for oil and gas producers in western Canada. Services offered include secure disposal of oilfield and industrial solid wastes into SECURE's owned or managed landfill network located in western Canada and North Dakota; project assessment and planning; demolition and decommissioning; and reclamation and remediation.

The new reporting structure provides a more direct connection between the Corporation's operations, the services it provides to customers and the ongoing strategic direction of the Corporation. Comparative information has been recast to conform to the current segmented reporting information. No changes were implemented with respect to the consolidated data as a result of the recast.

QUARTERLY HIGHLIGHTS

The following table summarizes the operating and financial highlights for the three months ending March 31, 2020 and 2019:

Three months ended March 31, | ||||

($000's except share and per share data) | 2020 | 2019 | % change | |

Revenue (excludes oil purchase and resale) | 177,541 | 177,379 | - | |

Oil purchase and resale | 433,555 | 611,503 | (29) | |

Total revenue | 611,096 | 788,882 | (23) | |

Adjusted EBITDA (1) | 42,094 | 55,139 | (24) | |

Per share ($), basic | 0.27 | 0.34 | (21) | |

Net (loss) income attributable to shareholders of Secure | (21,952) | 1,259 | (1,844) | |

Per share ($), basic and diluted | (0.14) | 0.01 | (1,500) | |

Cash flows from operating activities | 45,850 | 57,302 | (20) | |

Per share ($), basic | 0.29 | 0.36 | (19) | |

Dividends per common share | 0.0675 | 0.0675 | - | |

Capital expenditures (1) | 41,360 | 23,619 | 75 | |

Total assets | 1,574,420 | 1,648,660 | (5) | |

Long-term liabilities | 609,122 | 582,313 | 5 | |

Common shares - end of period | 158,444,194 | 161,437,474 | (2) | |

Weighted average common shares | ||||

Basic | 158,513,800 | 160,440,879 | (1) | |

Diluted | 158,513,800 | 163,456,268 | (3) | |

(1)Refer to "Non-GAAP Measures and Operational Definitions" for further information | ||||

- REVENUE OF $611.1 MILLION FOR THE THREE MONTHS ENDED MARCH 31, 2020

- Midstream Infrastructure segment revenue (excluding oil purchase and resale) during the three months ended March 31, 2020, decreased by 6% over the comparative period of 2019 to $80.1 million. The decrease is attributable to reduced crude oil marketing and rail activity as certain opportunities in the first quarter of 2019 resulting from volatile price differentials did not re-occur during the three months ended March 31, 2020. Partially offsetting this decrease is an unrealized gain resulting from crude oil futures and options contracts held at March 31, 2020, to help manage certain exposures to fluctuations in commodity prices. Facility revenues were relatively flat year over year as contributions from infrastructure additions in 2019 and higher drilling and completion activity at the beginning of the year were partially offset by the drop off in activity levels in March 2020;

- Oil purchase and resale revenue during the three months ended March 31, 2020, decreased 29% over the 2019 comparative period to $433.6 million as a result of reduced marketing activity and a 22% decrease in Canadian light oil benchmark pricing;

- Environmental and Fluid Management segment revenue during the three months ended March 31, 2020, increased 5% over the 2019 comparative period to $97.5 million due to higher drilling and completion activity in the Western Canadian Sedimentary Basin ("WCSB"), positively impacting revenue generated from service lines supporting these activities, including drilling and completion fluid services, solids control equipment rentals, drilling waste management, water management, and industrial landfill disposal.

- ADJUSTED EBITDA OF $42.1 MILLION FOR THE THREE MONTHS ENDED MARCH 31, 2020

- Adjusted EBITDA of $42.1 million decreased 24% from the three months ended March 31, 2019, or 21% on a per share basis. Higher year over year drilling and completion activity levels during January and February contributed to higher facility volumes and increased revenues from fluid management. However, this was more than offset by activity slowdowns in March, and reduced year over year Adjusted EBITDA from marketing activities and crude-by-rail transactions. Extraordinary price volatility and large differentials during the first quarter of 2019 created considerable crude oil marketing and rail opportunities that did not re-occur in the current year period. Additionally, the Corporation recorded a $1.9 million loss allowance for expected credit losses during the three months ended March 31, 2020, in light of the current macroeconomic environment.

- NET LOSS ATTRIBUTABLE TO SHAREHOLDERS OF SECURE OF $22.0 MILLION FOR THE THREE MONTHS ENDED MARCH 31, 2020

- For the three months ended March 31, 2020, there was a net loss attributable to shareholders of SECURE of $22.0 million, compared to income of $1.3 million in the three months ended March 31, 2019. The variance is primarily due to $25.1 million of impairment and restructuring charges recorded in the current year period, and higher depreciation, depletion and amortization expense.

- Impairment of non-current assets: In accordance with the accounting standards, the Corporation assesses at each reporting date whether there is an indication that an asset or cash generated unit ("CGUs") may be impaired. With the rapid and significant decline in oil prices and planned producer spending, indicators of impairment were present for SECURE's CGUs with cash flows tied primarily to drilling and completion activities. The value in use of the Technical Solutions CGU, determined using a five-year cash flow estimate discounted to March 31, 2020, exceeded the carrying amount of the CGU. Consequently, a $15.7 million impairment charge was recorded against intangible assets in order to write the CGU down to its recoverable amount;

- Restructuring costs: SECURE recorded an expense of $9.4 million during the three months ended March 31, 2020, related primarily to employee termination benefits expected to result from restructuring plans undertaken by the Corporation in the period, including right sizing the Corporation's workforce to anticipated activity levels and streamlining business processes resulting in the suspension or termination of certain functions;

- Depreciation, depletion and amortization ("DD&A"): DD&A increased $7.8 million as a result of new midstream infrastructure put into use in 2019 and the write-down of certain projects in development that may be delayed or suspended as a result of the current operating environment.

- These negative variances were partially offset by lower income tax expense resulting primarily from lower pre-tax earnings.

- CASH FLOWS FROM OPERATING ACTIVITIES OF $45.9 MILLION FOR THE THREE MONTHS ENDED MARCH 31, 2020

- The Corporation generated cash flows from operating activities of $45.9 million during the three months ended March 31, 2020, a decrease of $11.5 million from the prior year comparative period. The impact of lower Adjusted EBITDA was partially offset by changes in non-cash working capital during the period. SECURE carried total net working capital at March 31, 2020, of $96.6 million, down from $125.3 million at December 31, 2019.

- CAPITAL EXPENDITURES OF $41.4 MILLION FOR THE THREE MONTHS ENDED MARCH 31, 2020

- SECURE incurred $38.0 million of organic growth and expansion capital during the three months ended March 31, 2020, largely related to the East Kaybob Oil Pipeline System, as well as certain carryover costs related to expansion and optimization projects at existing facilities in the prior year. The Corporation also incurred sustaining capital of $3.4 million during the period relating primarily to well and facility maintenance. SECURE is committed to maintaining capital discipline as we navigate this downturn.

MIDSTREAM INFRASTRUCTURE SEGMENT HIGHLIGHTS

Three months ended Mar 31, | |||

($000's) | 2020 | 2019 | % Change |

Midstream Infrastructure services revenue | 80,091 | 84,818 | (6) |

Oil purchase and resale | 433,555 | 611,503 | (29) |

Midstream Infrastructure Revenue | 513,646 | 696,321 | (26) |

Cost of Sales | |||

Cost of sales excluding items noted below | 36,384 | 34,752 | 5 |

Depreciation and amortization | 23,502 | 17,281 | 36 |

Oil purchase and resale | 433,555 | 611,503 | (29) |

Midstream Infrastructure Cost of Sales | 493,441 | 663,536 | (26) |

Segment Profit Margin (1) | 43,707 | 50,066 | (13) |

Segment Profit Margin (1) as a % of revenue (a) | 55% | 59% | |

(1)Calculated as revenue less cost of sales excluding depreciation and amortization. Refer to "Non-GAAP Measures and Operational Definitions" for further information | |||

- Revenue generated from Midstream Infrastructure services decreased 6% for the three months ended March 31, 2020, from the respective 2019 comparative period. The decrease was due primarily to lower marketing and rail revenues in the current year period as certain opportunities presented in the first quarter of 2019 did not re-occur. Significant and volatile commodity price differentials at the beginning of 2019 created increased opportunities for price optimization at the Corporation's pipeline connected FSTs and supported economics for transporting crude by rail, resulting in higher revenues generated from the Corporation's crude oil marketing business and rail terminals during the prior year comparative period;

- Infrastructure additions during 2019, including produced water pipelines added at Gold Creek and Tony Creek, crude oil storage at Kerrobert and Cushing, and the Pipestone facility, along with various expansions at existing facilities, positively contributed to revenues during the three months ended March 31, 2020, partially offsetting the decrease discussed above. Additionally, increased production, drilling and completion activity in January and February of 2020 resulted in higher processing and disposal volumes in the current year period. Partially offsetting the positive impact to facilities revenue was lower realized pricing on recovered oil volumes due to a 22% decrease in benchmark oil prices in Canada year over year;

- Disposal volumes increased 17% during the three months ended March 31, 2020, from the respective 2019 comparative period due primarily to increased produced water disposal volumes delivered through pipelines added to the Corporation's Gold Creek and Pipestone facilities in 2019, along with expansions to increase water disposal capacity at various other facilities since the start of 2019 through additional disposal wells and improved injection rates;

- Processing volumes, including emulsion treating, and various waste stream processing, increased 8% during the three months ended March 31, 2020, from the 2019 comparative period due primarily to higher drilling waste as a result of increased activity levels in the Corporation's operating areas;

- Oil volumes recovered through our processing operations increased 18% during the three months ended March 31, 2020, from the 2019 comparative period as a result of higher overall volumes received at the Corporation's facilities. The impact of higher volumes on recovered oil revenue was offset by lower benchmark oil pricing in the current year period;

- Crude oil terminalling and pipeline volumes increased 18% during the three months ended March 31, 2020, from the 2019 comparative period as a result of the Corporation's best quarter to date for the Kerrobert crude oil pipeline system. During the first quarter, there were 20 approved shippers on the pipeline, with nearly 600,000 cubic metres shipped during the period, up 43% from the prior year;

- Oil purchase and resale revenue in the Midstream Infrastructure segment decreased 29% to $433.6 million for the three months ended March 31, 2020, from the respective 2019 comparative period. The decrease in the three months ended March 31, 2020, relates to reduced marketing activities and lower commodity prices in the current period;

- The Midstream Infrastructure segment's segment profit margin decreased 13% to $43.7 million for the three months ended March 31, 2020, from the 2019 comparative period. As a percentage of Midstream Infrastructure services revenue, segment profit margin was 55% for the three months ended March 31, 2020, down from 59% in the 2019 comparative period. The decrease was primarily a result of reduced marketing and rail revenue described above and associated blending margins due to lower stream pricing and flat differentials;

- G&A expenses decreased by 4% to $6.7 million for the three months ended March 31, 2020, from the respective 2019 comparative period. The decrease is mainly due to lower personnel costs partially offset by an increased loss allowance on trade receivables;

- Earnings before tax decreased 61% to $9.9 million for the three months ended March 31, 2020, from the respective 2019 comparative period. The decrease is a result of lower segment profit margin and increased depreciation and amortization expense in the 2020 period, as described above, as well as restructuring costs of $3.4 million related to right sizing the Corporation's workforce to anticipated activity levels and streamlining business processes resulting in the suspension or termination of certain functions.

ENVIRONMENTAL AND FLUID MANAGEMENT SEGMENT

Three months ended Mar 31, | |||

($000's) | 2020 | 2019 | % Change |

Environmental and Fluid Management Revenue | 97,450 | 92,561 | 5 |

Cost of Sales | |||

Cost of sales excluding depreciation, depletion and amortization | 74,408 | 72,669 | 2 |

Depreciation, depletion and amortization | 12,089 | 11,294 | 7 |

Environmental and Fluid Management Cost of Sales | 86,497 | 83,963 | 3 |

Segment Profit Margin (1) | 23,042 | 19,892 | 16 |

Segment Profit Margin (1) as a % of revenue | 24% | 21% | |

(1) Calculated as revenue less cost of sales excluding depreciation, depletion and amortization. Refer to "Non-GAAP Measures and Operational Definitions" for further information | |||

- The Environmental and Fluid Management segment revenue increased 5% to $97.5 million for the three months ended March 31, 2020, from the 2019 comparative period. The impact of reduced decommissioning, site reclamation and abandonment jobs on the Environmental Solution group was more than offset by greater project work awarded in Fort McMurray as the Corporation gains a reputation as a preferred service provider in the Oil Sands region, and higher contributions from Fluids Management resulting from production chemicals work awarded at the end of 2019. Also, drilling activity improvements from the first two months of the year drove higher drilling fluid sales and water pumping jobs;

- Segment profit margin increased 16% for the three months ended March 31, 2020, to $23.0 million from the 2019 comparative period due to higher revenues, a favourable job mix, and reduced fixed costs. The current year period had a greater proportion of higher margin business, including completion related water pumping and fracing services, and projects work in the Fort McMurray region. Segment profit margin as a percentage of revenue was 24% for the three months ended March 31, 2020, compared to 21% for the 2019 comparative period;

- G&A expense increased 2% to $8.1 million for the three months ended March 31, 2020, from the 2019 comparative period. The increase is primarily due to higher allowance for expected credit losses resulting from macro-economic factors at March 31, 2020, partially offset by lower personnel related costs as the Corporation manages costs in the current operating environment;

- The Environmental and Fluid Management segment had a loss before tax of $17.7 million for the three months ended March 31, 2020, compared to earnings of $0.6 million during the comparative period of 2019. The loss is largely attributable to a non-cash impairment charge recorded against intangible assets for the three months ended March 31, 2020.

OUTLOOK

The public health containment measures in place to limit the spread of COVID-19 have significantly reduced global oil demand, pressuring oil prices to the lowest levels seen in over 20 years. On April 12, 2020, a historic agreement to cut global oil production by almost 10% was finalized, which is expected to help balance the market and partially offset ongoing pressure on oil prices caused by such measures employed to control the COVID-19 outbreak. This health pandemic is an unprecedented situation whose ultimate duration and magnitude are unknown currently, and as a result raises a significantly higher degree of uncertainty on crude oil demand for the remainder of 2020.

It is however encouraging to have a historic agreement around longer term supply reductions and the potential to have further discussions when the 'return to normal' allows for greater insight on the true go forward demand for crude oil. While the supply cuts are expected to help in the back half of this year, the near-term issues of over supply are anticipated to have a significant impact on the crude oil market, specifically:

- Drilling and completion activity in the second quarter has historically been lower in Canada due to road bans and the effects of spring break up. We expect minimal drilling and completion volumes in the second quarter of 2020 and the typical ramp up in drilling and completion activity to be significantly lower in the back half of the year;

- Production in the second quarter of 2020 will be impacted by the current price of crude oil, crude oil differentials as well as storage constraints in both Canada and in the US. Storage constraints may be the largest factor contributing to production shut-ins if crude oil does not have a downstream destination and it physically has nowhere to be stored. Excluding the impact of storage, production shut-ins are difficult to predict as the decision to continue to produce may be a result of contract obligations or agreements, take or pay obligations, concern of well or reservoir damage, costs to shut-in/start up, bank covenants or cash flow requirements. In addition, there are producers that have risk management hedges to protect the downside throughout 2020.

SECURE's business remains highly concentrated on production volumes or related services that represent approximately 75% of the Corporation's Adjusted EBITDA. A portion of these production volumes are contracted and/or fee-for-service contracts that are expected to provide a certain degree of cash flow stability. The factors noted above relating to production shut-ins may have a short-term impact on financial results for the second quarter, however the pricing environment and supply cuts should support fewer production shut-ins in the third and fourth quarters of 2020. The resulting reduction in revenues from production shut-ins are expected to be partially offset by opportunities to leverage SECURE's crude oil storage assets at both Kerrobert and Cushing. In addition, SECURE will complete and commission the East Kaybob Oil Pipeline in the third quarter which provides the Corporation with additional, long-term, fee-for-service revenues from pipeline tariffs, and reliable volumes at the Fox Creek facility.

On April 17, 2020, the Canadian Federal Government announced a $1.7 billion fund to accelerate orphan and inactive well abandonments as part of an effort to reduce the economic fallout on oil-producing provinces from COVID-19. SECURE expects increased abandonment and remediation activity to positively impact all Canadian business units, particularly within the Environmental Management group as a result of higher demand for onsite abandonment, remediation and reclamation management and decommissioning work. Solid and waste volumes resulting from these operations will also require disposal; SECURE owns and operates six industrial landfills in Alberta capable of handling waste of this nature.

SECURE has also taken prudent measures to reduce costs to best position the Corporation for long-term success, including:

- Reduced the 2020 capital program by $20 million, or 25%, from previously anticipated amounts to $60 million, including approximately $50 million of growth and expansion capital, and $10 million of sustaining capital;

- Establishing a minimal preliminary capital program of $15 million for 2021, comprised primarily of sustaining capital;

- Reduced the monthly dividend from 2.25 cents to 0.25 cents effective May 1, 2020;

- Assessed the Canadian Federal Government's wage subsidy program to reduce the impact of the downturn on our staffing levels. The Corporation intends to file an application once the system is in operation;

- Reduced personnel costs by approximately 25%, to levels consistent with anticipated activity levels. Measures taken to reduce personnel costs included layoffs, salary reductions, modified work schedules and job sharing;

- Restricted discretionary spending and suspended all non-essential travel;

- Restructured into two reporting segments and corporate that should allow for SECURE to gain cost efficiencies across all reporting segments; and

- Delayed timing for the completion of planned divestitures announced in late 2019 related to specific service lines that do not have recurring or production-related revenue streams in light of the current economic environment. SECURE will remain patient in executing any divestitures and is committed to obtaining a price for these service lines that is commensurate with their long-term value.

The outlook on oil prices and drilling and completion activity levels resulting from the COVID-19 pandemic is difficult to predict; however, SECURE has positioned the business to navigate this challenging time through 2020 and beyond. The majority of our midstream processing facilities are located in low cost light oil and gas related plays in western Canada, which supports ongoing production at lower benchmark pricing. This activity will support oil treating, production chemicals, water disposal and terminalling. Furthermore, SECURE's oil and water pipelines have committed volumes, which will provide a recurring revenue stream. In addition, SECURE's contracted operations in Fort McMurray also support recurring revenue.

SECURE will continue to protect the strength in the balance sheet and is well positioned to withstand the impact this commodity price cycle will have on our activity levels, and to respond when industry activity resumes. Our $600 million first lien revolving credit facility matures June 2023 and had $272.7 million of available capacity (subject to covenant restrictions) at March 31, 2020.

SECURE's key strategic priorities for 2020 include:

- Maintaining financial resilience, protecting a strong balance sheet by maximizing cash flows and monitoring credit exposure;

- Implementing restructuring plans and cost reductions to align the Corporation's cost structure with expected industry activity; and

- Continuing to work with our customers to deliver innovative midstream and environmental solutions that reduce their costs, lower emissions, and improve safety.

SECURE's greatest assets are our people and the relationships we have with our customers, investors and the communities in which we have a presence. The Corporation will continue to keep our stakeholders top of mind and supported as it navigates through these events.

FINANCIAL STATEMENTS AND MD&A

The Corporation's condensed consolidated financial statements and notes thereto for the three months ended March 31, 2020 and 2019 and MD&A for the three months ended March 31, 2020 and 2019 are available immediately on SECURE's website at www.secure-energy.com. The condensed consolidated financial statements and MD&A will be available tomorrow on SEDAR at www.sedar.com.

FORWARD-LOOKING STATEMENTS

Certain statements contained in this document constitute "forward-looking statements" and/or "forward-looking information" within the meaning of applicable securities laws (collectively referred to as "forward-looking statements"). When used in this document, the words "may", "would", "could", "will", "intend", "plan", "anticipate", "believe", "estimate", "expect", and similar expressions, as they relate to SECURE, or its management, are intended to identify forward-looking statements. Such statements reflect the current views of SECURE with respect to future events, global economic events arising from COVID-19 and the OPEC decisions and operating performance and speak only as of the date of this document.

In particular, this document contains or implies forward-looking statements pertaining but not limited to: management's expectations with respect to the impact of COVID-19, including government responses thereto on demand for oil and our operations generally; the outlook for oil prices; spending by producers and the impact of this on SECURE's activity levels; the impact OPEC+ supply cuts may have on crude oil pricing; the impact of over supply on the crude oil market; the oil and natural gas industry in Canada and the U.S., including drilling, completion and production activity levels for the remainder of 2020 and beyond, and the impact of this on SECURE's business, operations and financial results; the benefits of midstream infrastructure and production concentrated volumes on SECURE's cash flow and the expected stability of such sources of cash flow; opportunities for the Corporation's storage assets; the timing of completion for projects underway, in particular the East Kaybob Oil Pipeline, and the timing and stability of contributions from new projects; the impact the Canadian Federal Government's orphan and inactive well fund may have to the business, operations and results of the Corporation; timing associated with potential divestitures related to specific service lines that do not have recurring or production-related revenue streams and the outcome of such sales process; activity levels in the Corporation's operating areas; the benefits of contracted and/or fee for service contracts on SECURE's cash flow and the expected stability of such sources of cash flow; the Corporation's proposed 2020 and 2021 capital expenditure programs, including growth and expansion and sustaining capital expenditures; the Corporation's ability to execute our restructuring plans and align the Corporation's cost structure with expected industry activity levels; the expected impacts of the Corporation's cost and capital expenditure reductions; future dividend payments and expected cash savings resulting from the reduction of the Corporation's cash dividend payments; debt service; and the Corporation's ability to meet obligations and commitments and operate within any credit facility restrictions, including the financial covenants related to our debt facilities; expectations that our capital investment, share repurchases and cash dividends will be funded from internally generated cash flows; the Corporation's credit risk levels and it's ability to collect on trade receivables; expected benefits customers will receive from our midstream and environmental solutions; key factors driving the Corporation's success; demand for the Corporation's services and products; industry fundamentals driving the success of SECURE's core operations; future capital needs and how the Corporation intends to fund its operations, working capital requirements, dividends and capital program; and access to capital.

Forward-looking statements are based on certain assumptions that SECURE has made in respect thereof as at the date of this document regarding, among other things: the impact of COVID-19, including related government responses related thereto and lower global energy pricing on oil and gas industry exploration and development activity levels and production volumes (including as a result of demand and supply shifts caused by COVID-19 and the actions of OPEC and non-OPEC countries); the success of SECURE's operations and growth projects; the Corporation's competitive position remaining substantially unchanged; future acquisition and sustaining costs will not significantly increase from past acquisition and sustaining costs; that counterparties comply with contracts in a timely manner; that there are no unforeseen events preventing the performance of contracts or the completion of the relevant facilities; that there are no unforeseen material costs relation to the Corporation's facilities; and that prevailing regulatory, tax and environmental laws and regulations apply.

Forward-looking statements involve significant known and unknown risks and uncertainties, should not be read as guarantees of future performance or results, and will not necessarily be accurate indications of whether such results will be achieved. Readers are cautioned not to place undue reliance on these statements as a number of factors could cause actual results to differ materially from the results discussed in these forward-looking statements, including but not limited to those factors referred to under the heading "Risk Factors" in the Corporation's Annual Information Form for the year ended December 31, 2019. In addition, the effects and impacts of the COVID-19 outbreak, the rapid decline in global energy prices and the length of time to significantly reduce the global threat of COVID-19 on SECURE's business, the global economy and markets are unknown at this time and could cause SECURE's actual results to differ materially from the forward-looking statements contained in this document.

Although forward-looking statements contained in this document are based upon what the Corporation believes are reasonable assumptions, the Corporation cannot assure investors that actual results will be consistent with these forward- looking statements. The forward-looking statements in this document are expressly qualified by this cautionary statement. Unless otherwise required by law, SECURE does not intend, or assume any obligation, to update these forward-looking statements.

NON-GAAP MEASURES AND OPERATIONAL DEFINITIONS

The Corporation uses accounting principles that are generally accepted in Canada (the issuer's "GAAP"), which includes International Financial Reporting Standards ("IFRS"). Certain supplementary measures in this document do not have any standardized meaning as prescribed by IFRS. These measures are intended as a complement to results provided in accordance with IFRS. The Corporation believes these measures provide additional useful information to analysts, shareholders and other users to understand the Corporation's financial results, profitability, cost management, liquidity and ability to generate funds to finance its operations. However, they should not be used as an alternative to IFRS measures because they do not have a standardized meaning under IFRS and therefore may not be comparable to similar measures presented by other companies. See the MD&A available at www.sedar.com for further details, including reconciliations of the Non-GAAP measures and additional GAAP measures to the most directly comparable measures calculated in accordance with IFRS.

ABOUT SECURE

SECURE is a publicly traded energy business listed on the Toronto Stock Exchange ("TSX") providing industry leading customer solutions to upstream oil and natural gas companies operating in western Canada and certain regions in the United States ("U.S.") through its network of midstream processing and storage facilities, crude oil and water pipelines, and crude by rail terminals located throughout key resource plays in western Canada, North Dakota and Oklahoma. SECURE's core midstream infrastructure operations generate cash flows from oil production processing and disposal, produced water disposal, and crude oil storage, logistics, and marketing. SECURE also provides comprehensive environmental and fluid management for landfill disposal, onsite abandonment, remediation and reclamation, drilling, completion and production operations for oil and gas producers in western Canada.

____________________________ |

i Refer to the "Non-GAAP Measures and Operational Definitions" section herein |

ii As defined in the Corporation's lending agreements. Refer to the MD&A for details on the Corporation's covenant calculations |

SOURCE SECURE Energy Services Inc.