News Releases

Stay in the know

CALGARY, March 24, 2020 /CNW/ - SECURE Energy Services Inc. ("SECURE" or the "Corporation") (TSX – SES) announced today an operational and corporate update on the actions SECURE is taking in response to the COVID-19 pandemic and the rapid decline in global energy prices.

In response to the COVID-19 pandemic, SECURE's action plan is focused on protecting the health of its employees, families, communities and other stakeholders. Safety is the Corporation's first priority and it continues to take steps to protect the health of its staff and the public in response to the COVID-19 pandemic. In line with recommendations from government authorities, SECURE employees are working from home unless required by business-critical functions and field operations. In addition, SECURE has implemented multiple business and operational continuity plans to ensure uninterrupted service to our customers.

"I want to thank our dedicated employees who are doing their part to slow down the spread of the virus to protect our health care system and those most vulnerable within our communities, while continuing to fulfill their work-place responsibilities from home. Despite unprecedented circumstances, we are executing well and are confident that we can meet the expectations of all SECURE stakeholders," said Mr. Amirault, SECURE's Chairman, President and Chief Executive Officer.

Global energy prices have experienced a significant and rapid decline based on over supply concerns and the reduced demand resulting from COVID-19. The prudent response from SECURE's customers has been to significantly reduce capital spending in 2020. This decision will impact both drilling and completions activity in 2020 and will also have an impact on production volumes that are shut in due to uneconomic crude oil prices or production that naturally declines due to lower capital spending. Given these measures are recent, and the full impact of reduced spending will be continually evaluated, the Corporation is responding to measures taken by our customers by taking prudent actions to protect its stakeholders. The following list highlights these actions and other areas of importance the Corporation has considered:

- SECURE will be reducing its 2020 capital program by $20 million, or 25%, from the amount previously announced. The remaining committed capital will be primarily spent in the second quarter for projects that are near completion and are expected to provide an immediate cash contribution. The East Kaybob oil pipeline system is currently 80 percent complete and is expected to be commissioned by the start of the third quarter. Capital for 2021 has been estimated at $15 million which will be primarily sustaining capital ($12 million);

- Maintaining significant financial flexibility while serving our customers and stakeholders is our priority. The Board of Directors has approved a dividend reduction from 2.25 cents per month to 0.25 cents per month effective May 1, 2020. This reduction of the dividend results in annualized cash savings of approximately $38 million. SECURE believes the sharing of excess cash flow with shareholders is a core business principle and will look for opportunities to increase the dividend as business conditions warrant;

- SECURE's business remains highly concentrated on production volumes or related services that represent approximately 75% of the Corporation's annual cash flows. A portion of these production volumes are contracted and/or fee for service contracts that are expected to provide a degree of cashflow stability. The Corporation continually monitors counterparty risk, and in 2019 no single customer accounted for greater than 5% of revenue;

- Executive management salaries and annual Board of Directors cash retainers will be reduced by 15% effective April 2020. In addition, a number of cost optimization and efficiency measures are being implemented that will reduce our costs to levels consistent with anticipated activity levels;

- Balance sheet strength and capital discipline are paramount in these uncertain times as companies seek to reduce risk in all areas. SECURE has ample liquidity as we move forward into 2020 and beyond. Our $600 million first lien revolving credit facility matures June 2023 and had $270 million of available capacity at December 31, 2019. Our $130 million second lien credit facility is fully drawn and matures July 2021. In addition, SECURE has a $75 million letter of credit facility with $42 million available for use under this facility as of December 31, 2019

The Corporation will continue to keep its stakeholders top of mind and supported as it navigates through these events. The Corporation stands by prepared to adjust its response as needed and will continue to base its decisions on recommendations from public health experts, its continuing evaluation of global energy prices, and the impact on SECURE's and our customers' businesses.

FORWARD-LOOKING STATEMENTS

Certain statements contained in this document constitute "forward-looking statements" and/or "forward-looking information" within the meaning of applicable securities laws (collectively referred to as "forward-looking statements"). When used in this document, the words "may", "would", "could", "will", "intend", "plan", "anticipate", "believe", "estimate", "expect", and similar expressions, as they relate to SECURE, or its management, are intended to identify forward-looking statements. Such statements reflect the current views of SECURE with respect to future events and operating performance and speak only as of the date of this document.

In particular, this document contains or implies forward-looking statements pertaining but not limited to: management's expectations with respect to the business, operations and results of the Corporation, including the impact thereon due to COVID-19 and the rapid decline in global energy prices; the Corporation's ability to meet stakeholder expectations; the oil and natural gas industry in Canada and the U.S., including 2020 activity levels and beyond, spending by producers and the impact of this on SECURE's activity levels; the Corporation's proposed 2020 and 2021 capital expenditures, the timing of completion for projects underway, in particular the East Kaybob oil pipeline system, and the timing of contributions from new projects; the benefits of contracted and/or fee for service contracts on SECURE's cash flow and the expected stability of such sources of cash flow; the continued availability, and sources of, liquidity; the expected impacts of the Corporation's cost and capital expenditure reductions; future dividend payments and expected cash savings resulting from the reduction of the Corporation's cash dividend payments; debt service; and the Corporation's ability to meet obligations and commitments and operate within any credit facility restrictions, including the financial covenants related to our debt facilities more fully described in the notes accompanying our audited 2019 financial statements.

Forward-looking statements are based on certain assumptions that SECURE has made in respect thereof as at the date of this news release regarding, among other things: the impact of COVID-19 and lower global energy pricing on oil and gas industry exploration and development activity levels and production volumes (including as a result of demand and supply shifts caused by COVID-19 and the actions of OPEC and non-OPEC countries); the success of SECURE's operations and growth projects; the Corporation's competitive position remaining substantially unchanged; future acquisition and sustaining costs will not significantly increase from past acquisition and sustaining costs; that counterparties comply with contracts in a timely manner; that there are no unforeseen events preventing the performance of contracts or the completion of the relevant facilities; that there are no unforeseen material costs relation to the Corporation's facilities; and that prevailing regulatory, tax and environmental laws and regulations apply.

Forward-looking statements involve significant known and unknown risks and uncertainties, should not be read as guarantees of future performance or results, and will not necessarily be accurate indications of whether such results will be achieved. Readers are cautioned not to place undue reliance on these statements as a number of factors could cause actual results to differ materially from the results discussed in these forward-looking statements, including but not limited to those factors referred to under the heading "Risk Factors" in the Annual Information Form for the year ended December 31, 2019. In addition, the effects and impacts of the COVID-19 outbreak, the rapid decline in global energy prices (including as a result of demand and supply shifts caused by COVID-19 and the actions of OPEC and non-OPEC countries) and the length of time to significantly reduce the global threat of COVID-19 on SECURE's business, the global economy and markets are unknown at this time and could cause SECURE's actual results to differ materially form the forward-looking statements contained in this news release.

Although forward-looking statements contained in this document are based upon what the Corporation believes are reasonable assumptions, the Corporation cannot assure investors that actual results will be consistent with these forward-looking statements. The forward-looking statements in this document are expressly qualified by this cautionary statement. Unless otherwise required by law, SECURE does not intend, or assume any obligation, to update these forward-looking statements.

ABOUT SECURE

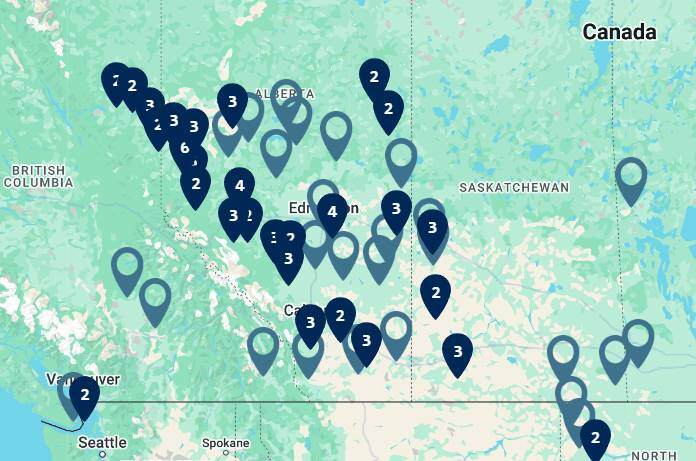

SECURE is a publicly traded energy business listed on the Toronto Stock Exchange providing industry leading customer solutions to upstream oil and natural gas companies operating in western Canada and certain regions in the United States through its three operating segments: Midstream Infrastructure, Environmental Solutions and Technical Solutions.

The Corporation owns and operates a network of over fifty midstream facilities throughout key resource plays in western Canada, North Dakota and Oklahoma. SECURE's core midstream infrastructure operations generate cash flows from oil production processing and disposal, produced water disposal, and crude oil logistics, marketing and storage.

SOURCE SECURE Energy Services Inc.