News Releases

Stay in the know

CALGARY, July 30, 2019 /CNW/ - Secure Energy Services Inc. ("Secure" or the "Corporation") (TSX – SES) announced today its operational and financial results for the three and six months ended June 30, 2019.

The following operational and financial highlights should be read in conjunction with the Corporation's management's discussion and analysis ("MD&A") and the interim consolidated financial statements and notes thereto for the three and six months ended June 30, 2019 of Secure which are available on SEDAR at www.sedar.com.

2019 SECOND QUARTER OPERATIONAL AND FINANCIAL HIGHLIGHTS

Increasing Cash Flow Stability

Secure achieved Adjusted EBITDAi of $35.0 million during the second quarter of 2019, a 12% increase from the three months ended June 30, 2018 despite lower oil and gas activity levels. Along with the impact of the adoption IFRS 16, Leasesii on January 1, 2019, growth initiatives over the last several years to increase capacity in response to customer demand and expand production-related service offerings more than offset the impact of lower revenues associated with reduced drilling and completion related volumes and related services. Secure's focus in recent years to capture new production-based revenue and long-term contracts has provided the Corporation with greater revenue stability. This shift into higher production-based exposure and contracted volumes significantly improves the predictability of Secure's cash flows, including during the second quarter where the Corporation's results are impacted by weather conditions resulting in road bans that hamper drilling and completion activity in Canada.

Executing Growth Strategy

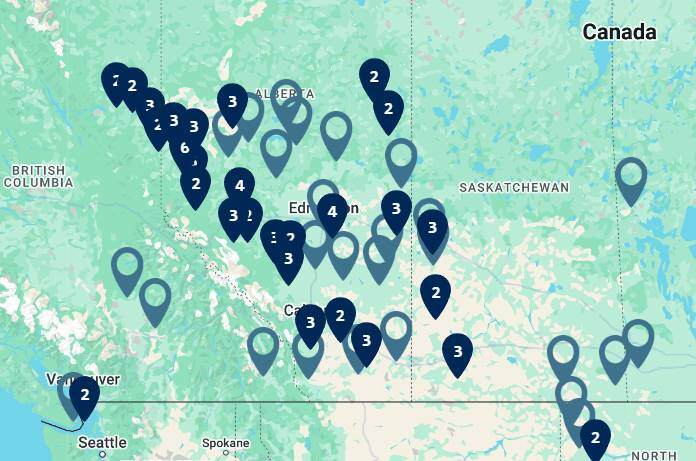

During the second quarter, Secure added key storage infrastructure, continuing to add to the Corporation's midstream growth strategy. At the Kerrobert terminal, Secure expanded total crude oil storage to 420,000 barrels with the completion of the construction of two 130,000 barrel tanks. Secure also acquired a 27% interest in a crude oil storage facility located in Cushing, Oklahoma, and a 51% interest in an adjacent 80-acre parcel of undeveloped land. The Cushing storage facility was constructed in 2015 and is strategically located on 10 acres of land in South Cushing with long-term connection agreements in place, ultimately providing connectivity to all major inbound and outbound pipelines in Cushing. Secure's majority investment in the 80-acre parcel of land provides the Corporation with significant optionality to develop additional midstream infrastructure in one of North America's key storage and trading hubs. Having access to multiple Canadian crude streams and well-connected infrastructure at hubs across North America will benefit our customers getting their product to market at the optimum price and significantly expands Secure's commercial revenue generating opportunities.

During the quarter, Secure also continued to identify and develop infrastructure near customer production to provide transportation and disposal solutions to customers that increase their operating netbacks and capital efficiency. In June 2019, Secure commenced construction of a new water disposal facility and produced water pipeline in the Montney region of Alberta. The facility, which is expected to be completed during the fourth quarter of 2019, has multi-year contracted volumes through facility and well dedications with an anchor tenant, providing reliable cash flows over the contract term.

Other growth and expansion capital incurred in the three months ended June 30, 2019 included progressing construction of a produced water transfer and injection pipeline in the Montney region, the addition of two new disposal wells in North Dakota at the Keene and 13 Mile facilities, completion of a second well at Tony Creek, and construction of an additional landfill cell at Willesden Green. Additionally, the Corporation increased capacity and efficiencies through various other expansion projects at the Corporation's existing facilities. Secure continues to evaluate additional opportunities relating to new infrastructure across the WCSB and North Dakota based on customer demand. In total, the Corporation invested growth and expansion capital (including acquisitions) of $46.6 million during the three months ended June 30, 2019.

Improving Financial Flexibility

During the second quarter, Secure closed an amendment to its First Lien Credit Facility, increasing the facility by $130 million and extending the maturity date by two years to June 30, 2023. The amended First Lien Credit Facility also includes an accordion feature, which, if exercised and approved by the Corporation's lenders, would increase the revolving credit facility by an additional $100 million. Secure has also entered into a new $75 million bilateral Letter of Credit Facility with two major financial institutions. As a result of the amended First Lien Credit Facility and new Letter of Credit Facility, Secure has a total credit capacity of $805 million.

At June 30, 2019, Secure's Total Debt to EBITDA ratio, as defined in the Corporation's lending agreements, was 2.3 to 1. The strength of the Corporation's balance sheet and increased credit capacity achieved in the quarter provides sufficient financial flexibility and the incremental borrowing capacity required for Secure to continue to operate efficiently, grow the business organically and execute on strategic acquisition opportunities that align with the profitable growth strategy of Secure.

Creating Shareholder Value

During the quarter, Secure renewed the normal course issuer bid ("NCIB") first initiated in May 2018. During the three months ended June 30, 2019, Secure purchased and cancelled 3,070,100 common shares of the Corporation ("shares") at a weighted average price per share of $7.30 for a total of $22.4 million. Subsequent to quarter end, the Corporation has purchased 450,900 additional shares. In total, Secure has repurchased and cancelled 9,199,173 shares since May 2018, representing approximately 6% of the number of common shares outstanding at the time of commencement. The Corporation believes that, at times, the prevailing market price for Secure's shares does not reflect their underlying value.

The Corporation's operating and financial highlights for the three and six month periods ending June 30, 2019 and 2018 can be summarized as follows:

Three months ended June 30, | Six months ended June 30, | ||||||

($000's except share and per share data) | 2019 | 2018 | % change | 2019 | 2018 | % change | |

Revenue (excludes oil purchase and resale) | 138,869 | 141,249 | (2) | 316,248 | 322,947 | (2) | |

Oil purchase and resale | 654,618 | 578,674 | 13 | 1,266,121 | 1,102,421 | 15 | |

Total revenue | 793,487 | 719,923 | 10 | 1,582,369 | 1,425,368 | 11 | |

Adjusted EBITDA (1) | 34,966 | 31,158 | 12 | 90,105 | 78,965 | 14 | |

Per share ($), basic and diluted | 0.22 | 0.19 | 16 | 0.56 | 0.48 | 17 | |

Net loss attributable to shareholders of Secure | (1,678) | (6,901) | (76) | (419) | (824) | 49 | |

Per share ($), basic and diluted | (0.01) | (0.04) | (75) | - | (0.01) | 100 | |

Cash flows from operating activities | 53,926 | 74,572 | (28) | 111,228 | 107,326 | 4 | |

Per share ($), basic and diluted | 0.34 | 0.45 | (24) | 0.69 | 0.65 | 6 | |

Dividends per common share | 0.0675 | 0.0675 | - | 0.1350 | 0.1350 | - | |

Capital expenditures (1) | 48,612 | 36,263 | 34 | 72,231 | 92,844 | (22) | |

Total assets | 1,605,988 | 1,538,001 | 4 | 1,605,988 | 1,538,001 | 4 | |

Long-term liabilities | 604,610 | 457,994 | 32 | 604,610 | 457,994 | 32 | |

Common shares - end of period | 158,452,248 | 163,431,134 | (3) | 158,452,248 | 163,431,134 | (3) | |

Weighted average common shares - basic and diluted | 160,371,354 | 164,524,360 | (3) | 160,405,924 | 164,268,516 | (2) | |

(1) Refer to "Non-GAAP Measures and Operational Definitions" for further information | |||||||

- REVENUE OF $793.5 MILLION AND $1.6 BILLION FOR THE THREE AND SIX MONTHS ENDED JUNE 30, 2019

- The Midstream Infrastructure division's revenue (excluding oil purchase and resale) increased to $85.5 million and $179.7 million during the three and six months ended June 30, 2019, up 6% and 11%, respectively, from the comparative periods in 2018. The increase in revenues was driven by infrastructure added in 2018, which resulted in new revenue streams and increased disposal capacity, and the Corporation's continued commitment to optimize realized pricing by utilizing multiple crude oil and condensate streams at Secure's pipeline connected FSTs, benefiting both the Corporation and our customers. The increase in revenue was partially offset by lower drilling and completions related processing and disposal volumes resulting from a slowdown in Canadian drilling and completion activity. During the three and six months ended June 30, 2019, industry rig counts decreased 28% and 35% from the comparative periods of 2018, and completions decreased 26% and 25%;

- Oil purchase and resale revenue in the Midstream Infrastructure division for the three and six months ended June 30, 2019 increased by 13% and 15% from the 2018 comparative periods to $654.6 million and $1.3 billion due to Secure's expanded commercial operations, particularly related to the Kerrobert crude oil pipeline system;

- Environmental Solutions division revenue of $16.0 million and $45.7 million for the three and six months ended June 30, 2019 decreased 38% and 21% from the respective comparative periods of 2018. The integrated fluids solutions service line was impacted by lower well completion activity in the WCSB and from reduced spending from major exploration and production companies in Canada. Project revenue decreased due to fewer reclamation and demolition jobs underway quarter over quarter and from the deferral of ongoing remediation and demolition jobs until the second half of the year as wet weather conditions in June limited field access to continue with these jobs. Increases in recurring revenue from the scrap metal recycling agreements combined with new project work in the Fort McMurray region partially offset the reduced revenue from the lower job volumes and program deferrals;

- Technical Solutions division revenue increased 7% to $37.3 million in the three months ended June 30, 2019 over the 2018 comparative period due to increased production services revenue from an expanded customer base. Drilling services revenue was relatively flat quarter over quarter as increased market share offset the impact of lower drilling activity in the WCSB. In the six months ended June 30, 2019, Technical Solutions revenue decreased 12% to $90.9 million as the impact of higher production services revenue was more than offset by the slowdown in drilling activity in Canada, as evidenced by a 35% decrease in rigs drilling in the WCSB from the same period in 2018.

- ADJUSTED EBITDA OF $35.0 MILLION AND $90.1 MILLION FOR THE THREE AND SIX MONTHS ENDED JUNE 30, 2019

- Adjusted EBITDA of $35.0 million and $90.1 million increased 12% and 14% from the three and six months ended June 30, 2018, primarily from higher Midstream Infrastructure revenue (excluding oil purchase and resale), continued cost efficiencies, and the impact of the adoption of IFRS 16. These factors more than offset the decrease in drilling and completions related volumes and demand for related services. IFRS 16 was adopted by the Corporation on January 1, 2019 and resulted in the reclassification of certain lease payments previously included in the determination of EBITDA to depreciation and amortization expense and interest costs;

- In the Midstream Infrastructure division, Adjusted EBITDA increased 8% in the second quarter of 2019 compared to the second quarter of 2018, and 19% during the six months ended June 30, 2019 over the same period in 2018. Higher water disposal volumes, new revenue streams, and Secure's utilization of multiple crude oil and condensate streams to optimize pricing at the Corporation's pipeline connected FSTs, benefiting both the Corporation and our customers, more than mitigated a decrease in facility volumes relating to less drilling and completions waste processing and disposal during the 2019 periods;

- Adjusted EBITDA generated from the Environmental Solutions division decreased $1.6 million and $3.1 million for the three and six months ended June 30, 2019 from the respective comparative periods in 2018, primarily from revenue variances described above. The majority of the Environmental Solutions division's cost of sales are variable with fluctuations corresponding to changes in revenue;

- The Technical Solutions division's Adjusted EBITDA improved $2.0 million during the three months ended June 30, 2019 over the 2018 comparative period primarily due to higher revenue from production services and lower general and administrative expenses following cost reductions initiated in late 2018 in response to lower oil and gas drilling activity. During the year to date, Adjusted EBITDA for the division decreased $1.0 million compared to the same period of 2018 primarily as a result of lower revenue driven by reduced drilling activity.

- NET LOSS ATTRIBUTABLE TO SHAREHOLDERS OF SECURE OF $1.7 MILLION AND $0.4 MILLION FOR THE THREE AND SIX MONTHS ENDED JUNE 30, 2019

- For the three months ended June 30, 2019, net loss attributable to shareholders of Secure of $1.7 million decreased from a net loss of $6.9 million in the three months ended June 30, 2018. The variance is primarily due to a $3.8 million increase to Adjusted EBITDA resulting from the factors described above, and lower tax expense driven by a reduction in corporate tax rates. These positive variances were partially offset by higher depreciation expense resulting from the adoption of IFRS 16 and new assets put into use since the second quarter of 2018 and higher interest expense resulting from higher debt levels to fund organic development and acquisitions in the past year. During the six months ended June 30, 2019, the net loss attributable to shareholders of Secure was $0.4 million, down slightly from $0.8 million in the six months ended June 30, 2018. The decrease in the net loss is due to the $11.1 million increase to Adjusted EBITDA and lower tax expense as described above, partially offset by higher depreciation expense resulting from the adoption of IFRS 16 and new assets put into use since the first quarter of 2018, and higher interest expense from increased debt levels to fund growth initiatives in the past year.

- CAPITAL EXPENDITURES OF $48.6 MILLION AND $72.2 MILLION FOR THE THREE AND SIX MONTHS ENDED JUNE 30, 2019

- Total capital expenditures for the three months ended June 30, 2019 included $32.7 million of organic growth and expansion capital, $13.9 million of acquisition capital related to the two tuck-in acquisitions at Cushing, and $2.1 million of sustaining capital. Growth and expansion capital (excluding business acquisitions) of $53.3 million incurred in the six months ended June 30, 2019 related primarily to progressing construction of a produced water transfer and injection pipeline from a customer plant in the Montney region; the additional crude oil storage at the receipt terminal in Kerrobert; commencement of construction of the new Montney water disposal facility; the addition of three water disposal wells at existing facilities (Tony Creek, Keene and 13 Mile); increasing processing and disposal capacity and creating efficiencies at various other facilities, including purchasing equipment to support existing services; and long lead items and upfront costs for future projects. Sustaining capital incurred in the year to date of $5.0 million relates primarily to well and facility maintenance.

- FINANCIAL FLEXIBILITY

- The total amount drawn on Secure's credit facilities as at June 30, 2019 increased by 6% to $437.0 million compared to $413.5 million at December 31, 2018. The amount drawn increased slightly in order to fund the Corporation's capital program;

- As at June 30, 2018, the Corporation had $330.3 million available under its credit facilities, subject to covenant restrictions, up from $148.4 million at December 31, 2018. In April 2019, Secure closed an amendment to its First Lien Credit Facility, increasing the capacity by $130 million and issued a new $75 million bilateral Letter of Credit Facility, resulting in total credit capacity of $805 million. The Corporation is well positioned to pursue further accretive acquisition opportunities and execute on the expected 2019 capital program;

- Secure is in compliance with all covenants related to its credit facilities at June 30, 2019. The following table outlines Secure's senior and total debt to trailing twelve month EBITDA ratios at June 30, 2019 and December 31, 2018:

Jun 30, 2019 | Threshold | % Variance | |||||

Senior Debt to EBITDA | 1.6 | 3.5 | (54) | ||||

Total Debt to EBITDA | 2.3 | 5.0 | (54) |

MIDSTREAM INFRASTRUCTURE DIVISION HIGHLIGHTS

Three months ended June 30, 2019 | Six months ended June 30, 2019 | |||||

($000's) | 2019 | 2018 | % Change | 2019 | 2018 | % Change |

Revenue | ||||||

Midstream Infrastructure (a) | 85,544 | 80,496 | 6 | 179,682 | 161,351 | 11 |

Oil purchase and resale | 654,618 | 578,674 | 13 | 1,266,121 | 1,102,421 | 15 |

Total Midstream Infrastructure division revenue | 740,162 | 659,170 | 12 | 1,445,803 | 1,263,772 | 14 |

Cost of Sales | ||||||

Midstream Infrastructure excluding items noted below | 39,419 | 37,796 | 4 | 78,656 | 71,247 | 10 |

Depreciation, depletion and amortization | 21,945 | 18,668 | 18 | 42,308 | 37,146 | 14 |

Oil purchase and resale | 654,618 | 578,674 | 13 | 1,266,121 | 1,102,421 | 15 |

Total Midstream Infrastructure division cost of sales | 715,982 | 635,138 | 13 | 1,387,085 | 1,210,814 | 15 |

Segment Profit Margin(1) | 46,125 | 42,700 | 8 | 101,026 | 90,104 | 12 |

Segment Profit Margin (1) as a % of revenue (a) | 54% | 53% | 56% | 56% | ||

(1) Calculated as revenue less cost of sales excluding depreciation and amortization. Refer to "Non-GAAP Measures and Operational Definitions" for further information | ||||||

- Revenue generated from Midstream Infrastructure services of $85.5 million and $179.7 million for the three and six months ended June 30, 2019 increased by 6% and 11% from the 2018 comparative periods. The increase in revenue was primarily driven by higher volumes associated with new infrastructure, including the Kerrobert crude oil pipeline system and expansions at certain of the Corporation's existing facilities during 2018 and the first half of 2019. Further increases in revenue during the three and six months ended June 30, 2019 were due to Secure's continued utilization of multiple crude oil and condensate streams at the Corporation's pipeline connected FSTs to optimize realized pricing, which benefited both the Corporation and our customers. These increases to revenue were partially offset by a decrease in processing and disposal volumes tied to drilling and completion activity, wet weather in June resulting in extensive road bans, and lower realized pricing on recovered oil;

- Disposal volumes increased slightly in the three months ended June 30, 2019 over the 2018 comparative period as a 31% increase in produced water disposal volumes at the Corporation's facilities in Canada more than offset the impact on landfill volumes and waste water volumes resulting from slower drilling and completion activity. The majority of the Corporation's facilities are located in high impact resource plays, such as the Montney and Duvernay regions, where producers were most active in the WCSB during the quarter. Average fluids pumped per well in these regions are also significantly higher than other regions of the WCSB, driving incremental volumes at Secure's facilities. In the past year, Secure has strategically added new facilities, including the Gold Creek and Tony Creek water disposal facilities, and increased capacity for water disposal at various other facilities in these regions in response to customer demand. These additions and expansions were the driving force behind higher produced water volumes in the quarter. Disposal volumes were relatively flat in the six months ended June 30, 2019 compared to the same period in 2018 as the impact of higher produced water disposal volumes described above was offset by lower completion-related water volumes and reduced drilling waste disposed at the Corporation's landfills;

- Processing volumes decreased by 30% and 26% in the three and six months ended June 30, 2019 from the 2018 comparative periods driven primarily by lower emulsion treating and waste processing over the comparative periods resulting from the slowdown of oil and gas activity due to challenging industry fundamentals stemming from volatile crude oil pricing, low natural gas prices and uncertainty with respect to the addition of pipeline capacity out of the WCSB. Additionally, cold weather in the first quarter of 2019 and a prolonged spring break-up due to rain in June impacted overall activity levels. In the WCSB, rig activity declined 28% and 35% in the three and six months ended June 30, 2019 from the 2018 comparative periods, and completions decreased 26% and 25% in these same periods;

- The Kerrobert crude oil pipeline system commenced commercial operations on October 1, 2018, resulting in a new revenue source for the Corporation in the three and six months ended June 30, 2019 compared to the same periods of 2018 through pipeline tariffs. The feeder pipeline project includes area dedication and contracted volume on both an annual and cumulative term basis over a 10 year term;

- Oil purchase and resale revenue in the Midstream Infrastructure division for the three and six months ended June 30, 2019 increased to $654.6 million and $1.3 billion driven by the addition of the Kerrobert crude oil pipeline system;

- The Midstream Infrastructure's segment profit margin for the three and six months ended June 30, 2019 of $46.1 million and $101.0 million increased by 8% and 12% from the prior year comparative periods, driven by the impact of increased revenues, as discussed above. As a percentage of Midstream Infrastructure services revenue, segment profit margin increased slightly to 54% during the three months ended June 30, 2019 from 53% in the second quarter of 2018, and remained flat at 56% in the year to date compared to the first half of 2018;

- General and administrative ("G&A") expenses of $7.6 million and $14.9 million for the three and six months ended June 30, 2019 increased from the respective 2018 comparative period balances of $6.6 million and $12.7 million. Excluding depreciation and amortization, G&A expenses decreased 6% and 5% during the three and six months ended June 30, 2019 from the respective 2018 comparative periods primarily due to the impact of IFRS 16 on office leases. The Corporation continues to minimize G&A costs by streamlining operations where possible;

- Earnings before tax of $16.1 million for the three months ended June 30, 2019 decreased 5% from the three months ended June 30, 2018. The decrease is primarily a result of higher depreciation and amortization expense partially offset by a $3.4 million increase in segment profit margin in the 2019 period. Earnings before tax increased 9% for the six months ended June 30, 2019 over the 2018 comparative period. The increase is driven primarily by a $10.9 million increase in segment profit margin as a result of facilities added in the second half of 2018 and the Corporation's continued focus on efficient and proactive cost management. This increase was partially offset by higher overall G&A expenses.

ENVIRONMENTAL SOLUTIONS DIVISION HIGHLIGHTS

Three months ended June 30, 2019 | Six months ended June 30, 2019 | |||||

($000's) | 2019 | 2018 | % Change | 2019 | 2018 | % Change |

Revenue | ||||||

Environmental Solutions | 16,027 | 26,043 | (38) | 45,699 | 58,207 | (21) |

Cost of Sales | ||||||

Environmental Solutions excluding depreciation and amortization | 13,371 | 21,100 | (37) | 38,035 | 46,629 | (18) |

Depreciation and amortization | 2,453 | 2,236 | 10 | 4,990 | 4,633 | 8 |

Total Environmental Solutions division cost of sales | 15,824 | 23,336 | (32) | 43,025 | 51,262 | (16) |

Segment Profit Margin (1) | 2,656 | 4,943 | (46) | 7,664 | 11,578 | (34) |

Segment Profit Margin (1) as a % of revenue | 17% | 19% | 17% | 20% | ||

(1) Calculated as revenue less cost of sales excluding depreciation and amortization. Refer to "Non-GAAP Measures and Operational Definitions" for further information | ||||||

- Environmental Solutions division revenue of $16.0 million and $45.7 million for the three and six months ended June 30, 2019 decreased by 38% and 21% from the comparative periods of 2018. Onsite water management and pumping service revenue was negatively impacted by lower well completion activity in the WCSB and from significantly reduced spending from major exploration and development companies in Canada. Project services revenue decreased as there were fewer large scale job opportunities quarter over quarter. Revenue in the second quarter of 2018 included two large remediation jobs, a significant demolition job and revenue from an oil spill clean-up. The second quarter of 2019 did not have similar type of jobs occurring. Additionally, ongoing remediation and demolition programs during this quarter were delayed due to spring break up and wet conditions in June which limited field access to continue these jobs. The programs are scheduled to re-start in the second half of the year. Increases in Oil Sands recurring revenue from scrap metal recycling agreements combined with new project work in the region partially offset the reduced revenue from the lower volume of jobs and program deferrals;

- Segment profit margin for the three and six months ended June 30, 2019 decreased by 46% and 34% to $2.7 million and $7.7 million from the prior year comparative periods due primarily to lower revenue. As a percentage of revenue, segment profit margin was 17% for both the three and six months ended June 30, 2019, down slightly from 19% and 20% in the three and six months ended June 30, 2018. The Environmental Solutions division's segment profit margin as a percentage of revenue can fluctuate depending on the volume and type of projects undertaken and the blend of business between remediation and reclamation projects, demolition projects, pipeline integrity projects, site clean-up, and other services in any given period. As a percentage of revenue, the segment profit margin in the first half of 2019 decreased primarily due to lower proportion of revenue from water pumping and fracing services, which typically generates higher margins than project type work. Additionally, competitive pricing due to lower market demand and limited water pumping opportunities decreased margin as a percentage of revenue for the integrated fluid solutions services in 2019 compared to 2018. The integrated services solutions margin decrease was partially offset by improving project type margins and higher margins associated with recurring revenue generated from the Oil Sands region;

- G&A expense for the three and six months ended June 30, 2019 decreased 31% and 23% from the 2018 comparative periods to $1.6 million and $3.4 million as a result of ongoing initiatives to minimize costs to correspond to with activity levels;

- During the three and six months ended June 30, 2019, the Environmental Solutions division had losses of $1.4 million and $0.8 million, respectively, compared to earnings of $0.4 million and $2.5 million during the three and six months ended June 30, 2018. The variances correspond primarily to the decrease in segment revenue and profit margin, offset by the positive impact of reduced G&A expense in the period.

TECHNICAL SOLUTIONS DIVISION HIGHLIGHTS

Three months ended June 30, 2019 | Six months ended June 30, 2019 | |||||

($000's) | 2019 | 2018 | % Change | 2019 | 2018 | % Change |

Revenue | ||||||

Technical Solutions | 37,298 | 34,710 | 7 | 90,867 | 103,389 | (12) |

Cost of Sales | ||||||

Technical Solutions excluding depreciation and amortization | 33,270 | 31,988 | 4 | 76,790 | 87,304 | (12) |

Depreciation and amortization | 6,194 | 5,313 | 17 | 11,869 | 10,486 | 13 |

Total Technical Solutions division cost of sales | 39,464 | 37,301 | 6 | 88,659 | 97,790 | (9) |

Segment Profit Margin (1) | 4,028 | 2,722 | 48 | 14,077 | 16,085 | (12) |

Segment Profit Margin (1) as a % of revenue | 11% | 8% | 15% | 16% | ||

(1) Calculated as revenue less cost of sales excluding depreciation and amortization. Refer to "Non-GAAP Measures and Operational Definitions" for further information | ||||||

- Technical Solutions division's revenue of $37.3 million in the three months ended June 30, 2019 increased 7% compared to the three months ended June 30, 2018. The increase in revenue was a result of higher contributions from production chemicals as the Corporation expands its customer base and product offerings. The division's drilling fluids and equipment revenue correlates with oil and gas drilling activity in the WCSB. During the three months ended June 30, 2019, rig activity and metres drilled in the WCSB decreased 28% and 13%, respectively, compared to the three months ended June 30, 2018. Despite the decrease in industry activity levels, revenue from drilling services was relatively flat in the three months ended June 30, 2019 from the comparative period of 2018 due to a steady number of operating days resulting from higher market share. During periods of low activity, such as the second quarter spring break-up where the average rig count is typically half of that in the first quarter of the year, the timing, type and location of one customer's drilling activities can create fluctuations in market share;

- During the six month period, rig activity and metres drilled in the WCSB decreased 35% and 25%, respectively, compared to the first half of 2018. As a result, drilling services revenue was negatively impacted by fewer operating days and rigs serviced. Secure was able to partially mitigate the impact of reduced activity levels with the increased contribution from Secure's production chemicals related services. Overall revenue from the Technical Solutions division for six months ended June 30, 2019 decreased 12% to $90.9 million from the comparative period of 2018;

- The Technical Solutions division's segment profit margin of $4.0 million for the three months ended June 30, 2019 increased 48% from the comparative period of 2018. Segment profit margin as a percentage of revenue was 11%, up from 8% in the prior year second quarter. The increase is attributable to improved production services margins resulting from higher revenues with relatively flat overhead costs, favorable product mix, and the adoption of IFRS 16 which has positively impacted the segment profit margin as certain production chemical blending plants are operated under lease agreements. Lower product margins related to drilling fluids partially offset these factors due to competitive pricing and higher costs related to products sourced in U.S. dollars;

- The Technical Solutions division's segment profit margin for the six months ended June 30, 2019 decreased 12% from the comparative period to $14.1 million as a result of lower revenue and proportionately lower expenses, as discussed above. Segment profit margin as a percentage of revenue was 15%, down from 16% in the six months ended June 30, 2018;

- G&A expenses decreased 12% and 8% to $4.6 million and $10.4 million as a result of the Corporation's continued efforts to manage costs efficiently and proactively while still responding to customer demands and activity levels. This is partially offset by costs associated with research and development projects as Secure continues its focus on expanding the value chain of services offered to customers, including innovative and cost-effective solutions to reduce waste in the drilling and production processes;

- During the three and six months ended June 30, 2019, the Technical Solutions division had losses before tax of $6.8 million and $8.1 million compared to $7.8 million and $5.7 million in the three and six months ended June 30, 2018. The variance was a result of a changes to segment profit margin as described above and the decrease in G&A expense.

OUTLOOK

Secure's outlook for oil and gas activity levels in the second half of 2019 remains conservative in light of ongoing macro-economic factors affecting the Canadian energy sector. Producers are continuing to be cautious with spending, impacting new drilling and completion related volumes and demand for related services. Despite a difficult operating environment, Secure has demonstrated consistent growth over the past several years. The Corporation continues to find new and innovative ways to help our customers and deliver energy to the world, so people and communities thrive. Over the past two years, Secure has strategically invested in midstream infrastructure in high impact resource plays located near customer production, significantly increased the Corporation's exposure to production-based revenues and entered into long-term contracts for increased reliability of future cash flows. Secure expects that these factors will mitigate the impact reduced year over year activity levels will have on the Corporation's financial results in 2019.

Secure's strategy remains focused on what is in the Corporation's control: help our customers by challenging what's possible. By doing midstream differently, Secure can work with customers to identify opportunities and integrated solutions where the Corporation can add value by increasing customer operating netbacks and improving capital efficiency. The industry fundamentals driving the success of Secure's core operations remain unchanged:

- Trend towards increased outsourcing of midstream work by producers;

- Produced water increasing at a disproportionate rate relative to aggregate production as a result of larger fracs, aging wells and maturing basins in both Canada and the U.S.;

- Increasing opportunities relating to crude oil logistics as volatile differentials allow for opportunities related to crude oil storage, and transporting crude by rail and via pipeline;

- Well density improving economics to pipeline connect production volumes to midstream facilities;

- Forecast global oil and gas demand driving production growth in the WCSB; and

- Highly regulated and best in the world environmental standards.

These factors are expected to result in the need for additional facilities to meet incremental requirements for processing and disposal capacity. Secure has made significant capital investments to ensure the business is well positioned to capture new demand. By offering exceptional customer service and owning and operating midstream facilities near customer production, Secure expects these trends will drive more volumes to the Corporation's midstream facilities.

Additionally, customers continue to seek cost effective transportation solutions for water, oil and condensate volumes. Employing the Corporation's approach of doing midstream differently, Secure has created strategic partnerships with customers leading to the recent development of the Kerrobert crude oil pipeline system and the ongoing construction of two produced water transfer pipelines. These feeder pipelines create value for Secure through fixed fee-for-service revenues and reliable volumes delivered to our facilities, and for our customers through lower transportation costs and higher operating netbacks.

The continued growth and development of the Corporation's midstream business, highlighted in the second quarter with the addition of storage infrastructure expanding Secure's strategic footprint at key North American crude hubs, provides Secure with the ability to offer customers market access flexibility to optimize pricing.

Secure's Technical and Environmental Solutions divisions offer significant torque to the Corporation's cash flows with increased commodity prices, improved producer spending and higher activity levels. Additionally, offering a suite of solutions across the energy life cycle creates synergies with the core business.

With the strength of the Corporation's balance sheet, experienced management team and proven track record, Secure is well positioned to execute on its growth strategy and respond with solutions to the market's requirements. The amendments to the Corporation's First Lien Credit Facility and the new Letter of Credit Facility during the second quarter increased the Corporation's total credit capacity to $805 million, providing financial flexibility and the borrowing capacity available for Secure to continue to operate efficiently and execute on the Corporation's growth and capital investment strategy. The Corporation has visible continued growth and expects to incur approximately $115 million of total growth and expansion capital in 2019 (acquisition and organic) depending on the outcome of various opportunities in development, such as regulatory approvals, development permits and other operating agreements. The current capital plan for the second half of the year includes completing the produced water transfer and injection pipelines in the Montney region; completing the new Montney water disposal facility and feeder pipeline; optimizing capabilities and increasing processing and disposal capacity at various other facilities, including additional disposal wells; and purchasing equipment to support existing services.

REPORTING CHANGES

The Corporation adopted International Financial Reporting Standard 16, Leases ("IFRS 16") as at the effective date of January 1, 2019 which replaced IAS 17, Leases ("IAS 17"). The new standard introduces a single lessee accounting model and requires a lessee to recognize assets and liabilities for all leases with a term of more than 12 months, unless the underlying asset is of low value.

The Corporation elected the modified retrospective transition approach, which provides lessees a method for recording existing leases at adoption with no restatement of prior period financial information. Under this approach, a lease liability was recognized at January 1, 2019 in respect of leases previously classified as operating leases, measured at the present value of the remaining lease payments, discounted using the lessee's incremental borrowing rate at transition. The associated right-of-use assets were measured at amounts equal to the respective lease liabilities, subject to certain adjustments allowed under IFRS 16.

Adoption of the new standard at January 1, 2019 resulted in the recording of additional right-of-use assets and lease liabilities of $33.4 million and $35.9 million, respectively, related to office space, warehouses, surface land, rail cars and certain heavy equipment. The new standard did not materially impact consolidated net income as the depreciation of right-of-use assets and interest and finance costs related to the lease liabilities recognized under IFRS 16 were mostly offset by reductions in operating lease expense, which were previously recognized in cost of sales and general and administrative expenses. The adoption of IFRS 16 had no impact on cash flows.

FINANCIAL STATEMENTS AND MD&A

The Corporation's condensed consolidated financial statements and notes thereto for the three and six months ended June 30, 2019 and 2018 and MD&A for the three and six months ended June 30, 2019 and 2018 are available immediately on Secure's website at www.secure-energy.com. The condensed consolidated financial statements and MD&A will be available tomorrow on SEDAR at www.sedar.com.

FORWARD-LOOKING STATEMENTS

Certain statements contained in this document constitute "forward-looking statements" and/or "forward-looking information" within the meaning of applicable securities laws (collectively referred to as forward-looking statements). When used in this document, the words "may", "would", "could", "will", "intend", "plan", "anticipate", "believe", "estimate", "expect", and similar expressions, as they relate to Secure, or its management, are intended to identify forward-looking statements. Such statements reflect the current views of Secure with respect to future events and operating performance and speak only as of the date of this document. In particular, this document contains or implies forward-looking statements pertaining to: key factors driving the Corporation's success; the Corporation's expected 2019 Adjusted EBITDA; the impact of new facilities, new service offerings, potential acquisitions, and prior year acquisitions on the Corporation's future financial results; demand for the Corporation's services and products; growth and expansion strategy; the Corporation's ability to continue to grow the business organically and execute on strategic growth opportunities based on current financial position; the oil and natural gas industry in Canada and the U.S., including 2019 and 2020 activity levels, spending by producers and the impact of this on Secure's activity levels; future pipeline development in Canada; industry fundamentals driving the success of Secure's core operations, including increased outsourcing of midstream work by producers, drilling, completion and production trends, opportunities relating to crude oil logistics, well density and economics for pipeline connecting production volumes to midstream facilities, and global oil and gas demand; the Corporation's proposed 2019 capital expenditure program including growth and expansion and sustaining capital expenditures, and the timing of completion for projects, in particular the new Montney water disposal facility; debt service; future capital needs and how the Corporation intends to fund its operations, working capital requirements, dividends and capital program; access to capital; and the Corporation's ability to meet obligations and commitments and operate within any credit facility restrictions.

Forward-looking statements concerning expected operating and economic conditions are based upon prior year results as well as the assumption that levels of market activity and growth will be consistent with industry activity in Canada and the U.S. and similar phases of previous economic cycles. Forward-looking statements concerning the availability of funding for future operations are based upon the assumption that the sources of funding which the Corporation has relied upon in the past will continue to be available to the Corporation on terms favorable to the Corporation and that future economic and operating conditions will not limit the Corporation's access to debt and equity markets. Forward-looking statements concerning the relative future competitive position of the Corporation are based upon the assumption that economic and operating conditions, including commodity prices, crude oil and natural gas storage levels, interest and foreign exchange rates, the regulatory framework regarding oil and natural gas royalties, environmental regulatory matters, the ability of the Corporation and its subsidiaries to successfully market their services and drilling and production activity in North America will lead to sufficient demand for the Corporation's services including demand for oilfield services for drilling and completion of oil and natural gas wells, that the current business environment will remain substantially unchanged, and that present and anticipated programs and expansion plans of other organizations operating in the energy industry may change the demand for the Corporation's services and its subsidiaries' services. Forward-looking statements concerning the nature and timing of growth are based on past factors affecting the growth of the Corporation, past sources of growth and expectations relating to future economic and operating conditions. Forward-looking statements in respect of the costs anticipated to be associated with the acquisition and maintenance of equipment and property are based upon assumptions that future acquisition and maintenance costs will not significantly increase from past acquisition and maintenance costs.

Forward-looking statements involve significant risks and uncertainties, should not be read as guarantees of future performance or results, and will not necessarily be accurate indications of whether such results will be achieved. Readers are cautioned not to place undue reliance on these statements as a number of factors could cause actual results to differ materially from the results discussed in these forward-looking statements, including but not limited to those factors referred to under the heading "Risk Factors" in the AIF for the year ended December 31, 2018 and also includes the risks associated with the possible failure to realize the anticipated synergies in integrating the assets acquired in prior year acquisitions with the operations of Secure. Although forward-looking statements contained in this document are based upon what the Corporation believes are reasonable assumptions, the Corporation cannot assure investors that actual results will be consistent with these forward-looking statements. The forward-looking statements in this document are expressly qualified by this cautionary statement. Unless otherwise required by law, Secure does not intend, or assume any obligation, to update these forward-looking statements.

NON-GAAP MEASURES AND OPERATIONAL DEFINITIONS

The Corporation uses accounting principles that are generally accepted in Canada (the issuer's "GAAP"), which includes International Financial Reporting Standards ("IFRS"). Certain supplementary measures in this document do not have any standardized meaning as prescribed by IFRS. These measures are intended as a complement to results provided in accordance with IFRS. The Corporation believes these measures provide additional useful information to analysts, shareholders and other users to understand the Corporation's financial results, profitability, cost management, liquidity and ability to generate funds to finance its operations. However, they should not be used as an alternative to IFRS measures because they do not have a standardized meaning under IFRS and therefore may not be comparable to similar measures presented by other companies. See the management's discussion and analysis available at www.sedar.com for further details, including reconciliations of the Non-GAAP measures and additional GAAP measures to the most directly comparable measures calculated in accordance with IFRS.

ABOUT SECURE ENERGY SERVICES INC.

Secure is a TSX publicly traded integrated energy business with midstream infrastructure, environmental and technical solutions divisions providing industry leading customer solutions to upstream oil and natural gas companies operating in western Canada and certain regions in the United States ("U.S.").

_____________________________________ |

i Refer to the "Non-GAAP Measures and Operational Definitions" section herein |

ii Refer to the "Reporting Changes" section herein for more information on Secure's adoption of IFRS 16. Secure anticipates the impact of the new standard to result in an increase of approximately $12 to $14 million to Adjusted EBITDA for the 2019 year |

SOURCE SECURE Energy Services Inc.