News Releases

Stay in the know

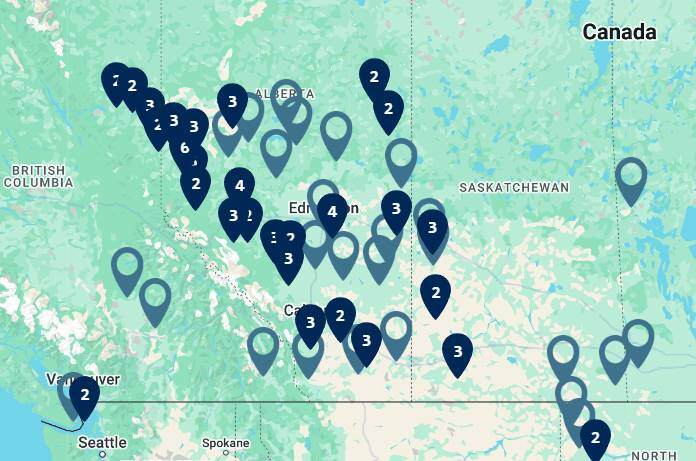

CALGARY, Aug. 1, 2017 /CNW/ - Secure Energy Services Inc. ("Secure" or the "Corporation") (TSX – SES) is pleased to announce the completion of the acquisition of Ceiba Energy Services Inc. ("Ceiba"), a service provider of stand-alone water disposal and oil treating facilities in western Canada. The acquisition was previously announced on May 15, 2017 and adds ten facilities that fit within, and add capacity to, Secure's existing PRD facility network. The additional facilities will provide customers with additional options to reduce their overall transportation costs for custom treating of crude oil, crude oil marketing, produced and waste water disposal and oilfield waste processing.

Pursuant to the acquisition, the Corporation paid approximately $35.5 million in cash (including outstanding debt) and issued 189,965 common shares for a total transaction value of approximately $37.0 million, subject to working capital and post-closing adjustments.

Secure also announced today its operational and financial results for the three and six months ended June 30, 2017. The following should be read in conjunction with the management's discussion and analysis ("MD&A") and the interim consolidated financial statements and notes thereto of Secure which are available on SEDAR at www.sedar.com.

Q2 2017 OPERATIONAL AND FINANCIAL HIGHLIGHTS

The second quarter of 2017 was very active for Secure as the Corporation completed the acquisition of a production chemicals business in April and entered into an agreement to acquire all of the issued and outstanding shares of Ceiba in May. In addition, the Corporation restructured its credit facilities in June to provide greater financial flexibility as Secure continues to be active on both acquisition and organic growth opportunities. There continues to be high demand for water disposal in many areas including the Montney and Deep Basin resource plays where Secure has recently added more disposal capacity.

Seasonality of the oil and gas industry, including the length of spring break-up, weather conditions, and the timing of road bans has the most significant effect on second quarter results. Financial results were positively influenced by more robust activity levels during the second quarter of 2017 and due to more favorable weather conditions resulting in shorter road bans.

ADJUSTED EBITDA INCREASE OF 135%

Average crude oil prices increased by 10% while industry rig counts and metres drilled in the WCSB increased by 142% and 215% respectively over the second quarter of 2016. As a result, all three of the Corporation's divisions were positively impacted and experienced increased revenues and improved margins compared to the second quarter of 2016. Increased industry activity, along with the addition of new facilities and expansions in underserviced markets in 2016, and ongoing production related volumes from existing facilities in the PRD division resulted in Adjusted EBITDA1 of $20.0 million and $62.2 million during the three and six months ended June 30, 2017 respectively, a 135% and 85% increase over the comparative periods.

INCREASED CAPITAL PROGRAM

In May, Secure announced an increase to its 2017 capital program. Secure expects to spend approximately $100 million on organic projects relating to the following:

- A new feeder pipeline to transport crude oil from producers' oil batteries to a storage and connection point. Long lead items and upfront engineering costs have been incurred in the first six months of 2017 with construction expected to be completed and the pipeline in operation in the fourth quarter of 2018, subject to obtaining remaining permits;

- A new SWD facility in the Montney region of Alberta with construction to commence during the fourth quarter;

- Increased capacity at existing locations with added disposal capacity, additional tanks and increased pump capacity, including the newly acquired Ceiba facilities;

- Increased landfill capacity with expansions being completed at South Grande Prairie, Fox Creek, Pembina and Saddle Hills landfills; and

- Long lead items and upfront engineering costs on various projects.

STRONG BALANCE SHEET LEVERAGED THROUGH NEW CREDIT FACILITIES

On June 30, 2017, Secure entered into new credit facilities consisting of a $470 million first lien credit facility ("First Lien Facility") and a $130 million second lien credit facility ("Second Lien Facility"). The combined facilities total $600 million and replace the Corporation's previous $700 million syndicated facility. The reduction in the total borrowing capacity allows the Corporation to optimize its debt structure to reduce costs associated with standby fees on undrawn amounts while maintaining target levels of liquidity.

The First Lien Facility has a maturity date of June 30, 2021 and bears interest at the Corporation's option of either the Canadian prime rate plus 0.45% to 2.00% or the banker acceptance rate plus 1.45% to 3.00%, depending, in each case, on the ratio of senior debt to EBITDA.

The Second Lien Facility has a maturity date of July 31, 2021 and through the utilization of interest rate swaps has an interest rate of 5% for the first three years and 5.5% thereafter.

The Corporation's balance sheet provides significant financial flexibility to pursue accretive acquisitions and continue to invest in organic capital projects as described above. At June 30, 2017, Secure's net debt1 was $88.9 million, and the Corporation's senior debt and total debt to EBITDA ratios, as defined by the Corporation's credit facilities, were both 1.8 to 1.

The operating and financial highlights for the three and six month periods ending June 30, 2017 and 2016 can be summarized as follows:

|

Three months ended June 30, |

Six months ended June 30, | |||||||

|

($000's except share and per share data) |

2017 |

2016 |

% change |

2017 |

2016 |

% change | ||

|

Revenue (excludes oil purchase and resale) |

115,372 |

66,148 |

74 |

256,085 |

168,415 |

52 | ||

|

Oil purchase and resale |

468,952 |

202,460 |

132 |

778,828 |

309,325 |

152 | ||

|

Total revenue |

584,324 |

268,608 |

118 |

1,034,913 |

477,740 |

117 | ||

|

Adjusted EBITDA (1) |

20,044 |

8,540 |

135 |

62,214 |

33,623 |

85 | ||

|

Per share ($), basic and diluted |

0.12 |

0.05 |

140 |

0.38 |

0.23 |

65 | ||

|

Net loss |

(13,529) |

(20,681) |

35 |

(10,089) |

(30,747) |

67 | ||

|

Per share ($), basic and diluted |

(0.08) |

(0.13) |

38 |

(0.06) |

(0.21) |

71 | ||

|

Adjusted net loss (1) |

(13,315) |

(20,467) |

35 |

(9,813) |

(29,065) |

66 | ||

|

Per share ($), basic and diluted |

(0.08) |

(0.13) |

38 |

(0.06) |

(0.19) |

68 | ||

|

Funds from operations (1) |

17,376 |

5,994 |

190 |

57,428 |

24,694 |

133 | ||

|

Per share ($), basic and diluted |

0.11 |

0.04 |

175 |

0.35 |

0.17 |

106 | ||

|

Dividends per common share |

0.06125 |

0.06 |

2 |

0.12125 |

0.12 |

1 | ||

|

Capital expenditures (1) |

49,688 |

74,356 |

(33) |

61,784 |

95,845 |

(36) | ||

|

Total assets |

1,417,372 |

1,374,164 |

3 |

1,417,372 |

1,374,164 |

3 | ||

|

Net debt (1) |

88,926 |

69,289 |

28 |

88,926 |

69,289 |

28 | ||

|

Common shares - end of period |

162,949,160 |

159,321,292 |

2 |

162,949,160 |

159,321,292 |

2 | ||

|

Weighted average common shares - basic and diluted |

162,776,950 |

158,437,296 |

3 |

162,421,437 |

149,226,219 |

9 | ||

|

(1) Refer to "Non-GAAP measures, operational definitions and additional subtotals" for further information. | ||||||||

- REVENUE OF $584.3 MILLION AND $1.0 BILLION FOR THE THREE AND SIX MONTHS ENDED JUNE 30, 2017

- Total processing, recovery and disposal volumes at PRD facilities for the three and six months ended June 30, 2017 increased from the 2016 comparative periods due to increased drilling activity levels across the WCSB, ongoing production related volumes and the addition of facilities in 2016, which included the acquisition of the Alida crude oil terminalling facility in June 2016, the increased ownership in the La Glace and Judy Creek FSTs from 50% to 100% in July 2016, and the commissioning of the Kakwa FST in August 2016. Overall, this resulted in the PRD division achieving revenue (excluding oil purchase and resale) of $60.3 million and $127.7 million in the three and six months ended June 30, 2017, up 61% and 48%, respectively, from the comparative periods in 2016;

- Oil purchase and resale revenue in the PRD division for the three and six months ended June 30, 2017 increased by 132% and 152% from the 2016 comparative periods to $469.0 million and $778.8 million due primarily to additional oil purchase and resale volumes from new facilities in 2016, which included the Alida crude oil terminalling facility, the increased ownership in the La Glace and Judy Creek FSTs, and the Kakwa FST;

- Activity in the DPS division is strongly correlated with oil and gas drilling activity in the WCSB, which experienced a 142% and 100% increase in active rig counts in the three and six months ended June 30, 2017 from the 2016 comparative periods. As a result of these improved activity levels, DPS division revenue increased by 202% and 82% to $33.9 million and $84.4 million in the three and six months ended June 30, 2017;

- OS division revenue increased 21% and 23% to $21.2 million and $43.9 million in the three and six months ended June 30, 2017 primarily due to revenue from new service lines and increased activity related to increased oil prices and industry activity compared to the prior year comparative periods.

- ADJUSTED EBITDA OF $20.0 MILLION AND $62.2 MILLION FOR THE THREE AND SIX MONTHS ENDED JUNE 30, 2017

- Adjusted EBITDA of $20.0 million and $62.2 million, a 135% and 85% increase from the 2016 comparative periods, resulted from increased average crude oil prices of 10% and 26% in the three and six months ended June 30, 2017 from the prior year comparative periods. This increase positively impacted all three of the Corporation's divisions. Increased drilling and completion activity positively impacted the DPS and OS divisions while ongoing production related volumes and increased volumes from acquisitions and facility expansions in the second and third quarters of 2016 drove both PRD revenues and operating margins.

- NET LOSS OF $13.5 MILLION AND $10.1 MILLION FOR THE THREE AND SIX MONTHS ENDED JUNE 30, 2017

- For the three and six months ended June 30, 2017, Secure's net loss of $13.5 million and $10.1 million improved from a net loss of $20.7 million and $30.7 million in the three and six months ended June 30, 2016. This improvement resulted from increased activity due to an earlier spring break up in the prior year, new facilities and expansions and the Corporation's continued focus on managing costs.

- ADJUSTED NET LOSS1 OF $13.3 MILLION AND $9.8 MILLION FOR THE THREE AND SIX MONTHS ENDED JUNE 30, 2017

- For the three and six months ended June 30, 2017, Secure's adjusted net loss of $13.3 million and $9.8 million improved by $7.2 million and $19.3 million from an adjusted net loss of $20.5 million and $29.1 million in the three and six months ended June 30, 2016. The positive variance is primarily a result of the factors discussed above impacting Adjusted EBITDA.

- CAPITAL EXPENDITURES OF $49.7 MILLION AND $61.8 MILLION FOR THE THREE AND SIX MONTHS ENDED JUNE 30, 2017

- Total capital expenditures (excluding business combinations) for the three and six months ended June 30, 2017 of $19.4 million and $31.5 million include:

- Equipment upgrades at various PRD facilities to increase capacity including additional tanks and pumps;

- Long lead items for various projects expected to commence in the 3rd and 4th quarters of 2017, including the feeder pipeline; and

- Sustaining capital expenditures at existing facilities required to maintain ongoing business operations

- PRODUCTION CHEMICALS ACQUISITION

- On April 13, 2017, the Corporation acquired the Canadian division of a production chemical business from a U.S. based multi-national company for an aggregate purchase price of $30.3 million, with consideration paid in cash (the "Production Chemicals Acquisition").

- The acquired assets will be integrated into the DPS division's Production Chemicals service line. The acquisition is expected to strengthen Secure's position in the market by adding over 100 fully formulated proprietary products, as well as key infrastructure related to the product offering and an experienced and dedicated employee base.

- The addition of advanced chemical products is expected to improve the Corporation's ability to help customers optimize production, provide flow assurance and maintain the integrity of their production assets. The research lab facility acquired demonstrates the Corporation's commitment to innovation and is intended to design customized chemical solutions for customers. The Corporation expects the Production Chemicals Acquisition to be accretive to funds from operations, Adjusted EBITDA and net income

- FINANCIAL FLEXIBILITY

- The total amount drawn on Secure's credit facilities as at June 30, 2017 increased by 6% to $221.2 million compared to $209.0 million at December 31, 2016. The amount drawn on Secure's credit facilities increased in order to fund the Production Chemicals Acquisition, which was offset by increased cash flows from operating activities. The Corporation continues to maintain its strong balance sheet and increase its financial flexibility to take advantage of accretive opportunities that may arise.

- Secure is in compliance with all covenants related to its credit facilities at June 30, 2017. Secure's senior and total debt to trailing twelve month EBITDA ratios, where EBITDA is defined in the lending agreement as earnings before interest, taxes, depreciation, depletion and amortization, and is adjusted for non-recurring losses, any non-cash impairment charges and any other non-cash charges, and acquisitions on a pro-forma basis, improved to 1.8 to 1 at June 30, 2017 compared to 2.2 to 1.0 at December 31, 2016. As no amount was drawn on the Second Lien Facility until July 5, 2017, senior debt was equal to total debt at June 30, 2017. In future periods senior debt will only be equal to amounts drawn on the First Lien Facility plus financial leases less any cash balances in excess of $5 million, whereas total debt will include senior debt plus the $130 million borrowed under the Second Lien Facility. The maximum covenant for the senior debt to EBITDA ratio is 3.5 to 1, while the total debt to EBITDA ratio is 5.0 to 1.

PRD DIVISION OPERATING HIGHLIGHTS

|

Three months ended June 30, |

Six months ended June 30, | ||||||

|

($000's) |

2017 |

2016 |

% Change |

2017 |

2016 |

% Change | |

|

Revenue |

|||||||

|

PRD services (a) |

60,278 |

37,450 |

61 |

127,748 |

86,156 |

48 | |

|

Oil purchase and resale service |

468,952 |

202,460 |

132 |

778,828 |

309,325 |

152 | |

|

Total PRD division revenue |

529,230 |

239,910 |

121 |

906,576 |

395,481 |

129 | |

|

Direct expenses |

|||||||

|

PRD services (b) |

28,709 |

19,670 |

46 |

56,362 |

42,493 |

33 | |

|

Oil purchase and resale service |

468,952 |

202,460 |

132 |

778,828 |

309,325 |

152 | |

|

Total PRD division direct expenses |

497,661 |

222,130 |

124 |

835,190 |

351,818 |

137 | |

|

Operating Margin (1) (a-b) |

31,569 |

17,780 |

78 |

71,386 |

43,663 |

63 | |

|

Operating Margin (1) as a % of revenue (a) |

52% |

47% |

56% |

51% |

|||

Highlights for the PRD division for the three and six months ended June 30, 2017 included:

- Processing, recovery and disposal services revenue of $60.3 million and $127.7 million for the three and six months ended June 30, 2017 increased by 61% and 48% from the 2016 comparative periods, driven by higher facility volumes, largely contributed from the new facilities added in 2016 and expansions at certain of the Corporation's existing facilities in 2016 and the first quarter of 2017, and higher drilling and completion related volumes resulting from the increase in average crude oil prices.

- The addition of new facilities, both organically and through acquisitions, accounted for $7.8 million and $14.2 million of the PRD services revenue in the three and six months ended June 30, 2017, an impact of 21% and 16% when comparing to the same periods of 2016.

- Processing volumes increased 28% and 24% in the three and six months ended June 30, 2017 from the comparative periods due to higher waste processing, emulsion and completions processing volumes.

- Recovery and terminalling revenues increased 85% and 74% in the three and six months ended June 30, 2017 from the comparative periods which is consistent with an 88% and 74% increase in recovery and terminalling volumes. The increase was driven by the Alida crude oil terminalling facility and crude oil marketing activities at the Corporation's pipeline connected FSTs.

- Disposal volumes increased by 36% and 26% in the three and six months ended June 30, 2017 from the comparative periods due primarily to increased disposal of waste at Secure's landfills resulting from higher drilling activity levels. Further driving the increase in disposal volumes is increased produced and waste water volumes across Secure's facilities from the comparative periods driven by increasing water production as wells mature and industry activity.

- Oil purchase and resale revenue in the PRD division for the three and six months ended June 30, 2017 increased by 132% and 152% from the 2016 comparative periods to $469.0 million and $778.8 million due primarily to additional oil purchase and resale volumes from new facilities in 2016, which included the Alida crude oil terminalling facility, the increased ownership in the La Glace and Judy Creek FSTs, and the Kakwa FST. The new facilities added in 2016 accounted for 46% and 43% of oil purchase and resale revenue in the three and six months ended June 30, 2017, or 107% and 109% of the increase over the three and six months ended June 30, 2016.

- Direct expenses from PRD services increased by 46% and 33% in the three and six months ended June 30, 2017 from the comparative periods of 2016. The increase in direct expenses relates primarily to the increased revenue as the Corporation maintains its ability to respond to higher activity levels while managing its fixed and variable costs.

- Operating margin as a percentage of PRD services revenue for the three and six months ended June 30, 2017 increased to 52% and 56% from 47% and 51% in the comparative periods of 2016. The increase in operating margin as a percentage of revenue over 2016 is due to increased revenues while minimizing fixed and related costs. The Corporation's revised cost management structure has resulted in improved operating margins realized across various facilities including FSTs, SWDs and landfills.

- General and administrative ("G&A") expenses of $4.4 million and $8.4 million for the three and six months ended June 30, 2017 increased by 61% and 40% from the comparative periods. Although the Corporation continues to minimize G&A costs by streamlining operations where possible, PRD G&A expenses have increased primarily due to the acquisitions completed in 2016 and the overhead requirements to support new facilities and expansions. As a percentage of PRD revenue, G&A costs have remained consistent at 7% for the three and six months ended June 30, 2017 and 2016.

DPS DIVISION OPERATING HIGHLIGHTS

|

Three months ended June 30, |

Six months ended June 30, | ||||||

|

($000's) |

2017 |

2016 |

% Change |

2017 |

2016 |

% Change | |

|

Revenue |

|||||||

|

Drilling and production services (a) |

33,921 |

11,235 |

202 |

84,389 |

46,442 |

82 | |

|

Direct expenses |

|||||||

|

Drilling and production services (b) |

31,878 |

12,396 |

157 |

70,745 |

42,123 |

68 | |

|

Operating Margin (1) (a-b) |

2,043 |

(1,161) |

276 |

13,644 |

4,319 |

216 | |

|

Operating Margin (1) as a % of revenue (a) |

6% |

-10% |

16% |

9% |

|||

|

(1) Refer to "Non-GAAP measures, operational definitions and additional subtotals" for further information. | |||||||

Highlights for the DPS division for the three and six months ended June 30, 2017 included:

- Revenue in the DPS division correlates with oil and gas drilling activity in the WCSB, most notably active rig counts and metres drilled. Commodity pricing, weather conditions and activity levels from oil and gas producers have a significant impact on the DPS division. For the three and six months ended June 30, 2017, industry rig counts in the WCSB increased 142% and 100%, and metres drilled increased 215% and 141% from the 2016 comparative periods. Revenue from the DPS division for the three and six months ended June 30, 2017 increased 202% and 82% to $33.9 million and $84.4 million from the comparative periods of 2016. Average crude oil price increases and improved weather conditions during the three and six months ended June 30, 2017 compared to the 2016 comparative periods drove increased industry activity strengthening the DPS division's revenue in 2017.

- Revenue per operating day decreased to $7,417 and $6,221 during the three and six months ended June 30, 2017 compared to the same periods in 2016 which generated revenue of $10,327 and $7,947 per operating day. The variance is a result of the geographic location and depth of wells which impacts the type of fluid used. In the second quarter of 2016 the Corporation was servicing a particular geographic location for certain customers resulting in a higher revenue per operating day but with fewer operating days resulting in lower revenues.

- The DPS division's market share increased to 24% in the three months ended June 30, 2017 from 19% in the 2016 comparative period. The timing, type and location of one customer's drilling activities can create fluctuations in the market share from period to period.

- Secure continues diversification efforts in the DPS division to become less dependent on drilling activity through expansion of the production chemicals and chemical EOR service lines which will benefit the Corporation in the medium to long-term. Strategic relationships with key suppliers and ongoing product development has resulted in a significant expansion to Secure's product offering resulting in multiple commercial projects in 2017. The Production Chemicals Acquisition completed on April 13, 2017 is expected to strengthen Secure's position in the market by adding over 100 fully formulated proprietary products, as well as key infrastructure related to the product offering and an experienced and dedicated employee base.

- The DPS division's direct expenses for the three and six months ended June 30, 2017 increased by 157% and 68% to $31.9 million and $70.7 million from the 2016 comparative periods. Overall, the increase in direct expenses from the 2016 period was primarily due to increased activity levels and is consistent with the increased revenues discussed above.

- The DPS division's operating margin for the three and six months ended June 30, 2017 improved by 276% and 216% from the 2016 comparative periods to $2.0 million and $13.6 million.

- Operating margin as a percentage of revenue increased to 6% and 16% in the three and six months ended June 30, 2017 from -10% and 9% in the comparative periods. Operating margins as a percentage of revenue were positively impacted by the increased revenues while minimizing fixed costs resulting in improved drilling fluids product margins and achieving economies of scale as activity increases.

- G&A expense for the three and six months ended June 30, 2017 increased by 49% and 23% from the comparative periods of 2016. Although the Corporation continues to manage costs efficiently and proactively while still responding to customer demands and activity levels, G&A expenses have increased as a result of expanding the production chemicals and chemical EOR service lines, including the Production Chemicals Acquisition in the second quarter of 2017. As a percentage of DPS revenue, G&A expenses have decreased to 10% and 8% in the three and six months ended June 30, 2017 from 21% and 12% in the prior year comparative periods.

OS DIVISION OPERATING HIGHLIGHTS

|

Three months ended June 30, |

Six months ended June 30, | ||||||

|

($000's) |

2017 |

2016 |

% Change |

2017 |

2016 |

% Change | |

|

Revenue |

|||||||

|

OnSite services (a) |

21,173 |

17,463 |

21 |

43,948 |

35,817 |

23 | |

|

Direct expenses |

|||||||

|

OnSite services (b) |

16,953 |

13,437 |

26 |

34,139 |

27,204 |

25 | |

|

Operating Margin (1) (a-b) |

4,220 |

4,026 |

5 |

9,809 |

8,613 |

14 | |

|

Operating Margin (1) as a % of revenue (a) |

20% |

23% |

22% |

24% |

|||

|

(1) Refer to "Non-GAAP measures, operational definitions and additional subtotals" for further information. | |||||||

Highlights for the OS division for the three and six months ended June 30, 2017 included:

- Diversified service lines and integrated service offerings, complemented by increased average oil prices and producer activity in the three and six months ended June 30, 2017 drove a 21% and 23% increase in OS division revenue to $21.2 million and $43.9 million in the three and six months ended June 30, 2017.

- Projects revenue during the three and six months ended June 30, 2017 increased 25% and 30% from the 2016 comparative periods. Projects revenue is dependent on the type and size of jobs as well as weather conditions, which can vary quarter to quarter. In the three and six months ended June 30, 2017, Projects revenue increased primarily as a result of jobs with new customers, new service offerings, regional expansion and acceptable weather conditions given the operating locations and time of year. The Projects service line continues to bid on larger scale work as producers increase their capital spending.

- Integrated fluids solutions revenue for the three and six months ended June 30, 2017 increased 27% and 26% from the 2016 comparative periods. Revenue increased due to overall improved industry activity and improved weather conditions compared to the three and six months ended June 30, 2016. The IFS services experienced increased utilization as well as the demand for completing wells carried over from the first quarter of 2017, and new customers were added which contributed to the overall revenue increase.

- Environmental services revenue for the three and six months ended June 30, 2017 increased 18% and 7% from the 2016 comparative periods, driven by higher drilling waste and bin revenue due to increased industry activity. These increases were partially offset by a decrease in reclamation and remediation revenue resulting from deferred customer spending created by relatively low commodity prices.

- Direct expenses for the three and six months ended June 30, 2017 increased 26% and 25% to $17.0 million and $34.1 million from the 2016 comparative periods. Overall, the variance in direct expenses was a direct result of the change in activity levels from the 2016 comparative periods. Additionally, operating overhead expenses have been reduced in order to match activity levels. These reductions were partially offset by operating expenses associated with new service lines offered by the OS division this year.

- The three and six months ended June 30, 2017 operating margins in the OS division of $4.2 million and $9.8 million improved by 5% and 14% over the prior year comparative periods due primarily to increased revenue. The operating margin as a percentage of revenue for the OS division in the three and six months ended June 30, 2017 was 20% and 22%, a slight decrease from 23% and 24% in the comparative 2016 periods. The OS division's operating margin as a percentage of revenue can fluctuate depending on the volume and type of projects undertaken and the blend of business between remediation and reclamation projects, demolition projects, pipeline integrity projects, site clean-up, and other services in any given period. As a percentage of revenue, the operating margin in the three and six months ended June 30, 2017 decreased from the comparative periods due to seasonality of activity and mix of customers work. Typically, in the second quarter equipment repairs and maintenance are performed to prepare for the increased activity in the third and fourth quarters.

- G&A expenses for the three and six months ended June 30, 2017 increased by $0.6 million and $1.3 million from the 2016 comparative periods to $2.2 million and $4.2 million due primarily to increased costs to support geographic expansion of Environmental services including bins and NORM management in the U.S.

OUTLOOK

The second quarter of 2017 results were in line with the Corporation's expectations as industry activity increased significantly compared to the second quarter of 2016. Currently, drilling and completion activities remain robust for the third quarter of 2017 and production related volumes have continued to increase at Secure's PRD facilities.

Secure continues to respond to customer demand by evaluating multiple opportunities relating to new infrastructure, as evidenced by the feeder pipeline project, and new and expanding facilities in the capacity constrained Montney region. Secure anticipates organic capital spending to be up to $100 million in 2017 subject to the timing of obtaining remaining permits for the feeder pipeline and other projects; and will spend approximately $15 million on sustaining and maintenance expenditures for the year within the PRD division. The Corporation will also continue to pursue opportunities for rail services, frac water hubs and water recycling, and expansion of services in the Fort McMurray region.

On May 15, 2017, Secure announced that it entered into an agreement to acquire Ceiba. The acquisition closed on August 1, 2017 and adds ten facilities to Secure's existing PRD facility network, increasing capacity and expanding the Corporation's geographic footprint. Secure expects to realize immediate volume increases in the third quarter of 2017 and plans to allocate incremental capital to the assets to enhance throughput and service capabilities. The acquisition enables Secure to expand its facility network while realizing synergies related to senior management, sales and general and administration costs.

The Production Chemicals Acquisition completed in the second quarter adds sizeable blending capacity and incremental revenue to our growing production chemicals service line, providing a platform capable of significant revenue growth with no further capital investment. The Corporation will continue to leverage off existing operator relationships and technical capabilities as we strive for increasing market share throughout the WCSB.

Secure's consistently strong balance sheet gives the Corporation flexibility to grow organically and to execute on strategic acquisition opportunities. Secure's focus remains on increasing production related services with a diverse asset base that lessens dependence on drilling related revenue streams. This diversification provides Secure with greater certainty on re-occurring cash flows and ensures the Corporation can optimize its capital structure to be well positioned for future growth.

AUTOMATIC SHARE DISPOSITION PLAN

The Corporation also announced today that Rene Amirault, President and Chief Executive Officer, and Amirault Partnership intend to adopt an automatic securities disposition plan ("ASDP") in accordance with applicable Canadian provincial securities legislation, including the guidance under the Ontario Securities Commission's Staff Notice 55-701. The objective of the ASDP is to facilitate the sale of up to 1,200,000 common shares of Secure held by Amirault Partnership, of which Mr. Amirault and The Rene Amirault Family Trust are the partners, during the term of the ASDP from August 4, 2017 to August 4, 2018. These shares represent approximately 28.5% of the total common shares under Mr. Amirault's control. Among other things, the ASDP provides for a minimum sales price of $10.00 and that not more than 100,000 shares may be sold each month.

Generally, Canadian securities legislation permits an insider to adopt a written ASDP to sell shares through an independent broker in accordance with a pre-arranged set of instructions, regardless of any subsequent material non-public information the insider may receive, as long as the ASDP satisfies certain requirements. In accordance with Canadian securities legislation, sales of shares under the ASDP will be effected by an independent securities broker in accordance with the trading parameters and other instructions set out in the ASDP. Mr. Amirault will not exercise any further discretion or influence over how dispositions will occur under the ASDP and the broker administrating the ASDP is not permitted to consult with him regarding any such dispositions. In addition, Mr. Amirault is subject to restrictions on his ability to modify, suspend or terminate his participation in the ASDP. In accordance with best practices, the ASDP includes a waiting period of 30 days between the date of adoption of the ASDP and the date the first disposition can be made under the ASDP. Dispositions pursuant to the ASDP will be reported on SEDI on an annual basis by no later than March 31 of each calendar year for all dispositions during the prior calendar year.

Secure recognizes that insiders may have reasons unrelated to their assessment of the Corporation or its prospects in deciding to sell shares of the Corporation. Secure also recognizes that many of its officers have a substantial portion of their personal net worth represented by shares of Secure and that such individuals are subject to lengthy restrictions on their ability to effect trades in Secure's shares because of trading blackouts imposed under the Company's Policy on Trading in Securities. The ASDP entered into by Mr. Amirault is intended to provide an orderly mechanism for Mr. Amirault to diversify his portfolio.

FINANCIAL STATEMENTS AND MD&A

The Corporation's unaudited condensed consolidated financial statements and notes thereto for the three and six months ended June 30, 2017 and 2016 and MD&A for the three and six months ended June 30, 2017 and 2016 are available immediately on Secure's website at www.secure-energy.com. The unaudited condensed consolidated financial statements and MD&A will be available tomorrow on SEDAR at www.sedar.com.

FORWARD-LOOKING STATEMENTS

Certain statements contained in this news release constitute "forward-looking statements" and/or "forward-looking information" within the meaning of applicable securities laws (collectively referred to as forward-looking statements). When used in this document, the words "may", "would", "could", "will", "intend", "plan", "anticipate", "believe", "estimate", "expect", and similar expressions, as they relate to Secure, or its management, are intended to identify forward-looking statements. Such statements reflect the current views of Secure with respect to future events and operating performance and speak only as of the date of this document. In particular, this document contains or implies forward-looking statements pertaining to: key priorities for the Corporation's success; the oil and natural gas industry; activity levels in the oil and gas sector, drilling levels, commodity prices for oil, natural gas liquids and natural gas; industry fundamentals for 2017; capital forecasts and spending by producers; demand for the Corporation's services and products; expansion strategy; the impact of oil and gas activity on 2017 activity levels; the Corporation's proposed 2017 capital expenditure program including growth, sustaining and maintenance capital expenditures; debt service; acquisition strategy and timing of potential acquisitions; the impact of new facilities, potential acquisitions, and the Production Chemicals Acquisition and Ceiba acquisition on the Corporation's financial and operational performance and growth opportunities; future capital needs and how the Corporation intends to fund its operations, working capital requirements, dividends and capital program; access to capital; and the Corporation's ability to meet obligations and commitments and operate within any credit facility restrictions.

Forward-looking statements concerning expected operating and economic conditions, including the Production Chemicals Acquisition and Ceiba Acquisition, are based upon prior year results as well as the assumption that levels of market activity and growth will be consistent with industry activity in Canada and the U.S. and similar phases of previous economic cycles. Forward-looking statements concerning the availability of funding for future operations are based upon the assumption that the sources of funding which the Corporation has relied upon in the past will continue to be available to the Corporation on terms favorable to the Corporation and that future economic and operating conditions will not limit the Corporation's access to debt and equity markets. Forward-looking statements concerning the relative future competitive position of the Corporation are based upon the assumption that economic and operating conditions, including commodity prices, crude oil and natural gas storage levels, interest and foreign exchange rates, the regulatory framework regarding oil and natural gas royalties, environmental regulatory matters, the ability of the Corporation and its subsidiaries to successfully market their services and drilling and production activity in North America will lead to sufficient demand for the Corporation's services and its subsidiaries' services including demand for oilfield services for drilling and completion of oil and natural gas wells, that the current business environment will remain substantially unchanged, and that present and anticipated programs and expansion plans of other organizations operating in the energy industry may change the demand for the Corporation's services and its subsidiaries' services. Forward-looking statements concerning the nature and timing of growth are based on past factors affecting the growth of the Corporation, past sources of growth and expectations relating to future economic and operating conditions. Forward-looking statements in respect of the costs anticipated to be associated with the acquisition and maintenance of equipment and property are based upon assumptions that future acquisition and maintenance costs will not significantly increase from past acquisition and maintenance costs.

Forward-looking statements involve significant risks and uncertainties, should not be read as guarantees of future performance or results, and will not necessarily be accurate indications of whether such results will be achieved. Readers are cautioned not to place undue reliance on these statements as a number of factors could cause actual results to differ materially from the results discussed in these forward-looking statements, including but not limited to those factors referred to and under the heading "Business Risks" and under the heading "Risk Factors" in the AIF for the year ended December 31, 2016 and also includes the risks associated with the possible failure to realize the anticipated synergies in integrating the assets acquired in the Production Chemicals Acquisition and Ceiba Acquisition with the operations of Secure. Although forward-looking statements contained in this document are based upon what the Corporation believes are reasonable assumptions, the Corporation cannot assure investors that actual results will be consistent with these forward-looking statements. The forward-looking statements in this document are expressly qualified by this cautionary statement. Unless otherwise required by law, Secure does not intend, or assume any obligation, to update these forward-looking statements.

NON-GAAP MEASURES, OPERATIONAL DEFINITIONS AND ADDITIONAL SUBTOTALS

The Corporation uses accounting principles that are generally accepted in Canada (the issuer's "GAAP"), which includes International Financial Reporting Standards ("IFRS"). Certain supplementary measures in this document do not have any standardized meaning as prescribed by IFRS. These non-GAAP measures, operational definitions and additional subtotals used by the Corporation may not be comparable to similar measures presented by other reporting issuers. These non-GAAP financial measures, operational definitions and additional subtotals are included because management uses the information to analyze operating performance, leverage and liquidity. Therefore, these non-GAAP financial measures, operational definitions and additional subtotals should not be considered in isolation or as a substitute for measures of performance prepared in accordance with GAAP. See the management's discussion and analysis available at www.sedar.com for a reconciliation of the Non-GAAP financial measures, operational definitions and additional subtotals.

ABOUT SECURE ENERGY SERVICES INC.

Secure is a TSX publicly traded energy services company that provides safe, innovative, efficient and environmentally responsible fluids and solids solutions to the oil and gas industry. The Corporation owns and operates midstream infrastructure and provides environmental services and innovative products to upstream oil and natural gas companies operating in western Canada and certain regions in the United States ("U.S.").

The Corporation operates three divisions:

Processing, Recovery and Disposal Division ("PRD"): The PRD division owns and operates midstream infrastructure that provides processing, storing, shipping and marketing of crude oil, oilfield waste disposal and recycling. More specifically these services are clean oil terminalling and rail transloading, custom treating of crude oil, crude oil marketing, produced and waste water disposal, oilfield waste processing, landfill disposal, and oil purchase/resale service. Secure currently operates a network of facilities throughout Western Canada and in North Dakota, providing these services at its full service terminals ("FST"), landfills, stand-alone water disposal facilities ("SWD") and full service rail facilities ("FSR").

Drilling and Production Services Division ("DPS"): The DPS division provides equipment and product solutions for drilling, completion and production operations for oil and gas producers in western Canada. The drilling service line comprises the majority of the revenue for the division which includes the design and implementation of drilling fluid systems for producers drilling for oil, bitumen and natural gas. The drilling service line focuses on providing products and systems that are designed for more complex wells, such as medium to deep wells, horizontal wells and horizontal wells drilled into the oil sands. The production services line focuses on providing equipment and chemical solutions that optimize production, provide flow assurance and maintain the integrity of production assets.

Onsite Services Division ("OS"): The operations of the OS division include Projects which include pipeline integrity (inspection, excavation, repair, replacement and rehabilitation), demolition and decommissioning, and reclamation and remediation of former wellsites, facilities, commercial and industrial properties, and environmental construction projects (landfills, containment ponds, subsurface containment walls, etc.); Environmental services which provide pre-drilling assessment planning, drilling waste management, remediation and reclamation assessment services, Naturally Occurring Radioactive Material ("NORM") management, waste container services, and emergency response services; and Integrated Fluid Solutions ("IFS") which include water management, recycling, pumping and storage solutions.

|

______________________________ |

|

1 Refer to the "Non-GAAP Measures, operational definitions and additional subtotals" section herein. |

SOURCE SECURE Energy Services Inc.