News Releases

Stay in the know

CALGARY, March 1, 2017 /CNW/ - Secure Energy Services Inc. ("Secure" or the "Corporation") (TSX – SES) today announced operational and financial results for the three and twelve months ended December 31, 2016. The following should be read in conjunction with the management's discussion and analysis ("MD&A") and the annual audited consolidated financial statements and notes thereto of Secure which are available on SEDAR at www.sedar.com.

Secure also announced today that it intends to suspend its Dividend Reinvestment Plan ("DRIP"). The Corporation's strong balance sheet provides significant flexibility to fund future growth without the dilutive impact to shareholders. Commencing with the April 1, 2017 dividend declaration, shareholders participating in the DRIP at that time will receive cash dividends starting with the April 17, 2017 dividend payment date.

ANNUAL OPERATIONAL AND FINANCIAL HIGHLIGHTS

2016 was another challenging year for the oil and gas industry. The steep and rapid deterioration in commodity prices beginning in late 2014 impacted industry cash flows, resulting in reduced capital investment and drilling activity across the Western Canadian Sedimentary Basin ("WCSB").

However, the Corporation has continued to demonstrate resilience during this period of reduced oil and gas activity levels on the back of production related volumes in the Processing, Recovery and Disposal ("PRD") division, the addition of new facilities in underserved markets, both through organic growth and acquisitions, a focus on cost controls, and diversification of services offered across the Corporation. As a result, during the year ended December 31, 2016, Secure realized Adjusted EBITDA of $94.1 million.

In 2016, Secure demonstrated its ability to achieve numerous operational successes and generate positive cash flows during an extended downturn in oil and gas activity and in a relatively poor commodity price environment. Furthermore, the Corporation was also able to expand its market presence and enhance its service offerings by taking advantage of accretive acquisition opportunities throughout the year. Operational highlights for 2016 include:

- Completing construction of the Kakwa Full Service Terminal ("FST"), a facility that was designed and constructed to meet specific customer requirements in a capacity constrained region;

- Expanding Secure's midstream facility network in Saskatchewan through the acquisition of PetroLama Energy Canada Inc. ("PetroLama") and the expansion of the Corporation's Kindersley FST to increase capacity and throughput;

- Increased ownership from 50 to 100 percent at its La Glace and Judy Creek facilities, which relieved Secure from administrative requirements under a joint venture structure while adding cash flow;

- Increasing capacity to meet demand at various existing facilities by adding additional tanks and disposal wells, and expanding landfill cells;

- Performing various drilling, completion, production and remediation services for ten of the most active drillers in western Canada;

- Gaining customer traction with the Drilling and Production Services ("DPS") division's new production chemicals and enhanced oil recovery ("EOR") service line;

- Enhancing the OnSite ("OS") division's reputation for completing successful projects on pipeline integrity, demolition and decommissioning, and reclamation and remediation of contaminated sites;

- Working with customers operating in the Alberta Deep Basin and Duvernay Formation on water recycling, storage and logistics.

The equity offering completed in the first quarter of 2016 further strengthened the Corporation's balance sheet and provided significant financial flexibility to pursue accretive acquisitions and continue to invest in organic capital projects in capacity constrained regions. The Corporation continues its disciplined approach to maintaining a strong balance sheet to effectively manage the business through a period of deteriorating commodity prices and industry activity. As a result of this approach, Secure has maintained a debt to EBITDA ratio, as defined by the Corporation's credit facility, of 2.2 to 1 at December 31, 2016, well below many other oilfield service providers during the extended downturn in oil and gas activity.

The operating and financial highlights for the year ended December 31, 2016 and each of the previous two years can be summarized as follows:

|

Twelve months ended Dec 31, | ||||

|

($000's except share and per share data) |

2016 |

2015 |

2014 | |

|

Revenue (excludes oil purchase and resale) |

393,159 |

560,898 |

794,590 | |

|

Oil purchase and resale |

1,016,904 |

785,527 |

1,477,061 | |

|

Total revenue |

1,410,063 |

1,346,425 |

2,271,651 | |

|

Adjusted EBITDA (1) |

94,100 |

126,652 |

208,990 | |

|

Per share ($), basic |

0.61 |

0.95 |

1.75 | |

|

Per share ($), diluted |

0.61 |

0.95 |

1.71 | |

|

Net (loss) earnings |

(48,943) |

(159,870) |

30,651 | |

|

Per share ($), basic |

(0.32) |

(1.20) |

0.26 | |

|

Per share ($), diluted |

(0.32) |

(1.20) |

0.25 | |

|

Adjusted net (loss) earnings (1) |

(48,111) |

(30,166) |

59,246 | |

|

Per share ($), basic |

(0.31) |

(0.23) |

0.50 | |

|

Per share ($), diluted |

(0.31) |

(0.23) |

0.48 | |

|

Funds from operations (1) |

97,291 |

89,905 |

184,624 | |

|

Per share ($), basic |

0.63 |

0.67 |

1.55 | |

|

Per share ($), diluted |

0.63 |

0.67 |

1.51 | |

|

Dividends per common share |

0.24 |

0.24 |

0.19 | |

|

Capital expenditures (1) |

150,877 |

117,518 |

400,806 | |

|

Total assets |

1,425,250 |

1,315,420 |

1,496,117 | |

|

Long-term liabilities |

336,830 |

393,774 |

522,557 | |

|

Common Shares - end of period |

160,652,221 |

137,708,127 |

121,367,451 | |

|

Weighted average common shares |

||||

|

basic |

154,625,869 |

133,380,634 |

119,272,994 | |

|

diluted |

154,625,869 |

133,380,634 |

122,364,419 | |

|

(1)Refer to "Non-GAAP measures, operational definitions and additional subtotals" for further information. | ||||

- REVENUE OF $1,410.1 MILLION FOR THE YEAR ENDED DECEMBER 31, 2016

- Total processing, recovery and disposal volumes at PRD facilities for the year ended December 31, 2016 decreased from the 2015 comparative periods as poor weather conditions during the second and third quarters and continued low oil prices during the year negatively impacted volumes at PRD facilities from drilling and completion related activities. The impact of the above to the PRD division's revenue was partially mitigated by ongoing production related volumes and the addition of facilities in 2015 and 2016, which included the construction and commissioning of Tulliby Lake FST, Kakwa FST, Big Mountain stand-alone water disposal facility ("SWD"), and Wonowon SWD, the conversion of the Rycroft full service rail facility ("FSR") to include water disposal services, the conversion of the 13 Mile facility from an SWD to an FST, the acquisition of the Alida crude oil terminalling facility from PetroLama in June 2016, and the increased ownership in the La Glace and Judy Creek FSTs from 50% to 100% in July 2016. Overall, this resulted in the PRD division achieving revenue (excluding oil purchase and resale) of $198.8 million in 2016, down 18% from 2015;

- Oil purchase and resale revenue in the PRD division for the year ended December 31, 2016 increased by 29% from the 2015 comparative period to $1,016.9 million due primarily to additional oil purchase and resale volumes related to the newly acquired Alida crude oil terminalling facility, the Kakwa FST commissioned in 2016 and the increased ownership in the La Glace and Judy Creek FSTs;

- Activity in the DPS division is strongly correlated with oil and gas drilling activity in the WCSB, which experienced a 33% decline in active rig count in 2016 from 2015 levels. As a result of these decreased activity levels and pricing pressures, DPS division revenue decreased by 42% to $111.3 million in 2016;

- OS division revenue decreased 34% in 2016 primarily due to reduced Projects revenue resulting from two significant jobs in 2015 for which there was no equivalents in 2016, wet weather conditions in the second and third quarters restricting site access and delaying job starts, and lower completion activities given the poor weather conditions and relatively low oil price during the year. The impact to revenue was partially mitigated by new service offerings and geographic expansion.

- ADJUSTED EBITDA OF $94.1 MILLION FOR THE YEAR ENDED DECEMBER 31, 2016

- Adjusted EBITDA of $94.1 million, a 26% decrease from 2015 and comparable to the decline in revenue as Secure has streamlined operations decreasing fixed costs across the Corporation's cost structure, resulting in strong operating margin percentages.

- Adjusted EBITDA in 2016 was impacted by unseasonable weather conditions in the middle of the year causing a reduction in drilling and completion activity throughout the WCSB which most heavily impacted the DPS division as the majority of operations are tied directly to drilling operations. The decrease in the PRD division was partially offset by ongoing production related volumes, the construction of new facilities in 2015 and 2016 and expansions at certain of the Corporation's existing facilities in the past year, two acquisitions, and cost saving initiatives implemented in 2015 and 2016 which have resulted in a strong operating margin and reduced general and administrative costs. The decrease in the OS division due to project work delays resulting from wet weather, and reduced services correlated to completions activity was somewhat mitigated by geographic expansion, new and diversified service lines and integrated service offerings.

- NET LOSS OF $48.9 MILLION FOR THE YEAR ENDED DECEMBER 31, 2016

- For the year ended December 31, 2016, Secure's net loss of $48.9 million improved by 69% compared to the net loss of $159.9 million in 2015. The decrease in net loss is primarily a result of non-cash impairments of non-current assets totaling $157.7 million recorded in the second half of 2015 in response to the decrease in commodity prices and industry activity levels.

- For the year ended December 31, 2016, Secure's net loss of $48.9 million improved by 69% compared to the net loss of $159.9 million in 2015. The decrease in net loss is primarily a result of non-cash impairments of non-current assets totaling $157.7 million recorded in the second half of 2015 in response to the decrease in commodity prices and industry activity levels.

- ADJUSTED NET LOSS OF $48.1 MILLION FOR THE YEAR ENDED DECEMBER 31, 2016

- For the year ended December 31, 2016, Secure's adjusted net loss of $48.1 million increased from $30.2 million in 2015 primarily as a result of the factors discussed above impacting Adjusted EBITDA, partially offset by lower general and administrative expenses and business development expenses as the Corporation is realizing the benefit of the cost saving initiatives implemented in 2015 and 2016. Secure has reduced personnel levels to match current industry activity levels, as well as reduced discretionary spending and streamlined and consolidated support functions where possible.

- For the year ended December 31, 2016, Secure's adjusted net loss of $48.1 million increased from $30.2 million in 2015 primarily as a result of the factors discussed above impacting Adjusted EBITDA, partially offset by lower general and administrative expenses and business development expenses as the Corporation is realizing the benefit of the cost saving initiatives implemented in 2015 and 2016. Secure has reduced personnel levels to match current industry activity levels, as well as reduced discretionary spending and streamlined and consolidated support functions where possible.

- 2016 CAPITAL EXPENDITURES OF $150.9 MILLION FOR THE YEAR ENDED DECEMBER 31, 2016

- Excluding business acquisitions, capital expenditures for the year ended December 31, 2016 of $62.6 million include:

- Construction of the Kakwa FST, which opened in August 2016;

- Disposal well additions at the Kaybob and Big Mountain SWD facilities;

- Cell expansions at the South Grande Prairie and Fox Creek landfills;

- Expansion of the Kindersley FST to increase storage and throughput capacity; and

- Sustaining capital expenditures at existing facilities required to maintain ongoing business operations.

- Excluding business acquisitions, capital expenditures for the year ended December 31, 2016 of $62.6 million include:

- PETROLAMA ACQUISITION

- On June 1, 2016, Secure closed the acquisition of all the operating assets (excluding working capital) of PetroLama ("PetroLama Acquisition"). The main asset acquired by the Corporation from PetroLama is a crude oil terminal in Alida, Saskatchewan which is connected to the Tundra Energy Marketing Limited (formerly Enbridge Pipelines (Saskatchewan) Inc.) pipeline system and includes truck unload risers and storage tanks. Secure also acquired various marketing contracts relating to the purchase, sale and transportation of propane, butane and condensate.

- The PetroLama Acquisition provides Secure with an attractive entry point into the southeast Saskatchewan midstream market. Secure has expanded its market presence and enhanced its service offering for continued midstream growth. The Alida terminal, a facility constructed in 2013, is uniquely positioned for sustainable cash flow generation in a new market area. Secure expects to leverage PetroLama's existing business into further growth opportunities and build upon PetroLama's relationships with oil producers, marketers and refiners with its breadth of oil and gas services. Secure expects its size and strong history of operational expertise in the PRD division will allow the Corporation to achieve additional operating efficiencies.

- The purchase price was paid with $61.7 million in cash and the balance of $5.9 million through the issuance of 664,972 common shares of the Corporation ("Common Shares"), and included $13.8 million of crude oil inventory stored at Cushing, Oklahoma. The value of the oil inventory fluctuates with oil prices and the U.S. dollar. At December 31, 2016, the oil inventory was valued at $15.6 million and is hedged with futures contracts. Subsequent to December 31, 2016 the oil inventory was sold and the storage lease expired on January 31, 2017.

- JV ACQUISITION

- On July 12, 2016, Secure completed the acquisition of the outstanding 50% interest in all of the joint venture assets of the La Glace and Judy Creek facilities (the "JV Acquisition"), increasing Secure's interest in these facilities to 100%.

- The purchase price of $26.6 million included working capital and was funded through existing capacity under the Corporation's credit facility. The JV Acquisition relieves Secure of the administrative requirements of operating the facilities under a joint venture structure, while adding additional cash flow from an increase in ownership in the facilities.

- FINANCIAL FLEXIBILITY

- On March 22, 2016, the Corporation completed a bought deal common share financing (the "Offering"), issuing a total of 19,550,000 Common Shares at a price of $7.65 per Common Share for gross proceeds of $149.6 million. Proceeds of the Offering have been used to repay outstanding debt and fund the cash portion of the PetroLama Acquisition and JV Acquisition, with the remaining balance expected to be used to fund capital expenditures, for other strategic acquisition opportunities, and/or general working capital purposes.

- The total amount drawn on Secure's credit facility as at December 31, 2016 decreased by 20% to $209.0 million compared to $262.0 million at December 31, 2015. The Corporation strengthened its balance sheet and increased its financial flexibility to take advantage of opportunities during the current low commodity price environment.

- Secure is in compliance with all covenants related to its credit facility at December 31, 2016. Secure's debt to trailing twelve month EBITDA ratio, where EBITDA is defined in the lending agreement as earnings before interest, taxes, depreciation, depletion and amortization, and is adjusted for non-recurring losses, any non-cash impairment charges and any other non-cash charges, and acquisitions on a pro-forma basis, was 2.2 to 1 as at December 31, 2016 (2015 – 2.2 to 1).

FOURTH QUARTER OPERATIONAL AND FINANCIAL HIGHLIGHTS

|

Three months ended Dec 31, | ||||

|

($000's except share and per share data) |

2016 |

2015 |

% change | |

|

Revenue (excludes oil purchase and resale) |

124,584 |

129,770 |

(4) | |

|

Oil purchase and resale |

405,939 |

160,203 |

153 | |

|

Total revenue |

530,523 |

289,973 |

83 | |

|

Adjusted EBITDA (1) |

33,046 |

31,808 |

4 | |

|

Per share ($), basic |

0.21 |

0.23 |

(9) | |

|

Net loss |

(10,075) |

(86,825) |

(88) | |

|

Per share ($), basic and diluted |

(0.06) |

(0.63) |

(90) | |

|

Adjusted net loss(1) |

(11,430) |

(14,650) |

(22) | |

|

Per share ($), basic |

(0.07) |

(0.11) |

(36) | |

|

Funds from operations (1) |

33,978 |

25,631 |

33 | |

|

Per share ($), basic |

0.21 |

0.19 |

11 | |

|

Dividends per common share |

0.06 |

0.06 |

- | |

|

Capital expenditures (1) |

15,408 |

29,359 |

(48) | |

|

Total assets |

1,425,250 |

1,315,420 |

8 | |

|

Common Shares - end of period |

160,652,221 |

137,708,127 |

17 | |

|

Weighted average common shares - basic and diluted |

160,314,786 |

137,500,242 |

17 | |

|

(1)Refer to "Non-GAAP measures, operational definitions and additional subtotals" for further information. | ||||

- REVENUE OF $530.5 MILLION FOR THE THREE MONTHS ENDED DECEMBER 31, 2016

- Total processing, recovery and disposal volumes at PRD facilities for the three months ended December 31, 2016 increased approximately 6% from the 2015 comparative period due primarily to the addition of new facilities subsequent to December 31, 2015 and contributions from the PetroLama and JV Acquisitions in 2016. The increased volumes, combined with an average crude oil pricing increase of 17% from the comparative period of 2015, resulted in the PRD division achieving revenue (excluding oil purchase and resale) for the three months ended December 31, 2016 of $62.0 million, an increase of 12% from the 2015 comparative period;

- Oil purchase and resale revenue in the PRD division for the three months ended December 31, 2016 increased by 153% from the 2015 comparative period to $405.9 million, primarily due to additional oil purchase and resale volumes related to the newly acquired Alida facility and the increased ownership in the La Glace and Judy Creek FSTs;

- DPS division revenue for the three months ended December 31, 2016 was $38.1 million, a 10% decrease from the 2015 comparative period. Reduced pricing to customers, shifts in the product mix between oil and non-oil based product, and the wind down of the DPS U.S. operations in the fourth quarter of 2015 were partially offset by an 8% increase in active rig count in the WCSB;

- OS division revenue of $24.5 million in the three months ended December 31, 2016 decreased 24% from the 2015 comparative period. Reduced revenues across all three OS service lines was a result of decreased large scale Projects revenues from two significant jobs in 2015 for which there was no equivalents in 2016, wet weather conditions continuing into the fourth quarter restricting site access and delaying job starts, and lower completion activities given the poor weather conditions and relatively low oil price during the year. Many reclamation and remediation projects were reduced or deferred into 2017 as capital budgets were revised.

- ADJUSTED EBITDA OF $33.0 MILLION FOR THE THREE MONTHS ENDED DECEMBER 31, 2016

- Diversification across Secure's three divisions has contributed to Adjusted EBITDA for the three months ended December 31, 2016 of $33.0 million, a 4% increase from the 2015 comparative period. The fourth quarter of 2016 saw a 17% increase in average crude oil pricing from the 2015 comparative period and benefitted from ongoing production related volumes, new facilities, facility expansions, and the PetroLama and JV acquisitions in the PRD division in 2016, partially offset by certain service lines which were still negatively impacted by reduced drilling and completion activity.

- Diversification across Secure's three divisions has contributed to Adjusted EBITDA for the three months ended December 31, 2016 of $33.0 million, a 4% increase from the 2015 comparative period. The fourth quarter of 2016 saw a 17% increase in average crude oil pricing from the 2015 comparative period and benefitted from ongoing production related volumes, new facilities, facility expansions, and the PetroLama and JV acquisitions in the PRD division in 2016, partially offset by certain service lines which were still negatively impacted by reduced drilling and completion activity.

- Q4 2016 CAPITAL EXPENDITURES

- Total capital expenditures for the three months ended December 31, 2016 of $15.4 million relate primarily to various expansion and sustaining projects at existing PRD facilities, including the addition of a cell at the Fox Creek landfill, and expansion at the Kindersley FST to increase capacity and throughput.

PRD DIVISION OPERATING HIGHLIGHTS

|

Three months ended Dec 31, |

Twelve months ended Dec 31, | ||||||

|

($000's) |

2016 |

2015 |

% Change |

2016 |

2015 |

% Change | |

|

Revenue |

|||||||

|

PRD services (a) |

61,988 |

55,171 |

12 |

198,813 |

242,734 |

(18) | |

|

Oil purchase and resale service |

405,939 |

160,203 |

153 |

1,016,904 |

785,527 |

29 | |

|

Total PRD division revenue |

467,927 |

215,374 |

117 |

1,215,717 |

1,028,261 |

18 | |

|

Direct expenses |

|||||||

|

PRD services (b) |

25,805 |

25,855 |

- |

91,620 |

118,515 |

(23) | |

|

Oil purchase and resale service |

405,939 |

160,203 |

153 |

1,016,904 |

785,527 |

29 | |

|

Total PRD division direct expenses |

431,744 |

186,058 |

132 |

1,108,524 |

904,042 |

23 | |

|

Operating Margin (1) (a-b) |

36,183 |

29,316 |

23 |

107,193 |

124,219 |

(14) | |

|

Operating Margin (1) as a % of revenue (a) |

58% |

53% |

54% |

51% |

|||

|

(1)Refer to "Non-GAAP measures, operational definitions and additional subtotals" for further information. | |||||||

Highlights for the PRD division for the three and twelve months ended December 31, 2016 included:

- Processing, recovery and disposal services revenue of $62.0 million for the three months ended December 31, 2016 increased by 12% from the 2015 comparative period, driven by a 28% increase in recovery volumes contributed from the new facilities added in 2016, expansions at certain of the Corporation's existing facilities in 2016, and the PetroLama and JV Acquisitions. Increased volumes and production activity in the quarter was further strengthened by the increase in average crude oil prices by 17% from the 2015 comparative period;

- Processing, recovery and disposal services revenue of $198.8 million for the twelve months ended December 31, 2016 decreased by 18% from the 2015 comparative period. With an average crude oil price decrease of 8% year over year, the continued low crude oil price impacted oil and gas producers' capital spending resulting in a 33% drop in industry rig counts in the WCSB and North Dakota, respectively, in 2016 from 2015. This resulted in a significant decline in volumes associated with drilling and completion activities in the Corporation's service areas. Production related services have been impacted to a much lesser extent in the twelve months ended December 31, 2016 compared to the same periods in 2015 due to ongoing production related volumes, the construction of new facilities in 2015 and 2016, expansions at certain of the Corporation's existing facilities in the past year, and the PetroLama and JV Acquisitions;

- The addition of new facilities, both organically and through acquisitions, accounted for $7.0 million and $25.9 million of revenue in the three and twelve months ended December 31, 2016, an impact of 13% and 11% when comparing to the same periods of 2015;

- Processing volumes remained relatively stable in the three months ended December 31, 2016 and decreased by 12% in the twelve months ended December 31, 2016 from the comparative periods due to decreases in emulsion and waste processing volumes;

- Disposal volumes remained stable in the three months ended December 31, 2016 and decreased by 13% in the twelve months ended December 31, 2016 from the comparative periods due mainly to a decrease in flow back water from less completion activities and less disposal of drilling waste in Secure's landfills;

- Recovery revenues increased 35% in the three months ended December 31, 2016 from the comparative period. The increase was driven by crude oil marketing activities at the Corporation's pipeline connected FSTs and the Alida crude oil terminalling facility, combined with the average crude oil price increase of 17% from the comparative period. The strong crude oil marketing revenues were partially offset by decreased recovered oil volumes and revenues from lower drilling and completion activity;

- Recovery revenues decreased 16% in the twelve months ended December 31, 2016 from the comparative 2015 period due to lower recovered oil sales as a result of the factors described above, compounded by an 8% decrease in average crude oil prices. The impact on recovery revenues from recovered oil sales was partially mitigated by the Corporation's ability to capitalize on crude oil marketing opportunities at its pipeline connected FSTs and the Alida crude oil terminalling facility;

- Oil purchase and resale revenue in the PRD division for the three and twelve months ended December 31, 2016 increased by 153% and 29% from the 2015 comparative periods to $405.9 million and $1,016.9 million. The increase is primarily due to additional oil and purchase resale volumes related to the newly acquired Alida facility and the increased ownership in the La Glace and Judy Creek FSTs, which in total accounted for 48% and 43% of oil purchase and resale revenue in the three and twelve months ended December 31, 2016;

- Operating margin as a percentage of PRD services revenue for the three and twelve months ended December 31, 2016 increased to 58% and 54% from 53% and 51% in the comparative periods of 2015. The increase in operating margin as a percentage of revenue over 2015 is due to the cost saving initiatives implemented in 2015 and 2016, including reducing employment costs, reduced costs associated with the Corporation's rail transloading facilities, and the elimination of start-up costs associated with new facilities commissioned, partially offset by lower drilling and completion volumes, and reduced recovered oil sales. The Corporation's revised cost management structure has resulted in improved operating margins realized across various facilities including FSTs, SWDs and landfills. In the three and twelve months ended December 31, 2015, the PRD division incurred $0.9 million and $1.2 million of severance and related costs which impacted the comparative operating margin percentages by 2% and 1%, respectively. Severance costs of $0.6 million were incurred in the twelve months ended December 31, 2016, which impacted the operating margin percentage by 0.5%;

- General and administrative ("G&A") expenses for the three and twelve months ended December 31, 2016 decreased 45% and 46% from the 2015 comparative periods to $2.9 million and $12.8 million as cost saving initiatives undertaken during 2015 and 2016 are being realized. In the twelve months ended December 31, 2016, the Corporation incurred $0.5 million in severance and related costs as part of its cost saving initiatives, compared to $0.4 million and $1.9 million in the three and twelve months ended December 31, 2015. The Corporation continues to minimize future costs by streamlining operations resulting in certain costs in the current year being re-allocated to the Corporate division.

DPS DIVISION OPERATING HIGHLIGHTS

|

Three months ended Dec 31, |

Twelve months ended Dec 31, | ||||||

|

($000's) |

2016 |

2015 |

% Change |

2016 |

2015 |

% Change | |

|

Revenue |

|||||||

|

Drilling and production services (a) |

38,063 |

42,153 |

(10) |

111,329 |

192,076 |

(42) | |

|

Direct expenses |

|||||||

|

Drilling and production services (b) |

31,776 |

36,248 |

(12) |

95,516 |

165,981 |

(42) | |

|

Operating Margin (1) (a-b) |

6,287 |

5,905 |

6 |

15,813 |

26,095 |

(39) | |

|

Operating Margin (1) as a % of revenue (a) |

17% |

14% |

14% |

14% |

|||

|

(1) Refer to "Non-GAAP measures, operational definitions and additional subtotals" for further information. | |||||||

Highlights for the DPS division for the three and twelve months ended December 31, 2016 included:

- Revenue in the DPS division correlates with oil and gas drilling activity in the WCSB, most notably active rig counts and metres drilled. Commodity pricing, weather conditions and the resulting drop off in activity levels from oil and gas producers had a significant impact on the DPS division in 2016. For the three months ended December 31, 2016, industry rig counts in the WCSB increased 8% and metres drilled increased 32% from the 2015 comparative periods. For the twelve months ended December 31, 2016, industry rig counts and metres drilled in the WCSB declined 33% and 23% from the 2015 comparative periods, respectively. With compressed industry activity throughout the year combined with pricing pressures on services and rental rates, revenue from the DPS division for the three and twelve months ended December 31, 2016 decreased 10% and 42% to $38.1 million and $111.3 million from the comparative periods of 2015. Average crude oil prices increases and improved weather conditions during the three months ended December 31, 2016 compared to the 2015 comparative period drove increased industry activity strengthening the DPS division's revenue in the latter part of the fourth quarter of 2016;

- Revenue per operating day decreased slightly to $6,877 and $7,279 during the three and twelve months ended December 31, 2016 compared to the same periods in 2015 which generated revenue of $7,171 and $7,481 per operating day. The variance is a result of the proportion of type of rigs serviced, which typically fluctuates quarter over quarter, and location of wells which impacts the type of fluid used and depth of well. In general, the DPS division has experienced increasing drilling fluids revenue per operating day over the past few years as a result of the industry trend towards drilling longer and more challenging wells which require specialty drilling fluids;

- The DPS division's market share decreased slightly to 29% in the three and twelve months ended December 31, 2016 from the comparative periods in 2015 (31% and 30%, respectively). During periods when the total rig count is low, the timing of one customer's drilling activities can have a significant impact on market share;

- Secure continues diversification efforts in the DPS division through expansion of the Production Chemicals and Chemical EOR service lines which will benefit the Corporation in the medium to long-term. Strategic relationships with key suppliers and ongoing product development has resulted in a significant expansion to Secure's product offering resulting in multiple commercial projects in 2016;

- The DPS division's operating margin for the three months ended December 31, 2016 increased 6% from the 2015 comparative period to $6.3 million. Operating margin for the twelve months ended December 31, 2016 decreased 39% from 2015 to $15.8 million. In the 2015 three and twelve month comparative periods the Corporation incurred $1.8 million and $5.9 million in restructuring costs related to the wind down of the DPS operations in the U.S., and $0.1 million and $2.9 million in severance and related costs and inventory impairment. The DPS division incurred $0.8 million in comparable charges in the twelve months ended December 31, 2016;

- Operating margin as a percentage of revenue increased to 17% in the three months ended December 31, 2016 from 14% in the comparative period, and remained consistent at 14% for the twelve months ended December 31, 2016. Offsetting the impact of the restructuring and severance charges discussed above, 2016 operating margins as a percentage of revenue were negatively impacted by reduced equipment utilization, the economies of scale required to operate the division's barite plant and price discounts provided to customers;

- G&A expense for the three and twelve months ended December 31, 2016 decreased 50% and 57% from the comparative periods of 2015 as a result of cost saving initiatives undertaken during 2015 and 2016. In the three and twelve month 2015 comparative periods, the Corporation incurred $1.1 million and $6.2 million including severance costs, and restructuring costs related to the wind down of DPS operations in the U.S.

OS DIVISION OPERATING HIGHLIGHTS

|

Three months ended Dec 31, |

Twelve months ended Dec 31, | ||||||

|

($000's) |

2016 |

2015 |

% Change |

2016 |

2015 |

% Change | |

|

Revenue |

|||||||

|

OnSite services (a) |

24,533 |

32,446 |

(24) |

83,017 |

126,088 |

(34) | |

|

Direct expenses |

|||||||

|

OnSite services (b) |

19,535 |

23,614 |

(17) |

63,180 |

93,961 |

(33) | |

|

Operating Margin (1) (a-b) |

4,998 |

8,832 |

(43) |

19,837 |

32,127 |

(38) | |

|

Operating Margin (1) as a % of revenue (a) |

20% |

27% |

24% |

25% |

|||

|

(1)Refer to "Non-GAAP measures, operational definitions and additional subtotals" for further information. | |||||||

Highlights for the OS division for the three and twelve months ended December 31, 2016 included:

- Diversified service lines, integrated service offerings and organic growth partially mitigated reduced activity driven by wet weather conditions and low commodity prices, resulting in a 24% and 34% decrease in revenue to $24.5 million and $83.0 million in the three and twelve months ended December 31, 2016;

- Projects revenue during the three and twelve months ended December 31, 2016 decreased 17% and 39% from the 2015 comparative periods. Projects revenue is dependent on the type and size of jobs which can vary quarter to quarter. Projects completed significant demolition and remediation jobs during 2015; similar scale jobs were not repeated in 2016 and weather and site conditions postponed several projects into 2017 that were scheduled for the fourth quarter of 2016. Partially offsetting the decrease was revenue generated from new services which include non-oil and gas related industries and abandonment services, geographic expansion, and a 31% increase in pipeline integrity activity in the three months ended December 31, 2016 from the comparative period. The Projects service line is continuing to bid on the larger scale jobs as producers revise their capital spending due to increased commodity prices;

- Environmental services revenue for the three and twelve months ended December 31, 2016 decreased 44% and 37% from the 2015 comparative periods primarily due to reduced reclamation and remediation revenue resulting from deferred customer spending created by low commodity prices. Drilling waste revenue has also decreased due to lower drilling activity combined with pricing reductions. This lack of activity has produced a competitive pricing environment for drill waste services. These decreases were partially offset by revenue generated from an emergency response job managed by the drill waste group, and by increased bin revenue in the three and twelve months ended December 31, 2016 compared to the same periods in 2015 resulting from geographic expansion and growth in Naturally Occurring Radioactive Material ("NORM") related solution services;

- Integrated fluids solutions revenue for the three and twelve months ended December 31, 2016 decreased approximately 50% and 31% from the 2015 comparative periods. Revenue decreased primarily due to lower customer field activity from continued depressed commodity prices. Wet weather conditions limiting field access in the third quarter and lower than anticipated activity during spring break-up decreased rental equipment utilization. Revenue has also been impacted in 2016 from competitive pricing pressure as a result of lower industry activity;

- The three and twelve months ended December 31, 2016 operating margin in the OS division of $5.0 million and $19.8 million was lower than the prior year comparative periods due primarily to decreased revenues. The operating margin as a percentage of revenue for the OS division in the three and twelve months ended December 31, 2016 was 20% and 24%, a decrease from 27% and 25% in the comparative 2015 periods. The OS division's operating margin as a percentage of revenue fluctuates depending on the volume and type of projects undertaken and the blend of business between remediation and reclamation projects, demolition projects, pipeline integrity projects, site clean-up, and other services in any given period. As a percentage of revenue, the decreased operating margin in the three and twelve months ended December 31, 2016 resulted from reduced large scale work in the Projects service line, an overall mix of lower margin projects, and costs to add or expand services within the division;

- G&A expenses for the three months and twelve months ended December 31, 2016 decreased 21% and 25% from the 2015 comparative periods to $1.9 million and $6.5 million due to re-allocating certain costs to the Corporate division and cost saving initiatives.

OUTLOOK

Crude oil prices remained depressed in 2016, with an average crude oil price decrease of 8% from 2015, driven by the continued imbalance of global oil supply and demand. However, since The Organization of the Petroleum Exporting Countries' ("OPEC") announcement on November 30, 2016 to cut production by 1.2 million barrels per day commencing in January 2017, there has been an upward shift on crude oil prices and the oil and gas industry is cautiously anticipating a more stable commodity price environment to operate in.

Because of the increased stability in commodity prices over the past number of months, Secure anticipates an increase in oil and gas producers' capital budgets for 2017 over 2016, which will drive higher activity levels in the WCSB and benefit all three of the Corporation's divisions. In January 2017, industry rig counts increased by 27% from January 2016 evidencing increased activity levels during the first quarter of 2017, primarily driven by the stabilized commodity environment, but also due to an improvement of weather conditions from the fourth quarter of 2016, which delayed projects until early 2017. Secure will continue to exercise caution and demonstrate the ability to operate profitably in this climate by maintaining its current cost structures which have enabled the Corporation to improve margins, reduce overhead costs and streamline operations to enhance customer service through the integrated services provided.

Secure anticipates 2017 capital spending of approximately $50 million primarily focused in PRD and directed towards high rate of return organic growth and expansion projects. The Corporation will spend approximately $15 million on sustaining and maintenance expenditures for the year. Total capital spending of $65 million is well within the Corporation's forecasted cash flow and is comparable to organic spending levels in 2016. Secure's strong balance sheet and financial flexibility positions the company to be able to increase capital spending levels above $65 million for the right opportunities.

Secure's key priorities for success throughout 2017 include:

- Working with industry partners to continue to reduce the overall cost structure, gain efficiencies and provide new services;

- Leveraging on all three operating divisions to provide benefits to customers for drilling, completion, production and remediation services;

- Gaining further traction on new services and products associated with production chemicals and chemical EOR;

- Working with customers on water recycling, storage and logistics. This market continues to expand as producers understand the need to access water sources and reuse fluids during completion activities;

- Expanding Secure's midstream facility network;

- Continuing a prudent approach to acquisitions and organic capital spending while maintaining financial flexibility;

- Continue to evaluate and assess further acquisition opportunities and/or partnership opportunities that provide strategic advantages;

- Focus on innovative technologies that help our customers achieve operational efficiencies while also reducing their overall impact on the environment.

Secure has a solid balance sheet and significant financial flexibility to continue to meet customer and market demands. The Corporation will continue to work with its customers to support their requirements relating to new facilities, disposal wells, landfill expansions and specialized equipment. Market share growth and new service lines will ensure that Secure is well positioned for future growth.

FINANCIAL STATEMENTS AND MD&A

The Corporation's annual audited consolidated financial statements and notes thereto for the years ended December 31, 2016 and 2015 and MD&A for the three and twelve months ended December 31, 2016 and 2015 are available immediately on Secure's website at www.secure-energy.com. The audited consolidated financial statements and MD&A will be available tomorrow on SEDAR at www.sedar.com.

FORWARD-LOOKING STATEMENTS

Certain statements contained in this document constitute "forward-looking statements" and/or "forward-looking information" within the meaning of applicable securities laws (collectively referred to as forward-looking statements). When used in this document, the words "may", "would", "could", "will", "intend", "plan", "anticipate", "believe", "estimate", "expect", and similar expressions, as they relate to Secure, or its management, are intended to identify forward-looking statements. Such statements reflect the current views of Secure with respect to future events and operating performance and speak only as of the date of this document. In particular, this document contains or implies forward-looking statements pertaining to: key priorities for the Corporation's success; the oil and natural gas industry; activity levels in the oil and gas sector, drilling levels, commodity prices for oil, natural gas liquids and natural gas; industry fundamentals for 2017; capital forecasts and spending by producers; demand for the Corporation's services and products; expansion strategy; the impact of oil and gas activity on 2017 activity levels; the Corporation's proposed 2017 capital expenditure program including growth, sustaining and maintenance capital expenditures; debt service; acquisition strategy and timing of potential acquisitions; the impact of new facilities, potential acquisitions, the PetroLama Acquisition, and JV Acquisition on the Corporation's financial and operational performance and growth opportunities; future capital needs and how the Corporation intends to fund its operations, working capital requirements, dividends and capital program; access to capital; and the Corporation's ability to meet obligations and commitments and operate within any credit facility restrictions.

Forward-looking statements concerning expected operating and economic conditions, including the PetroLama Acquisition and JV Acquisition, are based upon prior year results as well as the assumption that levels of market activity and growth will be consistent with industry activity in Canada and the U.S. and similar phases of previous economic cycles. Forward-looking statements concerning the availability of funding for future operations are based upon the assumption that the sources of funding which the Corporation has relied upon in the past will continue to be available to the Corporation on terms favorable to the Corporation and that future economic and operating conditions will not limit the Corporation's access to debt and equity markets. Forward-looking statements concerning the relative future competitive position of the Corporation are based upon the assumption that economic and operating conditions, including commodity prices, crude oil and natural gas storage levels, interest and foreign exchange rates, the regulatory framework regarding oil and natural gas royalties, environmental regulatory matters, the ability of the Corporation and its subsidiaries to successfully market their services and drilling and production activity in North America will lead to sufficient demand for the Corporation's services and its subsidiaries' services including demand for oilfield services for drilling and completion of oil and natural gas wells, that the current business environment will remain substantially unchanged, and that present and anticipated programs and expansion plans of other organizations operating in the energy industry may change the demand for the Corporation's services and its subsidiaries' services. Forward-looking statements concerning the nature and timing of growth are based on past factors affecting the growth of the Corporation, past sources of growth and expectations relating to future economic and operating conditions. Forward-looking statements in respect of the costs anticipated to be associated with the acquisition and maintenance of equipment and property are based upon assumptions that future acquisition and maintenance costs will not significantly increase from past acquisition and maintenance costs.

Forward-looking statements involve significant risks and uncertainties, should not be read as guarantees of future performance or results, and will not necessarily be accurate indications of whether such results will be achieved. Readers are cautioned not to place undue reliance on these statements as a number of factors could cause actual results to differ materially from the results discussed in these forward-looking statements, including but not limited to those factors referred to and under the heading "Business Risks" and under the heading "Risk Factors" in the Corporation's annual information form ("AIF") for the year ended December 31, 2016 and also includes the risks associated with the possible failure to realize the anticipated synergies in integrating the assets acquired in the Acquisition with the operations of Secure. Although forward-looking statements contained in this document are based upon what the Corporation believes are reasonable assumptions, the Corporation cannot assure investors that actual results will be consistent with these forward-looking statements. The forward-looking statements in this document are expressly qualified by this cautionary statement. Unless otherwise required by law, Secure does not intend, or assume any obligation, to update these forward-looking statements.

NON-GAAP MEASURES, OPERATIONAL DEFINITIONS AND ADDITIONAL SUBTOTALS

The Corporation uses accounting principles that are generally accepted in Canada (the issuer's "GAAP"), which includes International Financial Reporting Standards ("IFRS"). Certain supplementary measures in this document do not have any standardized meaning as prescribed by IFRS. These non-GAAP measures, operational definitions and additional subtotals used by the Corporation may not be comparable to similar measures presented by other reporting issuers. These non-GAAP financial measures, operational definitions and additional subtotals are included because management uses the information to analyze operating performance, leverage and liquidity. Therefore, these non-GAAP financial measures, operational definitions and additional subtotals should not be considered in isolation or as a substitute for measures of performance prepared in accordance with GAAP. See the management's discussion and analysis available at www.sedar.com for a reconciliation of the Non-GAAP financial measures, operational definitions and additional subtotals.

ABOUT SECURE ENERGY SERVICES INC.

Secure is a TSX publicly traded energy services company that provides safe, innovative, efficient and environmentally responsible fluids and solids solutions to the oil and gas industry. The Corporation owns and operates midstream infrastructure and provides environmental services and innovative products to upstream oil and natural gas companies operating in western Canada and certain regions in the United States ("U.S.").

The Corporation operates three divisions:

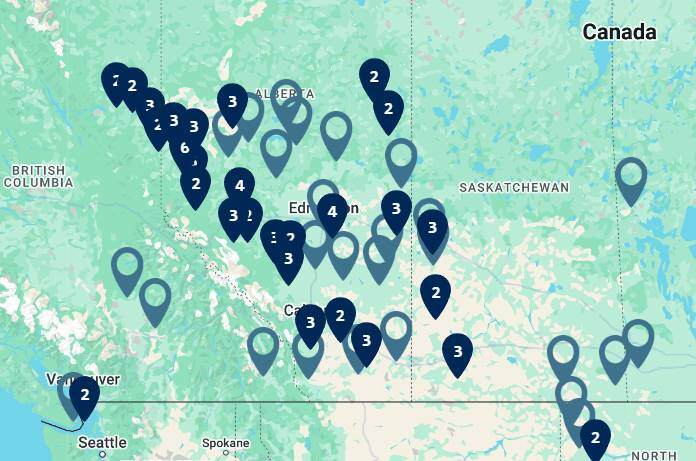

Processing, Recovery and Disposal Division ("PRD"): The PRD division owns and operates midstream infrastructure that provides processing, storing, shipping and marketing of crude oil, oilfield waste disposal and recycling. More specifically these services are clean oil terminalling and rail transloading, custom treating of crude oil, crude oil marketing, produced and waste water disposal, oilfield waste processing, landfill disposal, and oil purchase/resale service. Secure currently operates a network of facilities throughout Western Canada and in North Dakota, providing these services at its full service terminals ("FST"), landfills, stand-alone water disposal facilities ("SWD") and full service rail facilities ("FSR").

Drilling and Production Services Division ("DPS"): The DPS division provides equipment and product solutions for drilling, completion and production operations for oil and gas producers in Western Canada. The drilling service line comprises the majority of the revenue for the division which includes the design and implementation of drilling fluid systems for producers drilling for oil, bitumen and natural gas. The drilling service line focuses on providing products and systems that are designed for more complex wells, such as medium to deep wells, horizontal wells and horizontal wells drilled into the oil sands. The production services line focuses on providing equipment and chemical solutions that optimize production, provide flow assurance and maintain the integrity of production assets.

Onsite Services Division ("OS"): The operations of the OS division include Projects which include pipeline integrity (inspection, excavation, repair, replacement and rehabilitation), demolition and decommissioning, and reclamation and remediation of former wellsites, facilities, commercial and industrial properties, and environmental construction projects (landfills, containment ponds, subsurface containment walls, etc.); Environmental services which provide pre-drilling assessment planning, drilling waste management, remediation and reclamation assessment services, Naturally Occurring Radioactive Material ("NORM") management, waste container services, and emergency response services; and Integrated Fluid Solutions ("IFS") which include water management, recycling, pumping and storage solutions.

SOURCE SECURE Energy Services Inc.