News Releases

Stay in the know

CALGARY, May 2, 2016 /CNW/ - Secure Energy Services Inc. ("Secure" or the "Corporation") (TSX – SES) is pleased to announce today that it has entered into an agreement to acquire all of the operating assets (excluding working capital) of PetroLama Energy Canada Inc. ("PetroLama") for an aggregate purchase price of approximately $53.5 million, subject to certain customary closing conditions ("the Acquisition"). Secure also reports operational and financial results for the first quarter of 2016, including Adjusted EBITDA of $25.1 million.

SUMMARY OF THE ACQUISITION

PetroLama is a privately owned Calgary-based midstream company specializing in the physical trade, storage, terminalling and transport of crude oil from western Canada to the North American market. PetroLama's main asset is a crude oil terminal in Alida, Saskatchewan which is connected to the Enbridge Pipelines (Saskatchewan) Inc. pipeline system and includes truck unload risers and storage tanks. Under the terms of the Acquisition, Secure will also acquire various marketing contracts relating to the purchase, sale and transportation of propane, butane and condensate, including access to crude oil storage at Cushing, Oklahoma.

ACQUISITION DETAILS

Total consideration for the Acquisition is approximately $53.5 million, subject to certain closing adjustments. The purchase price will be paid with approximately $47.7 million in cash and the balance of approximately $5.8 million through the issuance of common shares of the Corporation. Secure has also agreed to purchase PetroLama's inventory on hand at closing. The expected range for PetroLama's contribution to consolidated Adjusted EBITDA for the next twelve months is anticipated to be approximately $8.0 to $9.0 million. The Acquisition will have an effective date of May 1, 2016 and is expected to close on or about June 1, 2016, subject to all necessary approvals being obtained.

STRATEGIC RATIONALE

The Acquisition provides Secure with an attractive entry point into the southeast Saskatchewan midstream market. Secure will be able to expand its market presence and enhance its current service offering for continued midstream growth. The Alida terminal, a facility constructed in 2013, is uniquely positioned for sustainable cash flow generation in a new market area. Secure expects to leverage PetroLama's existing business into further growth opportunities and build upon PetroLama's strong relationships with oil producers, marketers and refiners with its breadth of oil and gas services. Secure expects its size and strong history of operational expertise in the PRD division will allow the Corporation to achieve certain operating efficiencies.

"We are pleased to welcome the PetroLama team to Secure. This acquisition further expands our existing midstream infrastructure, strengthens our Crude Oil Marketing team and expands our strong alliances with both customers and suppliers," states Rene Amirault, Chairman, President and Chief Executive Officer of Secure. "With the current challenging outlook for commodity pricing, we have been patiently focused on looking to grow with the right acquisition of uniquely positioned assets that also offer opportunities for further expansion into new markets and services. We strive to deliver consistent financial results to our shareholders and this acquisition adds another cash flow generating midstream asset to our network."

Q1 2016 OPERATIONAL AND FINANCIAL HIGHLIGHTS

During the first quarter of 2016, oil and gas producers continued to reduce capital spending and activity levels in response to the persistent low crude oil and natural gas prices, which decreased compared to the end of 2015. In addition, spring break-up conditions commenced at the end of February, significantly shortening the typical length of the winter drilling season. The impact of these factors to Secure's operating and financial results in the quarter were partially mitigated by ongoing production related volumes in the PRD division and diversification of services offered across the Corporation. As a result, Secure realized Adjusted EBITDA of $25.1 million, demonstrating resilience during a period of reduced oil and gas activity levels. The continued weakness in commodity pricing continues to have the most significant impact on the DPS divisional results as the majority of operations are currently tied to drilling activity.

During the quarter, Secure strengthened its financial position by completing a bought deal equity financing raising gross proceeds of $149.6 million, consistent with the Corporation's disciplined approach to maintaining a strong balance sheet to effectively manage the business through a period of lower commodity pricing and industry activity.

In addition to the Acquisition described above, Secure is continuing to seek out and evaluate opportunities that will provide meaningful growth for the remainder of 2016, into 2017 and beyond.

The operating and financial highlights for the three months periods ending March 31, 2016 and 2015 can be summarized as follows:

|

Three months ended Mar 31, |

|||||||

|

($000's except share and per share data) |

2016 |

2015 |

% change |

||||

|

Revenue (excludes oil purchase and resale) |

102,267 |

169,652 |

(40) |

||||

|

Oil purchase and resale |

106,865 |

196,895 |

(46) |

||||

|

Total revenue |

209,132 |

366,547 |

(43) |

||||

|

Adjusted EBITDA (1) |

25,083 |

40,036 |

(37) |

||||

|

Per share ($), basic |

0.18 |

0.33 |

(45) |

||||

|

Net (loss) earnings |

(10,066) |

(3,223) |

212 |

||||

|

Per share ($), basic |

(0.07) |

(0.03) |

133 |

||||

|

Per share ($), diluted |

(0.07) |

(0.03) |

133 |

||||

|

Adjusted net (loss) earnings(1) |

(8,598) |

856 |

(1,104) |

||||

|

Per share ($), basic |

(0.06) |

0.01 |

(700) |

||||

|

Funds from operations (1) |

22,559 |

36,225 |

(38) |

||||

|

Per share ($), basic |

0.16 |

0.30 |

(47) |

||||

|

Dividends per common share |

0.06 |

0.06 |

- |

||||

|

Capital expenditures (1) |

21,489 |

42,084 |

(49) |

||||

|

Total assets |

1,267,835 |

1,465,364 |

(13) |

||||

|

Net debt (1) |

16,723 |

133,140 |

(87) |

||||

|

Common Shares - end of period |

157,932,560 |

135,824,597 |

16 |

||||

|

Weighted average common shares - basic and diluted |

140,015,143 |

122,689,850 |

14 |

||||

|

(1) Refer to "Non-GAAP measures, operational definitions and additional subtotals" for further information. | |||||||

- REVENUE OF $209.1 MILLION FOR THE THREE MONTHS ENDED MARCH 31, 2016

- Total processing, recovery and disposal volumes at PRD facilities for the three months ended March 31, 2016 decreased over the 2015 comparative period as low oil prices and early spring break-up conditions negatively impacted volumes at PRD facilities from drilling and completion related activities. Additionally, average crude oil prices decreased 24% in the first quarter of 2016 compared to the same period in 2015, which directly impacted recovered oil revenue. The impact of the above to the PRD division's revenue was partially mitigated by ongoing production related volumes and the addition of facilities in 2015, which included the construction and commissioning of Tulliby Lake FST, Big Mountain SWD, and Wonowon SWD, and the conversion of the Rycroft FSR and 13 Mile FST. Overall, this resulted in the PRD division achieving revenue (excluding oil purchase and resale) of $48.7 million in the three months ended March 31, 2016, down 30% from the same period in 2015;

- Oil purchase and resale revenue in the PRD division for the three months ended March 31, 2016 decreased by 46% from 2015 to $106.9 million. The average price of crude oil declined by 24% compared to the three months ended March 31, 2015, which directly reduced revenues from oil sales and also resulted in lower volumes of oil being purchased and resold during the period;

- Activity in the DPS division is strongly correlated with oil and gas drilling activity in the Western Canadian Sedimentary Basin ("WCSB"), where the rig count in the quarter was nearly half the 2015 first quarter levels. As a result, DPS division revenue correspondingly decreased by 43% to $35.2 million in the three months ended March 31, 2016;

- OS division revenue decreased 41% from the first quarter of 2015 to $18.4 million. The decrease is primarily due to reduced Projects revenue resulting from the completion of a major demolition job in the first quarter of 2015 for which there was no equivalent in the three months ending March 31, 2016, and lower completion activities given the current oil price and early spring break-up conditions primarily impacting both the Environmental and IFS service lines.

- ADJUSTED EBITDA OF $25.1 MILLION FOR THE THREE MONTHS ENDED MARCH 31, 2016

- Diversification and integration across Secure's three divisions has contributed to positive Adjusted EBITDA for the three months ended March 31, 2016 as certain service lines are not as heavily impacted by drilling activity and commodity prices. Adjusted EBITDA totaled $25.1 million in the first quarter of 2016, a 37% decrease from the same period in 2015.

- Overall, Adjusted EBITDA was in line with Secure's expectation given a reduction in drilling and completion activity throughout the WCSB which most heavily impacted the DPS division as the majority of operations are currently tied to drilling operations. The decrease in the PRD division was partially offset by ongoing production related volumes, the construction of new facilities in 2015 and expansions at certain of the Corporation's existing facilities in the past year, and cost saving initiatives implemented in 2015 which both improved operating margin and reduced general and administrative costs. The impact to the OS division was somewhat mitigated by geographic expansion, diversified service lines and integrated service offerings.

- NET LOSS OF $10.1 MILLION FOR THE THREE MONTHS ENDED MARCH 31, 2016

- For the three months ended March 31, 2016, Secure's net loss of $10.1 million, compared to net loss of $3.2 million in the three months ended March 31, 2015, is primarily a result of the factors discussed above impacting Adjusted EBITDA, offset partially by lower general and administrative expenses, business development expenses and share-based compensation as the Corporation is realizing the cost saving initiatives implemented in 2015. Secure has significantly reduced personnel levels to match current industry activity levels, as well as reduced discretionary spending and streamlined and consolidated support functions where possible.

- CAPITAL EXPENDITURES OF $21.5 MILLION FOR THE THREE MONTHS ENDED MARCH 31, 2016

- Total capital expenditures for the three months ended March 31, 2016 of $21.5 million includes:

- Progress of construction of the Kakwa FST which is expected to be completed and commissioned in the third quarter of 2016;

- Disposal well expansions at the Kaybob and Big Mountain SWD facilities;

- Sustaining capital expenditures at existing facilities required to maintain ongoing business operations.

- Total capital expenditures for the three months ended March 31, 2016 of $21.5 million includes:

- FINANCIAL FLEXIBILITY

- On March 22, 2016, the Corporation completed a bought deal common share financing (the "offering"), issuing a total of 19,550,000 common shares of the Corporation ("Common Shares") at a price of $7.65 per Common Share for gross proceeds of $149.6 million. In the short term, the proceeds of the offering will be used to repay outstanding debt and fund the cash portion of the Acquisition, and eventually will be used to fund capital expenditures, for strategic acquisition opportunities, and/or general working capital purposes.

- Secure's total long-term borrowings as at March 31, 2016 were $119.0 million compared to $262.0 million at December 31, 2015. The Corporation has strengthened its balance sheet and increased its financial flexibility to take advantage of opportunities during the current low commodity price environment.

- Secure is in compliance with all covenants related to its credit facility at March 31, 2016. Secure's debt to trailing twelve month EBITDA ratio, where EBITDA is defined in the lending agreement as earnings before interest, taxes, depreciation, depletion and amortization, and is adjusted for non-recurring losses, any non-cash impairment charges and any other non-cash charges, and acquisitions on a pro-forma basis, was 1.2 as at March 31, 2016 compared to 2.2 as at December 31, 2015. The Corporation is required under its credit facility to maintain a debt to EBITDA ratio of 3.5 to 1.0.

- As at March 31, 2016, the Corporation had $549.9 million available under its credit facility, subject to maintaining the debt to EBITDA ratio described above.

PRD DIVISION OPERATING HIGHLIGHTS

|

Three months ended Mar 31, | ||||||||

|

($000's) |

2016 |

2015 |

% Change | |||||

|

Revenue |

||||||||

|

PRD services (a) |

48,706 |

69,494 |

(30) | |||||

|

Oil purchase and resale service |

106,865 |

196,895 |

(46) | |||||

|

Total PRD division revenue |

155,571 |

266,389 |

(42) | |||||

|

Direct Operating Expenses |

||||||||

|

PRD services |

22,823 |

33,830 |

(33) | |||||

|

Deduct: non-recurring items |

||||||||

|

Severance and related costs |

(535) |

(188) |

185 | |||||

|

PRD services less non-recurring items (b) |

22,288 |

33,642 |

(34) | |||||

|

Oil purchase and resale service |

106,865 |

196,895 |

(46) | |||||

|

Total PRD division direct operating expenses |

129,688 |

230,725 |

(44) | |||||

|

Operating Margin (1) (a-b) |

26,418 |

35,852 |

(26) | |||||

|

Operating Margin (1) as a % of revenue (a) |

54% |

52% |

||||||

|

(1) Refer to "Non-GAAP measures, operational definitions and additional subtotals" for further information. | ||||||||

Highlights for the PRD division for the three months ended March 31, 2016 included:

- Processing, recovery and disposal revenue: Revenue of $48.7 million for the three months ended March 31, 2016, is down 30% from the 2015 comparative period, primarily as a result of lower drilling and completion activity impacting volumes and lower recovered oil revenue caused by the decrease in oil prices during the period. The decrease in oil prices since the first quarter of 2015, combined with an early spring break-up, has resulted in a 49% and 69% drop in industry rig counts in the WCSB and North Dakota, respectively, from the 2015 comparative period, which has resulted in a significant decline in volumes associated with drilling and completion activities in the Corporation's service areas. Production related services have been impacted to a lesser extent in the three months ended March 31, 2016 compared to the same period in 2015 due to ongoing production related volumes, the construction of new facilities in 2015 and expansions at certain of the Corporation's existing facilities in the past year. Accordingly, overall volumes in the period have only declined approximately 20%. In addition to the decrease in volumes, a 24% decrease in crude oil prices over the 2015 comparative period, primarily impacting recovered oil sales, have compounded the impact on revenue;

- Oil purchase and resale revenue: Oil purchase and resale revenue in the PRD division for the three months ended March 31, 2016 decreased by 46% from the 2015 comparative period to $106.9 million. The price of crude oil declined by 24% for the three months ended March 31, 2016 from the 2015 comparative period which directly reduced revenues from oil sales and also resulted in lower volumes of oil being purchased and resold during the period. Oil purchase and resale service has no net impact on Secure's financial results as it has a nil operating margin;

- Direct operating expenses less non-recurring items from PRD services for the three months ended March 31, 2016 decreased 34% to $22.3 million from $33.6 million in the comparative period of 2015. The decrease in direct operating expenses relates primarily to fewer variable costs resulting from lower volumes in the quarter, fewer fixed costs associated with Secure's rail operations as the Corporation has reduced the cost structure associated with the rail transloading facilities to match current activity levels, upfront commissioning costs incurred in the first quarter of 2015 associated with the 13 Mile and Tulliby Lake FSTs and the Rycroft FSR (none in the three months ended March 31, 2016), and a decrease in employee and other costs resulting from cost saving initiatives implemented by the Corporation in 2015;

- Operating margin as a percentage of revenue for the three months ended March 31, 2016 was 54%, a 2% increase from 52% in the comparative period of 2015. The impact to the operating margin for the three months ended March 31, 2016 compared to 2015 is due to operating efficiencies achieved as a result of cost saving initiatives implemented in 2015, including reducing employee costs, reduced costs associated with the Corporation's rail transloading facilities, and the elimination of start-up costs associated with new facilities commissioned in the first quarter of 2015. The favourable impact to operating margin was partially offset by lower drilling and completion volumes and reduced recovered oil sales;

- General and administrative ("G&A") expenses less non-recurring items for the three months ended March 31, 2016 decreased 44% from the 2015 comparative period to $3.7 million as cost saving initiatives undertaken during 2015 are being realized. The Corporation continues to minimize future costs by streamlining operations in the current oil and gas price environment. As part of these initiatives, certain costs in the current year have been moved to the Corporate division. Non-recurring items relate to employee severance payments.

DPS DIVISION OPERATING HIGHLIGHTS

|

Three months ended Mar 31, | |||||

|

($000's) |

2016 |

2015 (1) |

% Change | ||

|

Revenue |

|||||

|

Drilling and production services (a) |

35,207 |

62,098 |

(43) | ||

|

Direct Operating Expenses |

|||||

|

Drilling and production services |

29,727 |

50,969 |

(42) | ||

|

Deduct: non-recurring items |

|||||

|

Inventory impairment |

- |

(1,970) |

(100) | ||

|

Severance and related costs |

(661) |

(597) |

11 | ||

|

Drilling and production services less non-recurring items (b) |

29,066 |

48,402 |

(40) | ||

|

Operating Margin (2) (a-b) |

6,141 |

13,696 |

(55) | ||

|

Operating Margin (2) as a % of revenue (a) |

17% |

22% |

|||

|

(1) Excludes the results from the drilling services operations in the U.S. as these operations were wound down in the latter part of 2015 and are considered non-recurring. | |||||

|

(2) Refer to "Non-GAAP measures, operational definitions and additional subtotals" for further information. | |||||

Highlights for the DPS division for the three months ended March 31, 2016 included:

- Revenue in the DPS division correlates with oil and gas drilling activity in the WCSB, most notably active rig counts and meters drilled. As a result, the weakness in commodity pricing and the resulting drop off in activity levels from oil and gas producers had a significant impact on the DPS division in the three months ended March 31, 2016. For the three months ended March 31, 2016, industry rig counts in the WCSB declined 49%, while meters drilled declined 40% from the 2015 comparative period. As a result, revenue from the DPS division for the three months ended March 31, 2016 decreased 43% to $35.2 million from $62.1 million in the comparative period of 2015. This decrease in revenues was consistent with Secure's expectation given the decline in drilling activity, combined with pricing pressures on services and rental rates. Revenue in the DPS division was also impacted by the decline in the price of oil which reduced revenue earned on oil based drilling fluids sold to customers;

- Secure has continued to focus on providing customers with innovative solutions for deeper and more technically complex wells. This has enabled the division to achieve a market share of 31% for the three months ended March 31, 2016 compared to 29% in the three months ended March 31, 2015. As the rig count has dropped over the 2015 comparative period, the timing of when customers ramp-up or slow down drilling activities has a significant effect on market share at any point in time as one rig can change the percentage of market share held;

- Secure continues diversification efforts in the DPS division through production chemicals expansion and ancillary offerings which should benefit the Corporation in the medium to long-term;

- The DPS division's direct operating expenses less non-recurring items for the three months ended March 31, 2016 decreased by 40% to $29.1 million from $48.4 million in the 2015 comparative period. Overall, the decrease in direct operating expenses over the 2015 comparative period was primarily due to decreased activity levels, the realization of cost saving initiatives implemented in 2015, and a reduction in cost of goods sold for oil based drilling fluids. However, the stronger U.S. dollar in the period impacted the cost of goods sourced from the U.S., specifically for specialty chemicals, which increased direct operating expenses;

- The DPS division's operating margin for the three months ending March 31, 2016 was $6.1 million, down 55% compared to the same period in 2015. The DPS division's operating margin decreased as a result of the factors discussed above, combined with price discounts given to customers to reflect the depressed price of crude oil, a higher cost associated with specialty chemicals purchased from the U.S. due to foreign exchange movements, and a higher proportion of lower margin products sold when compared to the same period in 2015. As a result, operating margin as a percentage of revenue declined from 22% in the three months ended March 31, 2015 to 17% in the first quarter of 2016;

- G&A expense less non-recurring items for the three months ended March 31, 2016 decreased 40% from the comparative period of 2015 as a result of cost saving initiatives undertaken during 2015 and reduced shared service allocations from Corporate. Non-recurring items relate to severance costs incurred as the Corporation eliminated positions in order to properly align staff with activity levels.

OS DIVISION OPERATING HIGHLIGHTS

|

Three months ended Mar 31, | ||||||

|

($000's) |

2016 |

2015 |

% Change | |||

|

Revenue |

||||||

|

OnSite services (a) |

18,354 |

31,294 |

(41) | |||

|

Direct Operating Expenses |

||||||

|

OnSite services |

13,767 |

21,825 |

(37) | |||

|

Deduct: non-recurring items |

||||||

|

Severance and related costs |

(77) |

(116) |

(34) | |||

|

OnSite services less non-recurring items (b) |

13,690 |

21,709 |

(37) | |||

|

Operating Margin (1) (a-b) |

4,664 |

9,585 |

(51) | |||

|

Operating Margin (1) as a % of revenue (a) |

25% |

31% |

||||

|

(1) Refer to "Non-GAAP measures, operational definitions and additional subtotals" for further information. | ||||||

Highlights for the OS division for the three months ended March 31, 2016 included:

- Diversified service lines and integrated service offerings and organic growth partially mitigated reduced customer activity, which resulted in a 41% decrease in revenue from $31.3 million in the three months ended March 31, 2015 to $18.4 million in the three months ended March 31, 2016;

- Projects revenue decreased 45% in the three months ended March 31, 2016 from the 2015 comparative period. Projects revenue is dependent on the type and size of jobs which vary quarter to quarter. The comparative period included a significant demolition job in northern Alberta. Excluding this job, Projects revenue increased 7% from the 2015 comparative period due primarily to a multi-year contract to manage a landfill in northern Alberta and diversified offerings to new geographic regions and sectors outside of the oil and gas industry;

- Environmental services revenue for the three months ended March 31, 2016 decreased 29% from the 2015 comparative period as a result of reduced reclamation and remediation revenue resulting from deferred customer spending, and due to lower drilling waste revenue from decreases in drilling activity quarter over quarter. The decreases noted above were partially offset by increased bin revenue resulting from geographic expansion and growth in NORM related solution services;

- Integrated fluids solutions revenue for the three months ended March 31, 2016 decreased 49% from the 2015 comparative period as a result of decreased completion and drilling activity. As well, an earlier than usual spring break-up reduced customer field activity therefore decreasing equipment utilization. Rental unit pricing decreased from prior quarters due to the competitive pressures from the current depressed industry environment;

- Direct operating expenses less non-recurring items for the three months ended March 31, 2016 decreased 37% to $13.7 million from $21.7 million in the 2015 comparative period. Overall, the variance in direct operating expenses was a direct result of the change in activity and revenues from the 2015 comparative period;

- The first quarter operating margin in the OS division of $4.7 million was lower than the prior year quarter due primarily to decreased revenues. Operating expenses generally correspond to revenue changes. As well, the quarter had a higher proportion of smaller projects which typically have lower associated operating margin when compared to the same period in 2015. The Onsite division's operating margin as a percentage of revenue fluctuates depending on the volume and type of projects undertaken and the blend of business between remediation and reclamation projects, demolition projects, pipeline integrity projects, site clean-up, and other services in any given period. The operating margin as a percentage of revenue for the OS division in the three months ended March 31, 2016 was 25% versus 31% in the comparative 2015 period. The margin percentage decrease was due to a significant higher margin demolition job completed in the first quarter of 2015. The operating margin as a percentage of revenue during the first quarter of 2016 was in line with the average margin for the year ended December 31, 2015 of 25%;

- G&A expenses less non-recurring items for the three months ended March 31, 2016 decreased 40% to $1.3 million from $2.2 million in the comparative period of 2015. G&A expenses in the three months ended March 31, 2016 decreased due to lower volumes of activity, reduced shared service allocations from Corporate, and cost saving initiatives taken across the organization.

OUTLOOK

The Corporation remains well positioned in the current industry environment. The offering completed during the first quarter further strengthened the Corporation's balance sheet and has provided Secure with significant flexibility to seek out and evaluate opportunities that will provide accretive growth to the Corporation in 2016 and beyond. The acquisition of PetroLama's assets will provide a solid platform for further midstream growth.

While crude oil prices have begun trending upwards in recent weeks, on average crude oil prices declined 24% in the first quarter of 2016 compared to the first quarter of 2015, and currently remain lower than the average price in 2015. Based on current activity levels and commodity prices, Secure anticipates an extended spring break-up period as customers delay drilling and completion activities in the current commodity price environment, including a slower ramp up of activity into the third quarter. For the second quarter specifically, Secure anticipates oil and gas producers will be unwilling to incur additional costs due to weather related issues if the oil and gas activity can be delayed into the summer months.

Secure will continue to evaluate and assess further acquisition opportunities and/or partnership opportunities that provide strategic advantages. Secure remains patient to ensure the right acquisitions are executed to complement existing services and/or expand geographical presence in key operating areas, particularly in the current oil and gas environment. The Corporation expects to close the transaction to acquire all of the operating assets (excluding working capital) of PetroLama in the second quarter, which Secure believes will provide further opportunities to execute on the Corporation's midstream growth strategy.

During the remainder of the year, the Corporation will continue its prudent approach to organic capital spending by allocating funds to projects that generate the highest rates of return. Secure expects to spend approximately $30 million in the remainder of 2016 on the following:

- Kakwa Full Service Terminal;

- Landfill expansions;

- Disposal well expansions;

- Additional tanks and risers;

- Maintenance expenditures.

Secure's key priorities for success in the remainder of 2016 include:

- Working with partners to reduce the overall cost structure, gain efficiencies and provide new services;

- Maintaining financial flexibility;

- Leveraging on all three operating divisions to gain efficiencies for customers for drilling, completion, production and remediation services;

- Gaining further traction on new services and products associated with production chemicals and chemical enhanced oil recovery ("EOR");

- Working with customers on water recycling, storage and logistics. This market continues to expand as producers understand the need to access water sources and reuse fluids during completion activities.

Overall, Secure has a solid balance sheet and is well positioned to respond with solutions and the right people to the market's needs today. As industry activity increases the Corporation will be able to respond quickly and remain agile. Secure continues to work with its customers to support their needs relating to new facilities, disposal wells, landfill expansions and specialized equipment. Market share gains and new service lines will ensure that Secure is well positioned for future growth.

FINANCIAL STATEMENTS AND MD&A

The Corporation's unaudited condensed consolidated financial statements and notes thereto for the three months ended March 31, 2016 and 2015 and MD&A for the three months ended March 31, 2016 and 2015 are available immediately on Secure's website at www.secure-energy.com. The unaudited condensed consolidated financial statements and MD&A will be available tomorrow on SEDAR at www.sedar.com.

FORWARD-LOOKING STATEMENTS

Certain statements contained in this document constitute "forward-looking statements" and/or "forward-looking information" within the meaning of applicable securities laws (collectively referred to as forward-looking statements). When used in this document, the words "may", "would", "could", "will", "intend", "plan", "anticipate", "believe", "estimate", "expect", and similar expressions, as they relate to Secure, or its management, are intended to identify forward-looking statements. Such statements reflect the current views of Secure with respect to future events and operating performance and speak only as of the date of this document. In particular, this document contains or implies forward-looking statements pertaining to: corporate strategy; goals; general market conditions; the oil and natural gas industry; activity levels in the oil and gas sector, including market fundamentals and the impact to each division on revenue and operating margins, drilling levels, commodity prices for oil, natural gas liquids ("NGLs") and natural gas; industry fundamentals for the second and third quarters of 2016; capital forecasts and spending by producers; demand for the Corporation's services and products; expansion strategy; the impact of the reduction in oil and gas activity on 2016 activity levels; revenue and operating margin for the PRD, DPS and OS divisions; the Corporation's proposed 2016 capital expenditure program and the intended use thereof; debt service; completion of facilities (including the new PRD FST); acquisition strategy and timing of potential acquisitions, including the expected closing of the Acquisition; the impact of new facilities and potential acquisitions, including the Acquisition, on the Corporation's financial and operational performance and growth opportunities, the expected range for PetroLama's contribution to consolidated Adjusted EBITDA in the next twelve months; future capital needs; and access to capital.

Forward-looking statements concerning expected operating and economic conditions and the Acquisition are based upon prior year results as well as the assumption that levels of market activity and growth will be consistent with industry activity in Canada and the U.S. and similar phases of previous economic cycles. Forward-looking statements concerning the availability of funding for future operations are based upon the assumption that the sources of funding which the Corporation has relied upon in the past will continue to be available to the Corporation on terms favorable to the Corporation and that future economic and operating conditions will not limit the Corporation's access to debt and equity markets. Forward-looking statements concerning the relative future competitive position of the Corporation are based upon the assumption that economic and operating conditions, including commodity prices, crude oil and natural gas storage levels, interest and foreign exchange rates, the regulatory framework regarding oil and natural gas royalties, environmental regulatory matters, the ability of the Corporation and its subsidiaries to successfully market their services and drilling and production activity in North America will lead to sufficient demand for the Corporation's services and its subsidiaries' services including demand for oilfield services for drilling and completion of oil and natural gas wells, that the current business environment will remain substantially unchanged, and that present and anticipated programs and expansion plans of other organizations operating in the energy industry may change the demand for the Corporation's services and its subsidiaries' services. Forward-looking statements concerning the nature and timing of growth are based on past factors affecting the growth of the Corporation, past sources of growth and expectations relating to future economic and operating conditions. Forward-looking statements in respect of the costs anticipated to be associated with the acquisition and maintenance of equipment and property are based upon assumptions that future acquisition and maintenance costs will not significantly increase from past acquisition and maintenance costs.

Forward-looking statements involve significant risks and uncertainties, should not be read as guarantees of future performance or results, and will not necessarily be accurate indications of whether such results will be achieved. Readers are cautioned not to place undue reliance on these statements as a number of factors could cause actual results to differ materially from the results discussed in these forward-looking statements, including but not limited to those factors referred to and under the heading "Business Risks" and under the heading "Risk Factors" in the AIF for the year ended December 31, 2015 and also includes the risks associated with the possible failure to realize the anticipated synergies in integrating the assets acquired in the Acquisition with the operations of Secure. Any "financial outlook" in this document, as defined by applicable securities legislation, has been approved by management of Secure and is included for the purpose of illustrating the materiality of the Acquisition, and for no other purpose. Although forward-looking statements contained in this document are based upon what the Corporation believes are reasonable assumptions, the Corporation cannot assure investors that actual results will be consistent with these forward-looking statements. The forward-looking statements in this document are expressly qualified by this cautionary statement. Unless otherwise required by law, Secure does not intend, or assume any obligation, to update these forward-looking statements.

NON-GAAP MEASURES, OPERATIONAL DEFINITIONS AND ADDITIONAL SUBTOTALS

The Corporation uses accounting principles that are generally accepted in Canada (the issuer's "GAAP"), which includes, International Financial Reporting Standards ("IFRS"). Certain supplementary measures in this document do not have any standardized meaning as prescribed by IFRS. These non-GAAP measures, operational definitions and additional subtotals used by the Corporation may not be comparable to similar measures presented by other reporting issuers. These non-GAAP financial measures, operational definitions and additional subtotals are included because management uses the information to analyze operating performance, leverage and liquidity. Therefore, these non-GAAP financial measures, operational definitions and additional subtotals should not be considered in isolation or as a substitute for measures of performance prepared in accordance with GAAP. See the management's discussion and analysis available at www.sedar.com for a reconciliation of the Non-GAAP financial measures, operational definitions and additional subtotals.

ABOUT SECURE ENERGY SERVICES INC.

Secure is a TSX publicly traded energy services company that provides safe, innovative, efficient and environmentally responsible fluids and solids solutions to the oil and gas industry. The Corporation owns and operates midstream infrastructure and provides environmental services and innovative products to upstream oil and natural gas companies operating in western Canada and certain regions in the United States ("U.S.").

The Corporation operates three divisions:

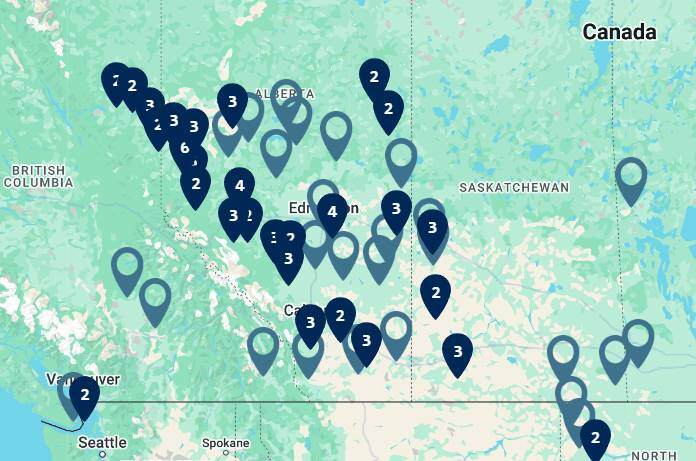

Processing, Recovery and Disposal Division ("PRD"): The PRD division owns and operates midstream infrastructure that provides processing, storing, shipping and marketing of crude oil, oilfield waste disposal and recycling. More specifically these services are clean oil terminalling and rail transloading, custom treating of crude oil, crude oil marketing, produced and waste water disposal, oilfield waste processing, landfill disposal, and oil purchase/resale service. Secure currently operates a network of facilities throughout Western Canada and in North Dakota, providing these services at its full service terminals ("FST"), landfills, stand-alone water disposal facilities ("SWD") and full service rail facilities ("FSR").

Drilling and Production Services Division ("DPS"): The DPS division provides equipment and product solutions for drilling, completion and production operations for oil and gas producers in Western Canada. The drilling service line comprises the majority of the revenue for the division which includes the design and implementation of drilling fluid systems for producers drilling for oil, bitumen and natural gas. The drilling service line focuses on providing products and systems that are designed for more complex wells, such as medium to deep wells, horizontal wells and horizontal wells drilled into the oil sands. The production services line focuses on providing equipment and chemical solutions that optimize production, provide flow assurance and maintain the integrity of production assets.

Onsite Services Division ("OS"): The operations of the OS division include Environmental services which provide pre-drilling assessment planning, drilling waste management, remediation and reclamation assessment services, Naturally Occurring Radioactive Material ("NORM") management, and waste container services; Integrated Fluid Solutions ("IFS") which include water management, recycling, pumping and storage solutions; and Projects which include pipeline integrity (inspection, excavation, repair, replacement and rehabilitation); demolition and decommissioning, and reclamation and remediation of former wellsites, facilities, commercial and industrial properties, and environmental construction projects (landfills, containment ponds, subsurface containment walls, etc.).

SOURCE SECURE Energy Services Inc.