News Releases

Stay in the know

/NOT FOR DISTRIBUTION TO U.S. NEWS WIRE SERVICES OR FOR DISSEMINATION IN THE U.S./

CALGARY, March 30 /CNW/ - Secure Energy Services Inc. ("Secure" or the "Corporation") announced today that it has completed its initial public offering of 19,166,667 common shares at a price of $3.00 per common share for gross proceeds of $57,500,001. The offering was carried out by a syndicate of investment dealers led by FirstEnergy Capital Corp. and including Raymond James Ltd. and Peters & Co. Limited (collectively, the "Agents"). The Corporation has granted to the Agents an option, exercisable, in whole or in part from time to time, for up to 30 days following closing, to offer for sale up to an additional 2,875,000 common shares at a price of $3.00 per common share to cover over allotments, if any, and for market stabilization purposes. The common shares of the Corporation will commence trading today on the Toronto Stock Exchange ("TSX") under the symbol "SES".

The net proceeds of the offering will be used to fund the Corporation's 2010 capital expenditure program. Proceeds realized upon exercise of the over allotment option, if any, will also be utilized to fund the Corporation's 2010 capital expenditure program.

"We are excited to announce the completion of our initial public offering and to commence trading on the Toronto Stock Exchange," stated Rene Amirault, Chairman, President and Chief Executive Officer of Secure. "This significant corporate milestone will enable us to pursue our 2010 capital expenditure program and to continue the expansion of our network of facilities in keeping with our business strategy."

About Secure Energy Services Inc.

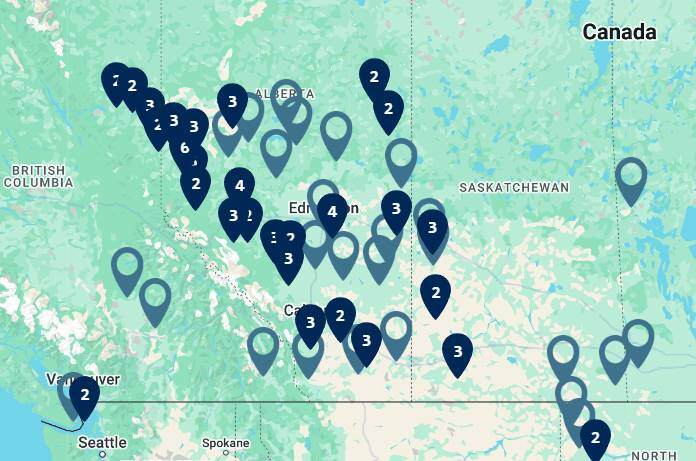

Secure is an energy services company that focuses on providing specialized services to upstream oil and natural gas companies operating in the Western Canadian Sedimentary Basin. The services provided by Secure assist these companies with the treatment and sale of crude oil and the handling of by-products associated with oil and natural gas development and production. The services provided by Secure include crude oil emulsion treatment, the terminalling, storage and marketing of crude oil, oilfield waste processing, tank washing, landfill disposal and disposal of produced and waste water. The Corporation's services are provided at eight facilities in Alberta and one facility in British Columbia.

When used in this news release, the words "will", "estimate" and similar expressions are intended to identify forward-looking statements. Such statements are subject to certain risks, uncertainties and assumptions that could cause actual results to differ materially from those contemplated in the forward-looking statements. Forward-looking statements are based on the estimates and opinions of management at the date that the statements are made, and the Corporation undertakes no obligation to update forward-looking statements if conditions or opinions should change, except as required by applicable law.

The TSX has not reviewed and does not accept responsibility for the adequacy or accuracy of this news release.