At our upcoming Annual General Meeting, we will be asking you to re-approve both the Stock Option Plan and the Unit Incentive Plan (UIP). These plans are designed to attract, retain and incentivize our most key resource: our people.

Institutional Shareholder Services (ISS) has released their Proxy Analysis & Benchmark Voting Recommendations that include recommendations to vote FOR all of the proposals except for the re-approval of the Unit Incentive Plan.

ISS Proxy Analysis & Benchmark Voting Recommendations

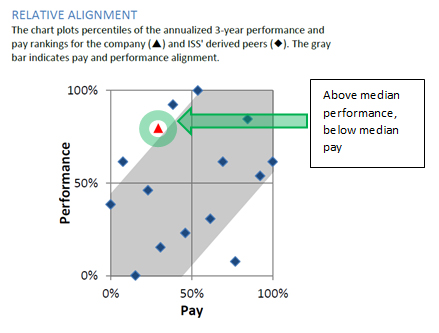

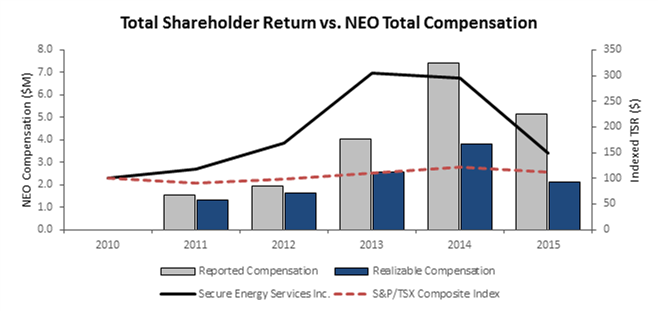

The overall theme of the ISS report is positive, with Secure receiving a Governance QuickScore of 3 (with 1 being the best possible score and 10 being the worst) and a recommendation to vote FOR the Advisory Vote on Executive Compensation. ISS indicates a low concern on the quantitative pay-for-performance screen (as illustrated in the exhibit to the right) and highlights the positive alignment between share price performance, reported NEO pay and realizable NEO pay (as illustrated below). ISS also recommends voting for re-approval of the Stock Option Plan.

ISS concludes their report by stating that “…overall the company has demonstrated adequate stewardship of investor’s interests regarding executive compensation”.

The Unit Incentive Plan

The two largest contributing factors to ISS’s recommendations to vote against the re-approval of the amended UIP are:

- Excessive Plan Cost

- Excessive Burn Rate

Secure has been following a dilution/burn rate reduction strategy for the last 24 months:

- Transitioning away from using stock option awards, which are more dilutive, as the sole form of equity-based compensation towards an approach that includes less dilutive instruments like Restricted and Performance Share Units (RSUs and PSUs). The Unit Incentive Plan includes RSU’s, PSU’s and CSU’s.

- Our use of stock options has decreased each year, there are no planned stock option grants in 2016 and we anticipate that, moving forward, stock options will no longer be granted to employees below the senior executive level

- Stock options granted to Senior Executives in December 2015 are in respect of 2016 and vest in accordance with that plan, but had the unintended result of making the 2015 plan cost higher in the ISS analysis, which is focused on grant year, versus service year

- Secure has maintained its approach to equity-based incentive awards that is based on established grant amounts according to organization levels versus peers who have followed a “% of base pay target”; thereby reducing the dilutive effects of award determination based on declining share prices

The re-approval of the plan as proposed is critical to the continued reduction in the annual burn rate over the course of the next 3 years, where it is projected to fall within the ISS upper limit of 1.5% of shares outstanding. The continued availability of the UIP allows management to continue along this path of reduced dilution and burn rate by awarding one (1) RSU, PSU or Compensation Share Unit (CSU) where previously three (3) stock options would have been required.

The inclusion of CSUs in this plan is estimated to save the Company approximately $3.5 million in cash compensation costs in 2016; capital that is critical to execution of Secure’s business plan in the current economic environment (for more detail on the CSU program, please see our Information Circular).

SES Recommendation

Management firmly believes the approval and use of the UIP as the core element in reducing the Company’s burn rate and conserving cash in this environment of economic uncertainty. For that reason it is our recommendation that shareholders re-approve the Unit Incentive Plan as proposed.